Kinnevik Results Presentation Deck

VALUATIONS ASCRIBED TO OUR COMPANIES IN FUNDING ROUNDS OR OTHER

TRANSACTIONS ARE IMPORTANT CALIBRATORS OF PREMIUMS/DISCOUNTS TO PEERS

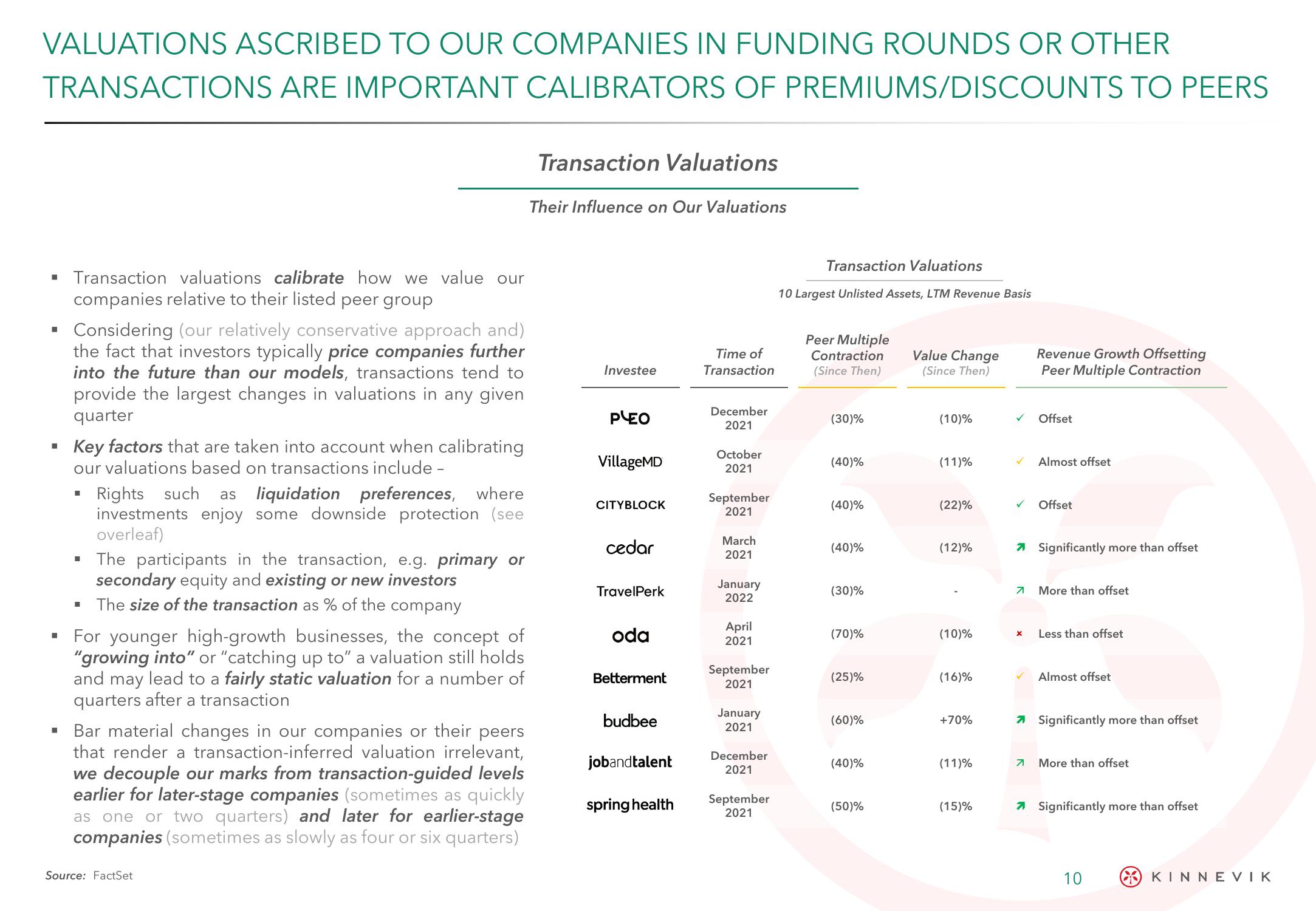

▪ Transaction valuations calibrate how we value our

companies relative to their listed peer group

■

■

Considering (our relatively conservative approach and)

the fact that investors typically price companies further

into the future than our models, transactions tend to

provide the largest changes in valuations in any given

quarter

Key factors that are taken into account when calibrating

our valuations based on transactions include -

■

Rights such as liquidation preferences, where

investments enjoy some downside protection (see

overleaf)

The participants in the transaction, e.g. primary or

secondary equity and existing or new investors

▪ The size of the transaction as % of the company

For younger high-growth businesses, the concept of

"growing into" or "catching up to" a valuation still holds

and may lead to a fairly static valuation for a number of

quarters after a transaction

▪ Bar material changes in our companies or their peers

that render a transaction-inferred valuation irrelevant,

we decouple our marks from transaction-guided levels

earlier for later-stage companies (sometimes as quickly

as one or two quarters) and later for earlier-stage

companies (sometimes as slowly as four or six quarters)

Source: FactSet

Transaction Valuations

Their Influence on Our Valuations

Investee

PLEO

VillageMD

CITYBLOCK

cedar

TravelPerk

oda

Betterment

budbee

jobandtalent

spring health

Time of

Transaction

December

2021

October

2021

September

2021

March

2021

January

2022

April

2021

September

2021

January

2021

December

2021

September

2021

Transaction Valuations

10 Largest Unlisted Assets, LTM Revenue Basis

Peer Multiple

Contraction

(Since Then)

(30)%

(40)%

(40)%

(40)%

(30)%

(70)%

(25)%

(60)%

(40)%

(50)%

Value Change

(Since Then)

(10)%

(11)%

(22)%

(12)%

(10)%

(16)%

+70%

(11)%

(15)%

✓ Offset

✓

Revenue Growth Offsetting

Peer Multiple Contraction

71

✓ Offset

Almost offset

71

Significantly more than offset

More than offset

X Less than offset

Almost offset

Significantly more than offset

More than offset

Significantly more than offset

10

KINNEVIKView entire presentation