Fourth Quarter and Fiscal Year 2023 Financial Results

15

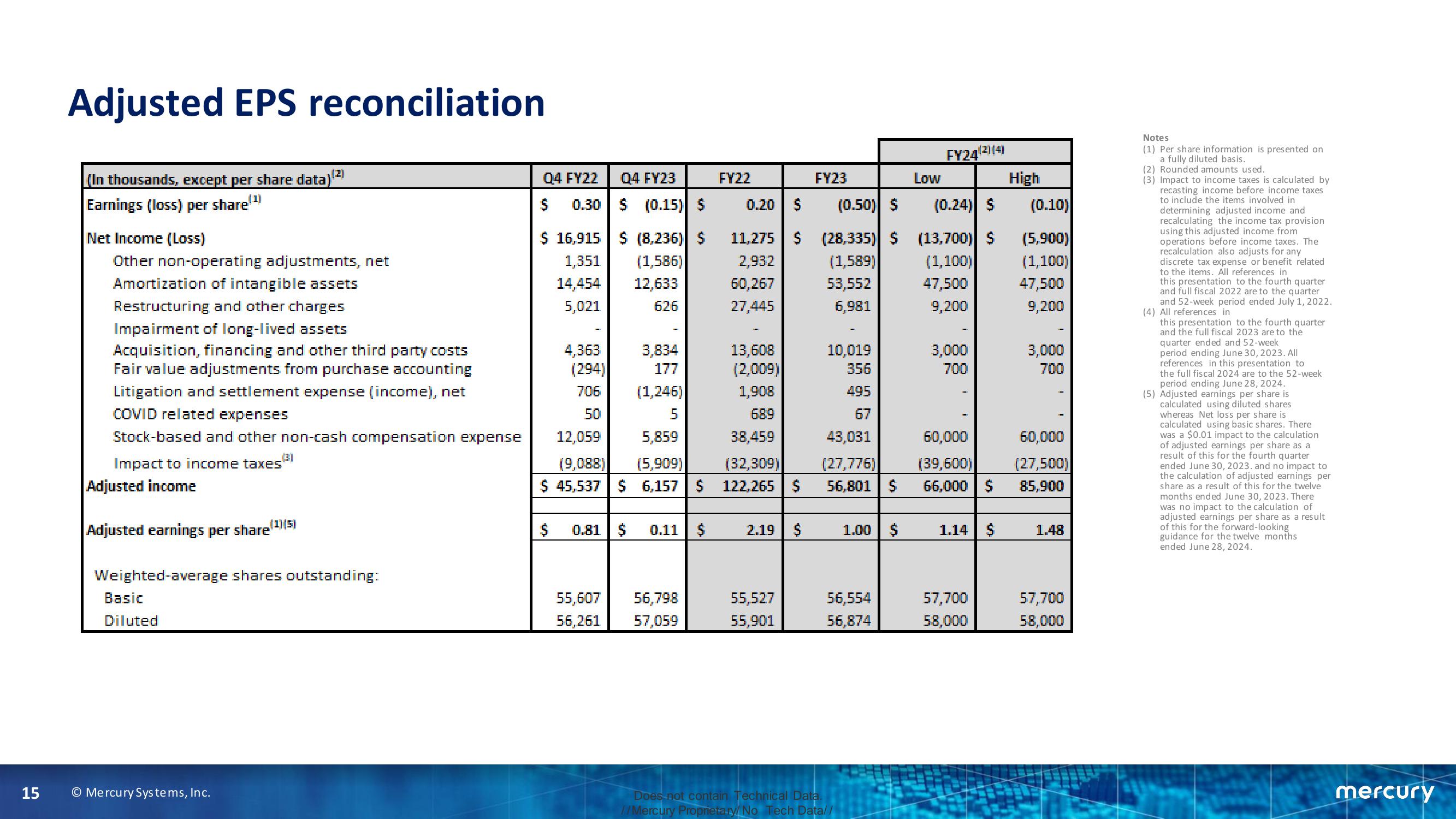

Adjusted EPS reconciliation

(In thousands, except per share data)

Earnings (loss) per share!¹¹)

Net Income (Loss)

Other non-operating adjustments, net

Amortization of intangible assets

Restructuring and other charges

Impairment of long-lived assets

Acquisition, financing and other third party costs

Fair value adjustments from purchase accounting

Litigation and settlement expense (income), net

COVID related expenses

Stock-based and other non-cash compensation expense

Impact to income taxes"

Adjusted income

Adjusted earnings per share

(1)(5)

Weighted-average shares outstanding:

Basic

Diluted

© Mercury Systems, Inc.

Q4 FY22

$ 0.30

$ 16,915

$ (8,236) $

1,351

(1,586)

14,454 12,633

5,021

626

04 FY23

$ (0.15) $

4,363

(294)

706

50

$ 0.81 $ 0.11 $

FY22

3,834

13,608

(2,009)

1,908

177

(1,246)

5

5,859

(9,088) (5,909)

689

12,059

38,459

(32,309)

$ 45,537 $ 6,157 $ 122,265 $

55,607 56,798

56,261

57,059

0.20 $

11,275 $

2,932

60,267

27,445

2.19 $

55,527

55,901

FY23

10,019

356

495

67

43,031

(27,776)

56,801 $

(0.50) $ (0.24) $

(0.10)

(28,335) $ (13,700) $ (5,900)

(1,589)

(1,100)

(1,100)

53,552

47,500

47,500

6,981

9,200

9,200

1.00 $

56,554

56,874

Does not contain Technical Data.

//Mercury Proprietary/No Tech Data//

Low

FY24

(2)(4)

3,000

700

60,000

(39,600)

66,000 $

1.14 $

57,700

58,000

High

3,000

700

60,000

(27,500)

85,900

1.48

57,700

58,000

Notes

(1) Per share information is presented on

a fully diluted basis.

(2) Rounded amounts used.

(3) Impact to income taxes is calculated by

recasting income before income taxes

to include the items involved in

determining adjusted income and

recalculating the income tax provision

using this adjusted income from

operations before income taxes. The

recalculation also adjusts for any

discrete tax expense or benefit related

to the items. All references in

this presentation to the fourth quarter

and full fiscal 2022 are to the quarter

and 52-week period ended July 1, 2022.

(4) All references in

this presentation to the fourth quarter

and the full fiscal 2023 are to the

quarter ended and 52-week

period ending June 30, 2023. All

references in this presentation to

the full fiscal 2024 are to the 52-week

period ending June 28, 2024.

(5) Adjusted earnings per share is

calculated using diluted shares

whereas Net loss per share is

calculated using basic shares. There

was a $0.01 impact to the calculation

of adjusted earnings per share as a

result of this for the fourth quarter

ended June 30, 2023. and no impact to

the calculation of adjusted earnings per

share as a result of this for the twelve

months ended June 30, 2023. There

was no impact to the calculation of

adjusted earnings per share as a result

of this for the forward-looking

guidance for the twelve months

ended June 28, 2024.

mercuryView entire presentation