Main Street Capital Investor Day Presentation Deck

Q

Co-Lead

10.0%

Private Loan Deal Flow (4), (5)

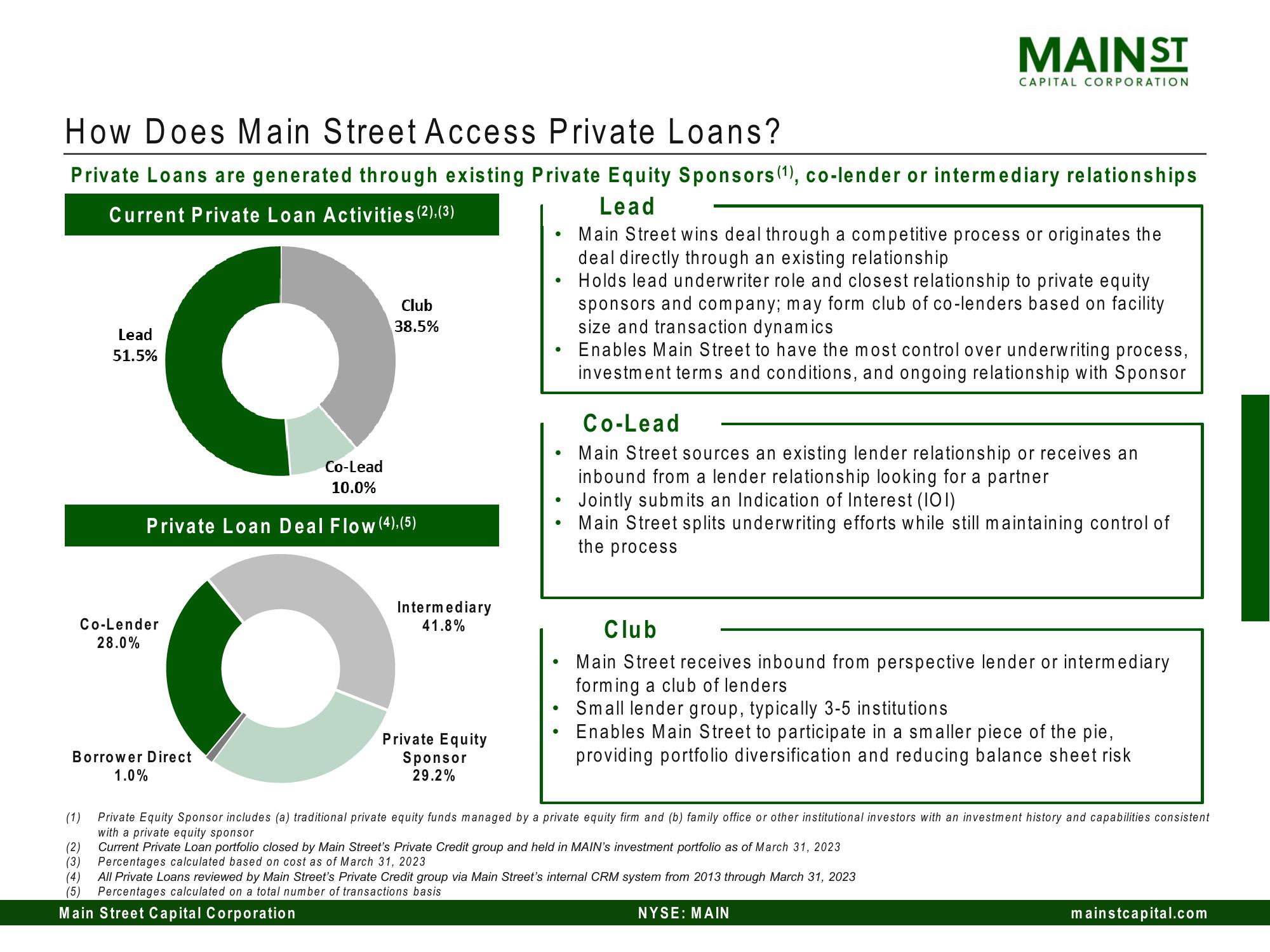

How Does Main Street Access Private Loans?

Private Loans are generated through existing Private Equity Sponsors (¹), co-lender or intermediary relationships

Current Private Loan Activities (2), (3)

Lead

Lead

51.5%

Co-Lender

28.0%

Borrower Direct

1.0%

Club

38.5%

Intermediary

41.8%

Private Equity

Sponsor

29.2%

●

●

●

●

●

●

MAIN ST

CAPITAL CORPORATION

Main Street wins deal through a competitive process or originates the

deal directly through an existing relationship

Holds lead underwriter role and closest relationship to private equity

sponsors and company; may form club of co-lenders based on facility

size and transaction dynamics

Enables Main Street to have the most control over underwriting process,

investment terms and conditions, and ongoing relationship with Sponsor

Co-Lead

Main Street sources an existing lender relationship or receives an

inbound from a lender relationship looking for a partner

Jointly submits an Indication of Interest (101)

Main Street splits underwriting efforts while still maintaining control of

the process

Club

Main Street receives inbound from perspective lender or intermediary

forming a club of lenders

Small lender group, typically 3-5 institutions

Enables Main Street to participate in a smaller piece of the pie,

providing portfolio diversification and reducing balance sheet risk

(4) All Private Loans reviewed by Main Street's Private Credit group via Main Street's internal CRM system from 2013 through March 31, 2023

(5) Percentages calculated on a total number of transactions basis

Main Street Capital Corporation

NYSE: MAIN

(1)

rivate Equity Sponsor includes (a) traditional private equity funds managed by a private equity firm and (b) family office or other institutional investors with an investment history and capabilities consistent

with a private equity sponsor

(2)

Current Private Loan portfolio closed by Main Street's Private Credit group and held in MAIN's investment portfolio as of March 31, 2023

(3) Percentages calculated based on cost as of March 31, 2023

mainstcapital.comView entire presentation