Fast Radius SPAC Presentation Deck

Appendix A

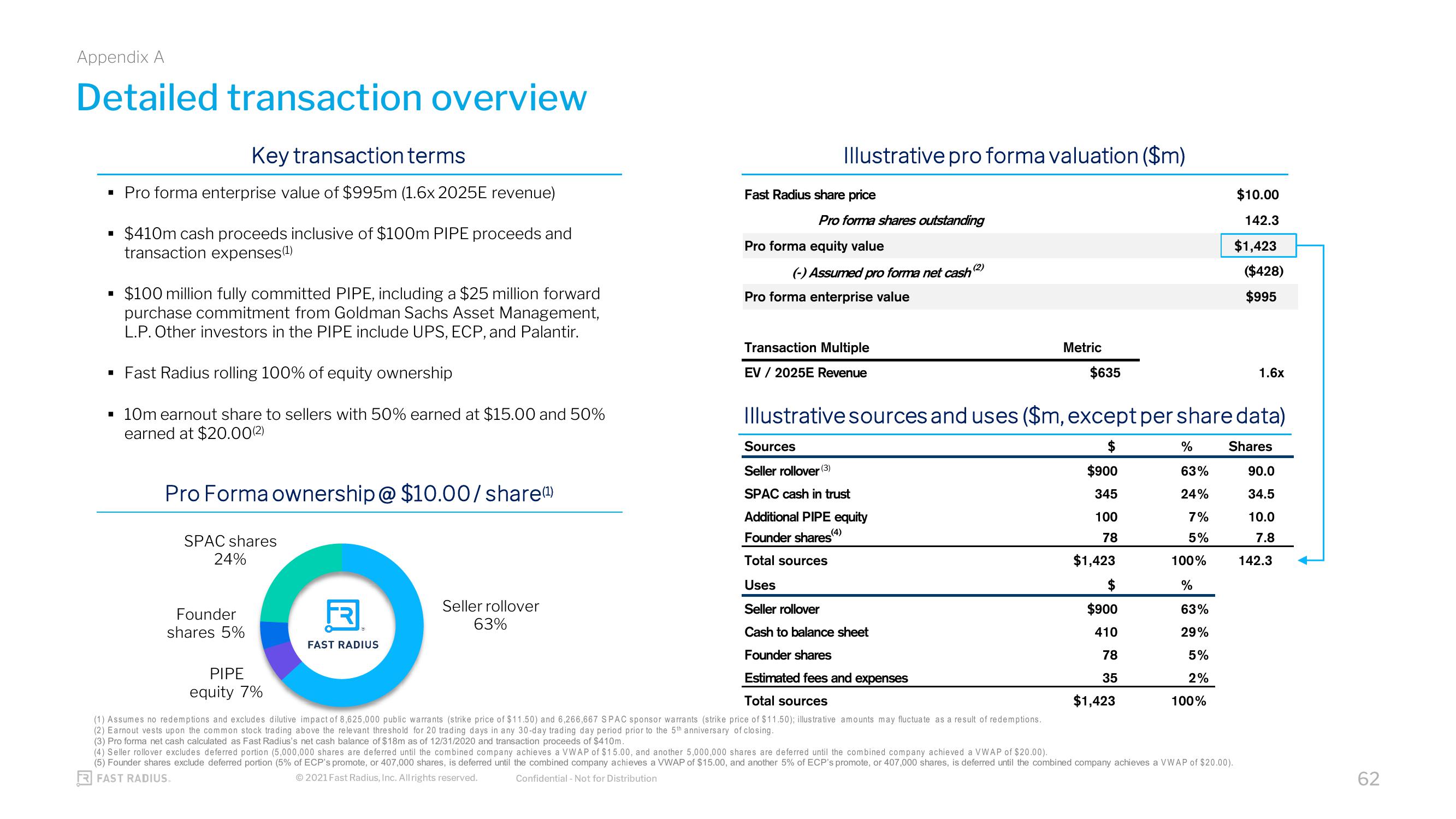

Detailed transaction overview

Key transaction terms

▪ Pro forma enterprise value of $995m (1.6x 2025E revenue)

$410m cash proceeds inclusive of $100m PIPE proceeds and

transaction expenses(¹)

■

$100 million fully committed PIPE, including a $25 million forward

purchase commitment from Goldman Sachs Asset Management,

L.P. Other investors in the PIPE include UPS, ECP, and Palantir.

▪ Fast Radius rolling 100% of equity ownership

▪ 10m earnout share to sellers with 50% earned at $15.00 and 50%

earned at $20.00(2)

Pro Forma ownership@ $10.00/share(¹)

SPAC shares

24%

Founder

shares 5%

PIPE

equity 7%

FAST RADIUS

Illustrative pro forma valuation ($m)

Seller rollover

63%

Fast Radius share price

Pro forma shares outstanding

Pro forma equity value

(2)

(-) Assumed pro forma net cash

Pro forma enterprise value

Sources

Seller rollover (3)

SPAC cash in trust

Additional PIPE equity

(4)

Founder shares

Total sources

Uses

Seller rollover

Cash to balance sheet

Founder shares

Estimated fees and expenses

Total sources

(1) Assumes no redemptions and excludes dilutive impact of 8,625,000 public warrants (strike price of $11.50) and 6,266,667 SPAC sponsor warrants (strike price of $11.50); illustrative amounts may fluctuate as a result of redemptions.

(2) Earnout vests upon the common stock trading above the relevant threshold for 20 trading days in any 30-day trading day period prior to the 5th anniversary of closing.

(3) Pro forma net cash calculated as Fast Radius's net cash balance of $18m as of 12/31/2020 and transaction proceeds of $410m.

(4) Seller rollover excludes deferred portion (5,000,000 shares are deferred until the combined company achieves a VWAP of $15.00, and another 5,000,000 shares are deferred until the combined company achieved a VWAP of $20.00).

(5) Founder shares exclude deferred portion (5% of ECP's promote, or 407,000 shares, is deferred until the combined company achieves a VWAP of $15.00, and another 5% of ECP's promote, or 407,000 shares, is deferred until the combined company achieves a VWAP of $20.00).

FR FAST RADIUS.

© 2021 Fast Radius, Inc. All rights reserved.

Confidential - Not for Distribution

Transaction Multiple

EV / 2025E Revenue

Metric

$635

Illustrative sources and uses ($m, except per share data)

Shares

90.0

34.5

10.0

7.8

142.3

$900

345

100

78

$1,423

$

$900

410

78

35

$1,423

%

63%

24%

7%

5%

100%

%

63%

29%

5%

2%

$10.00

142.3

$1,423

($428)

$995

100%

1.6x

62View entire presentation