Engine No. 1 Activist Presentation Deck

ExxonMobil still has no credible plan to protect value

in an energy transition ...

●

ExxonMobil is world's 5th largest

producer of greenhouse gas (GHG)

emissions (after coal from China, Saudi

Aramco, Gazprom, and Nat'l Iranian Oil)

• This is an existential business risk given

that 2/3 of emissions come from

countries that have pledged to reach

net zero emissions by 2050

●

Any diversification strategy must be

profitable over the long-term to be

sustainable. However, ExxonMobil's

Board must be able to balance

maintaining current profitability with

addressing the risk of a narrow focus

on fossil fuel projects that can take

decades to deliver a return and for

which there may be significantly

reduced future demand

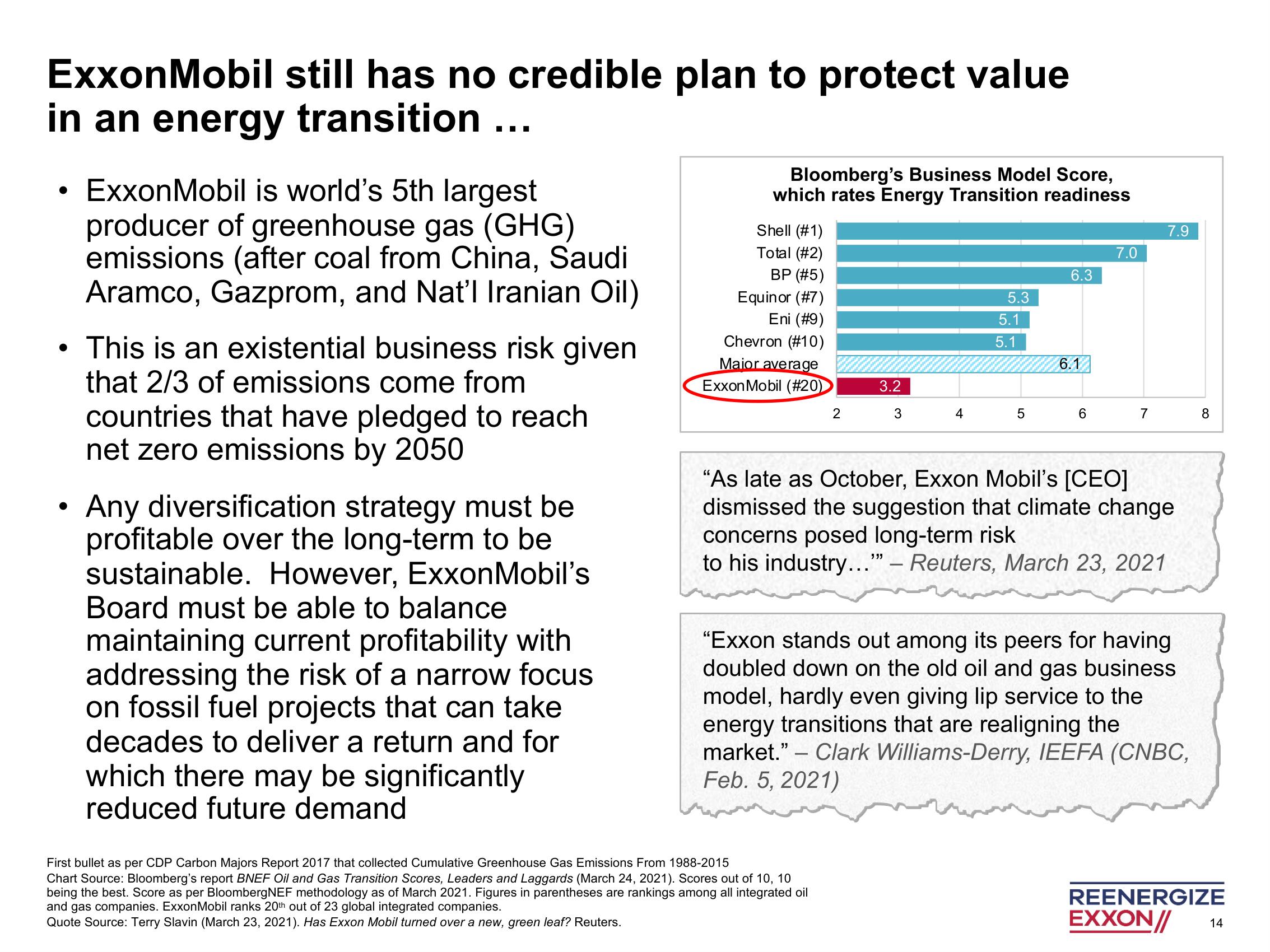

Bloomberg's Business Model Score,

which rates Energy Transition readiness

Shell (#1)

Total (#2)

BP (#5)

Equinor (#7)

Eni (#9)

Chevron (#10)

Maior average

ExxonMobil (#20)

2

-

3.2

3

First bullet as per CDP Carbon Majors Report 2017 that collected Cumulative Greenhouse Gas Emissions From 1988-2015

Chart Source: Bloomberg's report BNEF Oil and Gas Transition Scores, Leaders and Laggards (March 24, 2021). Scores out of 10, 10

being the best. Score as per BloombergNEF methodology as of March 2021. Figures in parentheses are rankings among all integrated oil

and gas companies. ExxonMobil ranks 20th out of 23 global integrated companies.

Quote Source: Terry Slavin (March 23, 2021). Has Exxon Mobil turned over a new, green leaf? Reuters.

4

5.3

5.1

5.1

5

6.3

6.1

6

7.0

7

"As late as October, Exxon Mobil's [CEO]

dismissed the suggestion that climate change

concerns posed long-term risk

to his industry..." - Reuters, March 23, 2021

7.9

"Exxon stands out among its peers for having

doubled down on the old oil and gas business

model, hardly even giving lip service to the

energy transitions that are realigning the

market." Clark Williams-Derry, IEEFA (CNBC,

Feb. 5, 2021)

8

REENERGIZE

EXXON//

14View entire presentation