Affirm Investor Day Presentation Deck

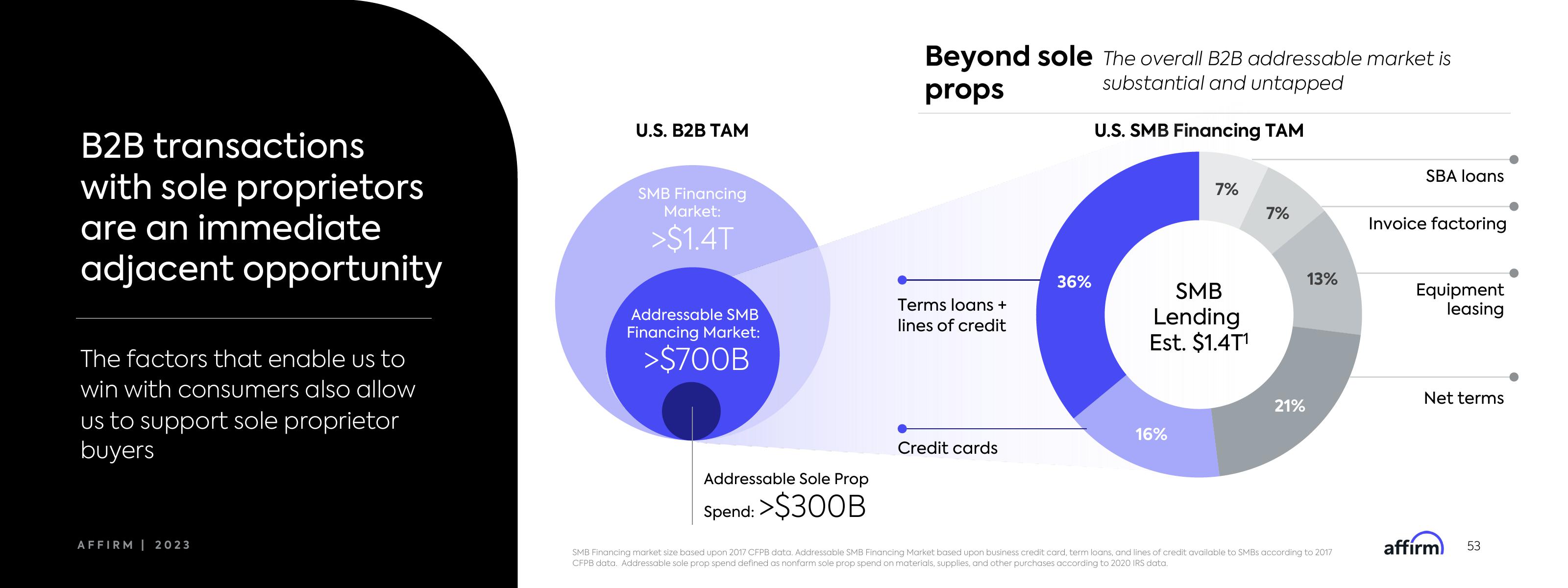

B2B transactions

with sole proprietors

are an immediate

adjacent opportunity

The factors that enable us to

win with consumers also allow

us to support sole proprietor

buyers

AFFIRM | 2023

U.S. B2B TAM

SMB Financing

Market:

>$1.4T

Addressable SMB

Financing Market:

>$700B

Addressable Sole Prop

Spend:>$300B

Beyond sole The overall B2B addressable market is

props

substantial and untapped

Terms loans +

lines of credit

Credit cards

36%

U.S. SMB Financing TAM

7%

SMB

Lending

Est. $1.4T¹

16%

7%

21%

13%

SMB Financing market size based upon 2017 CFPB data. Addressable SMB Financing Market based upon business credit card, term loans, and lines of credit available to SMBs according to 2017

CFPB data. Addressable sole prop spend defined as nonfarm sole prop spend on materials, supplies, and other purchases according to 2020 IRS data.

SBA loans

Invoice factoring

Equipment

leasing

Net terms

affirm

53View entire presentation