Moelis & Company Investment Banking Pitch Book

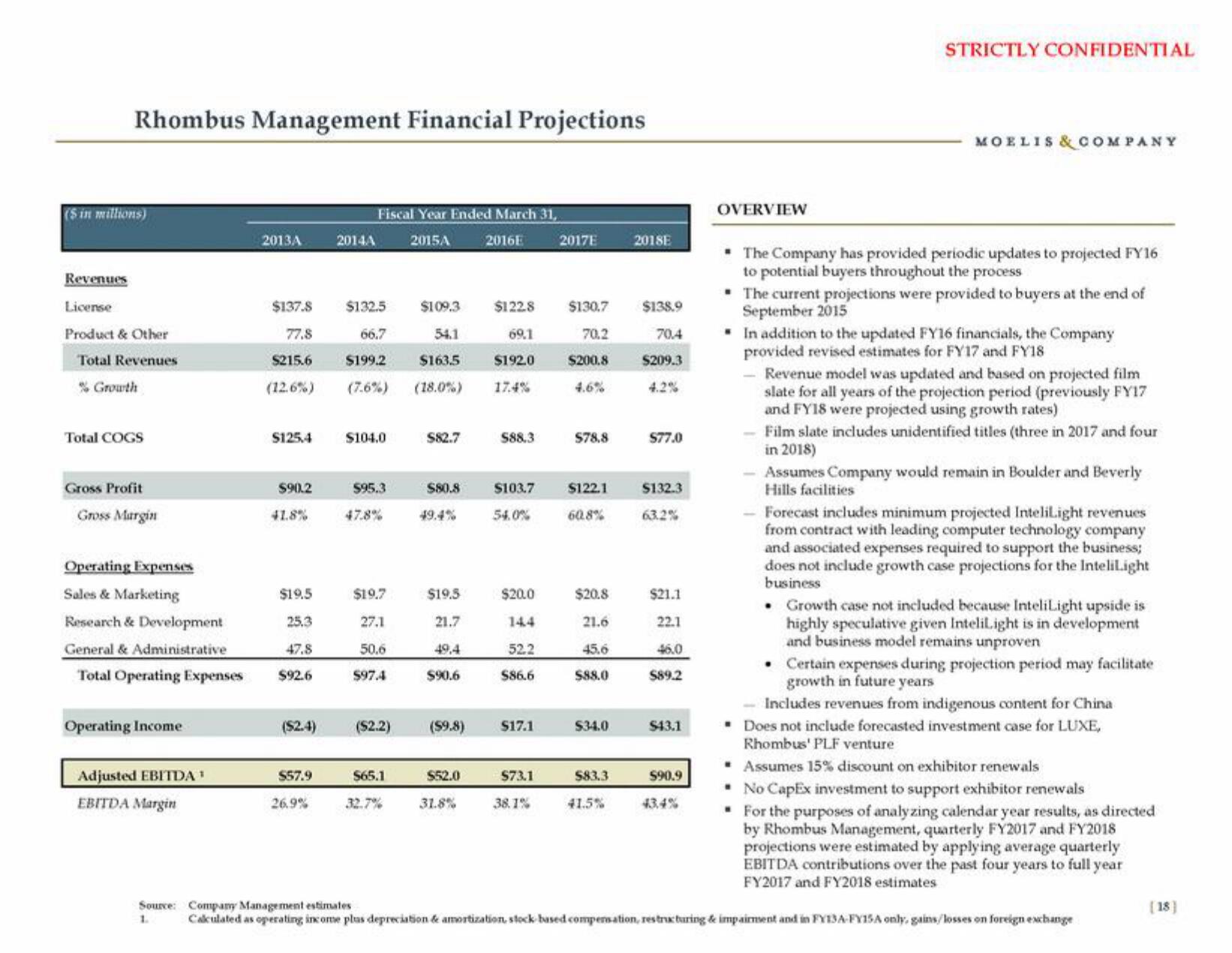

Rhombus Management Financial Projections

($ in millions)

Revenues

License

Product & Other

Total Revenues

% Growth

Total COGS

Gross Profit

Gross Margin

Operating Expenses

Sales & Marketing

Research & Development

General & Administrative

Total Operating Expenses

Operating Income

Adjusted EBITDA

EBITDA Margin

2013A

$125,4

$90.2

$137.8

$109.3 $122.8 $130.7

77.8

54.1

70.2

$215.6

$163.5

69.1

$192.0

17.4%

$200.8

(12.6%) (7.6%) (18.0%)

41.8%

$19.5

25.3

47.8

$92.6

($2.4)

$57.9

Fiscal Year Ended March 31,

2015A

2016E

26.9%

2014A

$132.5

66.7

$199.2

$104.0

$95.3

47.8%

$19.7

27.1

50,6

$97.4

($2.2)

$65.1

32.7%

$82.7

$80.8

$19.5

21.7

49.4

$90.6

($9.8)

$52.0

31.8%

$88.3

$103.7

54.0%

$20.0

52.2

$86.6

$17.1

2017E

$73.1

38.1%

$78.8

$122.1

60.8%

$20.8

21.6

45.6

$88.0

$34.0

583.3

41.5%

2018E

$138.9

70.4

$209.3

$77.0

$132.3

63.2%

$21.1

22.1

46.0

$89.2

$43.1

$90.9

43.4%

STRICTLY CONFIDENTIAL

MOELIS & COMPANY

OVERVIEW

The Company has provided periodic updates to projected FY16

to potential buyers throughout the process

• The current projections were provided to buyers at the end of

September 2015

. In addition to the updated FY16 financials, the Company

provided revised estimates for FY17 and FY18

Revenue model was updated and based on projected film

slate for all years of the projection period (previously FY17

and FY18 were projected using growth rates)

-- Film slate includes unidentified titles (three in 2017 and four

in 2018)

Assumes Company would remain in Boulder and Beverly

Hills facilities

Forecast includes minimum projected InteliLight revenues

from contract with leading computer technology company

and associated expenses required to support the business;

does not include growth case projections for the Intelilight

business

• Growth case not included because InteliLight upside is

highly speculative given Intelil.ight is in development

and business model remains unproven

• Certain expenses during projection period may facilitate

growth in future years

Includes revenues from indigenous content for China

* Does not include forecasted investment case for LUXE,

Rhombus' PLF venture

▪ Assumes 15% discount on exhibitor renewals

No CapEx investment to support exhibitor renewals

• For the purposes of analyzing calendar year results, as directed

by Rhombus Management, quarterly FY2017 and FY2018

projections were estimated by applying average quarterly

EBITDA contributions over the past four years to full year

FY2017 and FY2018 estimates

Source: Company Management estimates

Calculated as operating income plus depreciation & amortization, stock based compensation, restructuring & impairment and in FY13A-FY15A only, gains/losses on foreign exchange

[18]View entire presentation