Babylon Investor Day Presentation Deck

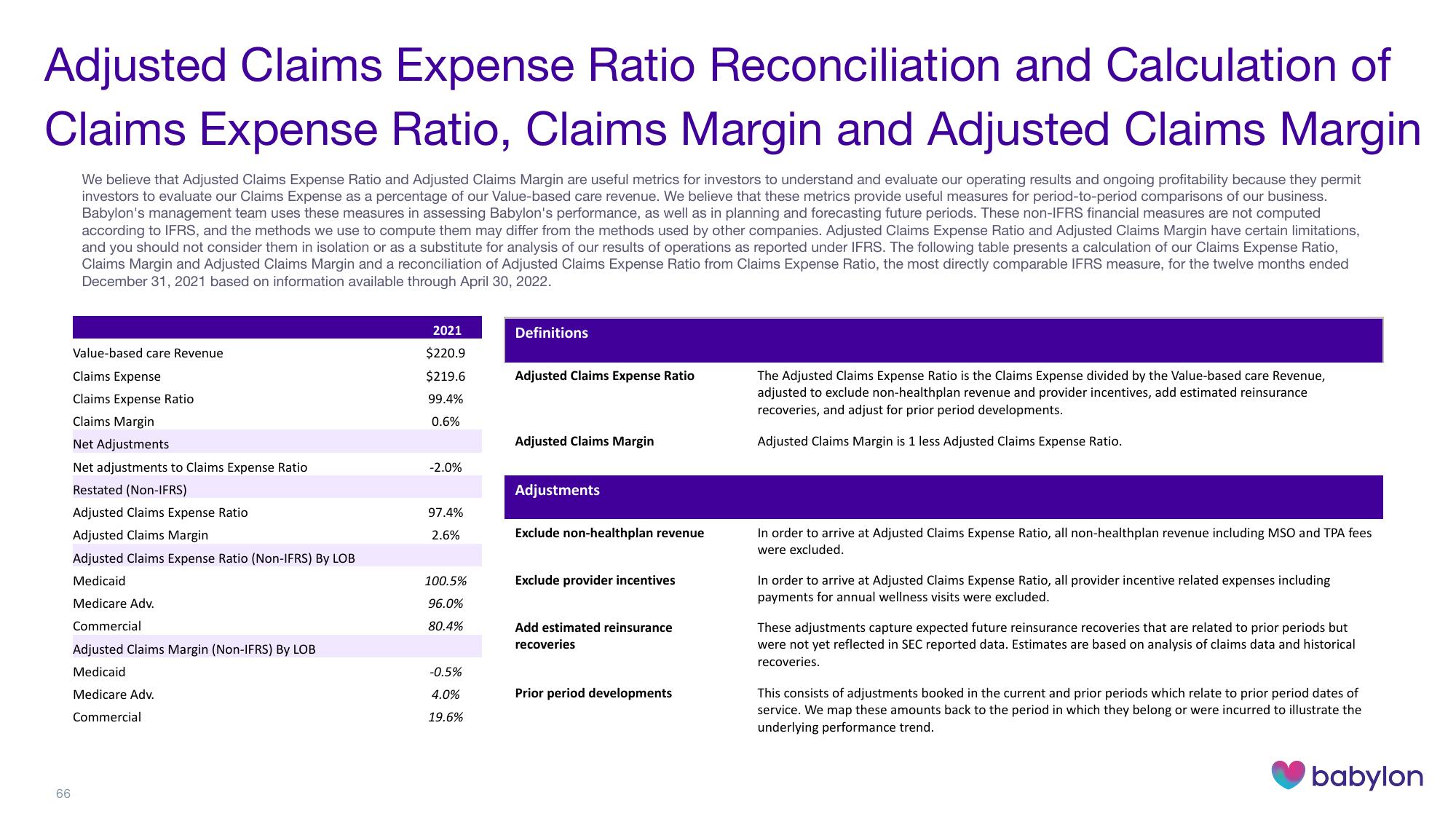

Adjusted Claims Expense Ratio Reconciliation and Calculation of

Claims Expense Ratio, Claims Margin and Adjusted Claims Margin

We believe that Adjusted Claims Expense Ratio and Adjusted Claims Margin are useful metrics for investors to understand and evaluate our operating results and ongoing profitability because they permit

investors to evaluate our Claims Expense as a percentage of our Value-based care revenue. We believe that these metrics provide useful measures for period-to-period comparisons of our business.

Babylon's management team uses these measures in assessing Babylon's performance, as well as in planning and forecasting future periods. These non-IFRS financial measures are not computed

according to IFRS, and the methods we use to compute them may differ from the methods used by other companies. Adjusted Claims Expense Ratio and Adjusted Claims Margin have certain limitations,

and you should not consider them in isolation or as a substitute for analysis of our results of operations as reported under IFRS. The following table presents a calculation of our Claims Expense Ratio,

Claims Margin and Adjusted Claims Margin and a reconciliation of Adjusted Claims Expense Ratio from Claims Expense Ratio, the most directly comparable IFRS measure, for the twelve months ended

December 31, 2021 based on information available through April 30, 2022.

66

Value-based care Revenue

Claims Expense

Claims Expense Ratio

Claims Margin

Net Adjustments

Net adjustments to Claims Expense Ratio

Restated (Non-IFRS)

Adjusted Claims Expense Ratio

Adjusted Claims Margin

Adjusted Claims Expense Ratio (Non-IFRS) By LOB

Medicaid

Medicare Adv.

Commercial

Adjusted Claims Margin (Non-IFRS) By LOB

Medicaid

Medicare Adv.

Commercial

2021

$220.9

$219.6

99.4%

0.6%

-2.0%

97.4%

2.6%

100.5%

96.0%

80.4%

-0.5%

4.0%

19.6%

Definitions

Adjusted Claims Expense Ratio

Adjusted Claims Margin

Adjustments

Exclude non-healthplan revenue

Exclude provider incentives

Add estimated reinsurance

recoveries

Prior period developments

The Adjusted Claims Expense Ratio is the Claims Expense divided by the Value-based care Revenue,

adjusted to exclude non-healthplan revenue and provider incentives, add estimated reinsurance

recoveries, and adjust for prior period developments.

Adjusted Claims Margin is 1 less Adjusted Claims Expense Ratio.

In order to arrive at Adjusted Claims Expense Ratio, all non-healthplan revenue including MSO and TPA fees

were excluded.

In order to arrive at Adjusted Claims Expense Ratio, all provider incentive related expenses including

payments for annual wellness visits were excluded.

These adjustments capture expected future reinsurance recoveries that are related to prior periods but

were not yet reflected in SEC reported data. Estimates are based on analysis of claims data and historical

recoveries.

This consists of adjustments booked in the current and prior periods which relate to prior period dates of

service. We map these amounts back to the period in which they belong or were incurred to illustrate the

underlying performance trend.

babylonView entire presentation