Solar Industry Update

Percent of Planned Solar, Wind, and

Battery Markets Located in Energy

Communities

Click here to interactively view

this data on Tableau Public.

Out of Energy Community

In Energy Community

Capacity (GW)

100

80

10

40

20

20

0

70%

% Capacity in Energy Community

60%

X% Capacity in Energy Community (new projects)

50%

40%

30%

Added Planned

Projects

Planned Projects

20%

.

Planned (Sep. Planned (Sep. Planned (Sep. Planned (Sep. Planned (Sep. Planned (Sep.

2022)

2023)

2022)

2023)

2022)

2023)

- 10%

0%

Note: based on EIA data, there werende planned offshore wits announced between septem22nd September 2023.

Additionally, the latitude and longitude of these projects reported in EIA Form 860 likely does not reflect the location in which these

projects will determine their eligibility (i.e., the point of interconnection).

Sources: U.S. Energy Information Administration (EIA), EIA Form 860 (November 2022, November 2023).

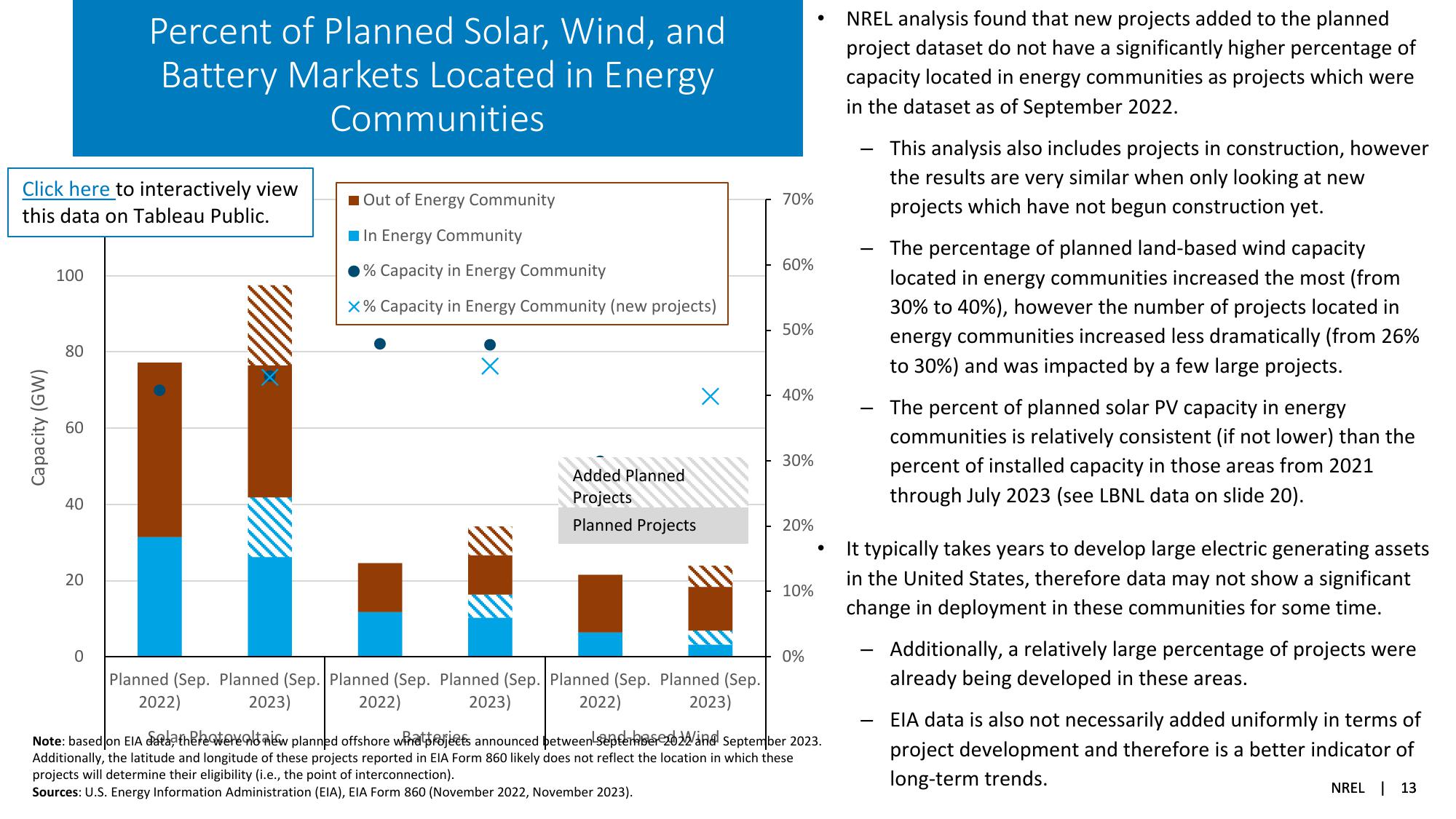

NREL analysis found that new projects added to the planned

project dataset do not have a significantly higher percentage of

capacity located in energy communities as projects which were

in the dataset as of September 2022.

-

-

This analysis also includes projects in construction, however

the results are very similar when only looking at new

projects which have not begun construction yet.

The percentage of planned land-based wind capacity

located in energy communities increased the most (from

30% to 40%), however the number of projects located in

energy communities increased less dramatically (from 26%

to 30%) and was impacted by a few large projects.

The percent of planned solar PV capacity in energy

communities is relatively consistent (if not lower) than the

percent of installed capacity in those areas from 2021

through July 2023 (see LBNL data on slide 20).

It typically takes years to develop large electric generating assets

in the United States, therefore data may not show a significant

change in deployment in these communities for some time.

Additionally, a relatively large percentage of projects were

already being developed in these areas.

EIA data is also not necessarily added uniformly in terms of

project development and therefore is a better indicator of

long-term trends.

NREL 13View entire presentation