Apollo Global Management Investor Day Presentation Deck

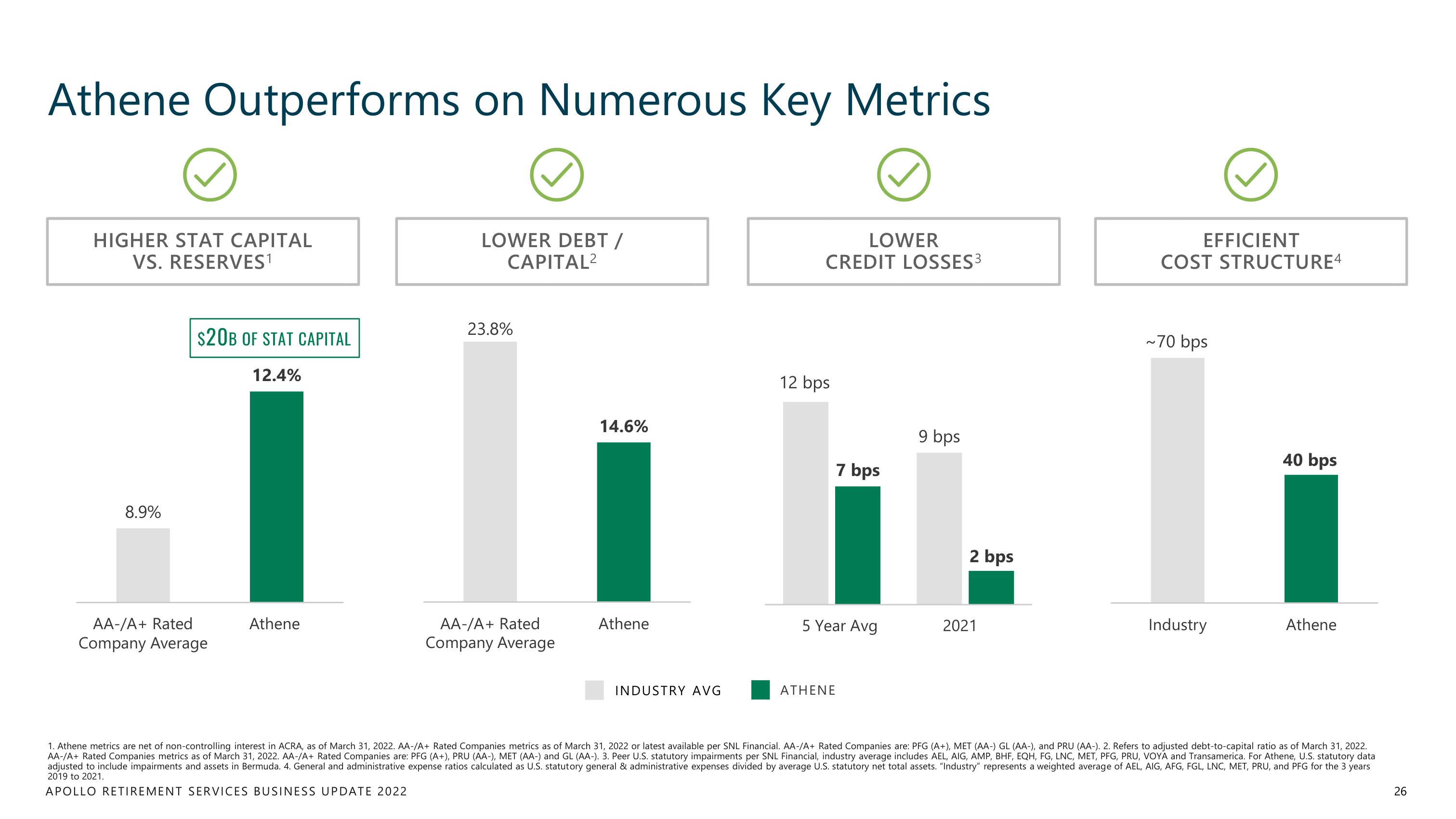

Athene Outperforms on Numerous Key Metrics

HIGHER STAT CAPITAL

VS. RESERVES1

8.9%

$20B OF STAT CAPITAL

AA-/A+ Rated

Company Average

12.4%

Athene

LOWER DEBT/

CAPITAL²

23.8%

AA-/A+ Rated

Company Average

14.6%

Athene

INDUSTRY AVG

CREDIT LOSSES3

12 bps

LOWER

ATHENE

7 bps

5 Year Avg

9 bps

2 bps

2021

EFFICIENT

COST STRUCTURE4

~70 bps

Industry

40 bps

Athene

1. Athene metrics are net of non-controlling interest in ACRA, as of March 31, 2022. AA-/A+ Rated Companies metrics as of March 31, 2022 or latest available per SNL Financial. AA-/A+ Rated Companies are: PFG (A+), MET (AA-) GL (AA-), and PRU (AA-). 2. Refers to adjusted debt-to-capital ratio as of March 31, 2022.

AA-/A+ Rated Companies metrics as of March 31, 2022. AA-/A+ Rated Companies are: PFG (A+), PRU (AA-), MET (AA-) and GL (AA-). 3. Peer U.S. statutory impairments per SNL Financial, industry average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data

adjusted to include impairments and assets in Bermuda. 4. General and administrative expense ratios calculated as U.S. statutory general & administrative expenses divided by average U.S. statutory net total assets. "Industry" represents a weighted average of AEL, AIG, AFG, FGL, LNC, MET, PRU, and PFG for the 3 years

2019 to 2021.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

26View entire presentation