Antero Midstream Partners Investor Presentation Deck

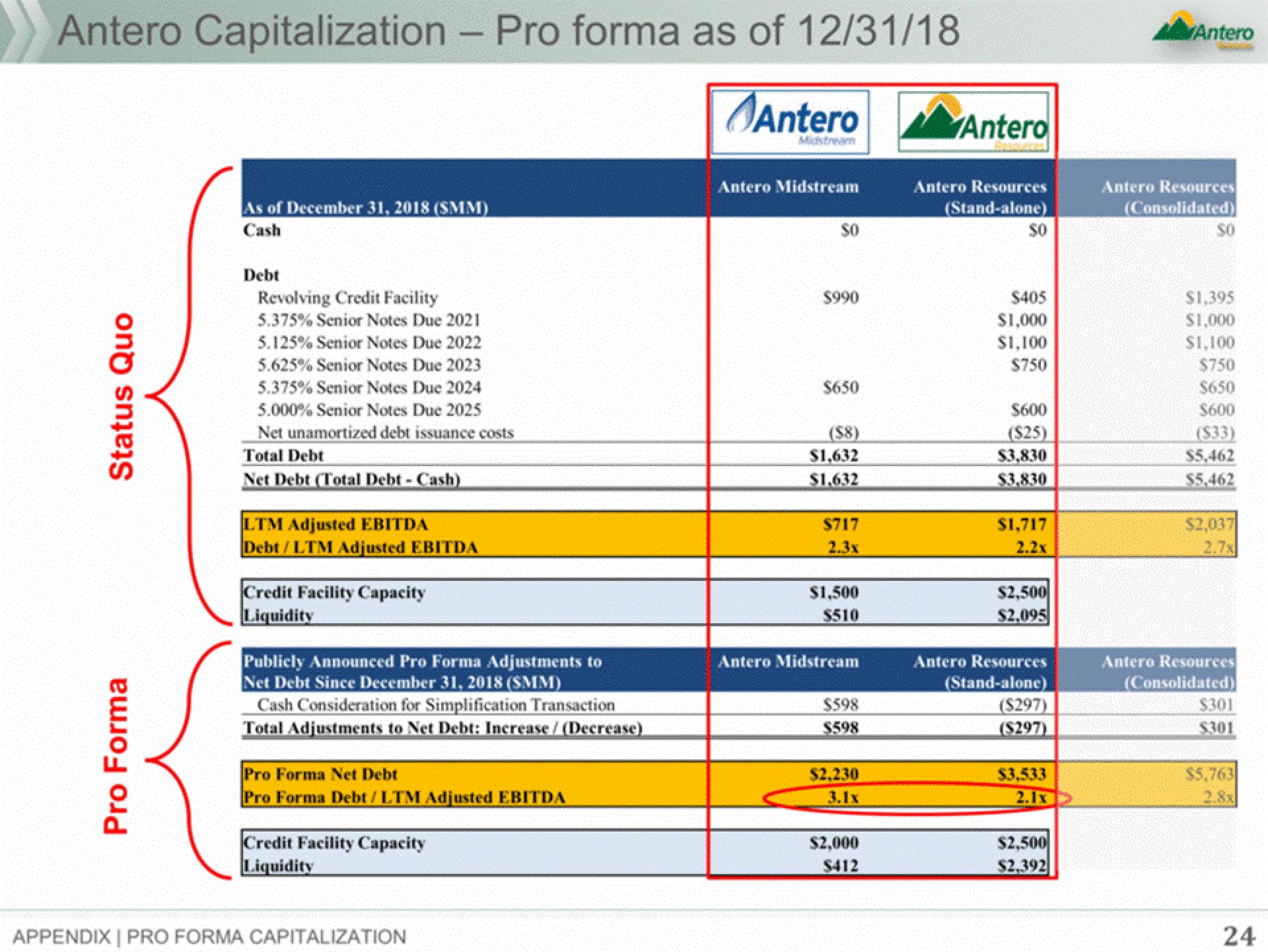

Antero Capitalization - Pro forma as of 12/31/18

Antero

Midstream

Status Quo

Pro Forma

As of December 31, 2018 (SMM)

Cash

Debt

Revolving Credit Facility

5.375% Senior Notes Due 2021

5.125% Senior Notes Due 2022

5.625% Senior Notes Due 2023

5.375% Senior Notes Due 2024

5.000% Senior Notes Due 2025

Net unamortized debt issuance costs

Total Debt

Net Debt (Total Debt - Cash)

LTM Adjusted EBITDA

Debt/LTM Adjusted EBITDA

Credit Facility Capacity

Liquidity

Publicly Announced Pro Forma Adjustments to

Net Debt Since December 31, 2018 (SMM)

Cash Consideration for Simplification Transaction

Total Adjustments to Net Debt: Increase / (Decrease)

Pro Forma Net Debt

Pro Forma Debt / LTM Adjusted EBITDA

Credit Facility Capacity

Liquidity

APPENDIX | PRO FORMA CAPITALIZATION

Antero Midstream

50

$990

$650

($8)

$1,632

$1,632

$717

$1,500

$510

Antero Midstream

$598

$598

$2,230

3.1x

$2,000

$412

Antero

Antero Resources

(Stand-alone)

50

$405

$1,000

$1,100

$750

$600

($25)

$3,830

$3,830

$1,717

2.2x

$2,500

$2,095

Antero Resources

(Stand-alone)

($297)

($297)

$3.533

2.1x

$2,500

$2,392

Antero

Antero Resources

(Consolidated)

$0

$1,395

$1,000

$1,100

$750

$650

$600

($33)

$5,462

$5,462

$2,037

2.7x

Antero Resources

(Consolidated)

$301

$301

$5,763

2.8x

24View entire presentation