Credit Suisse Investment Banking Pitch Book

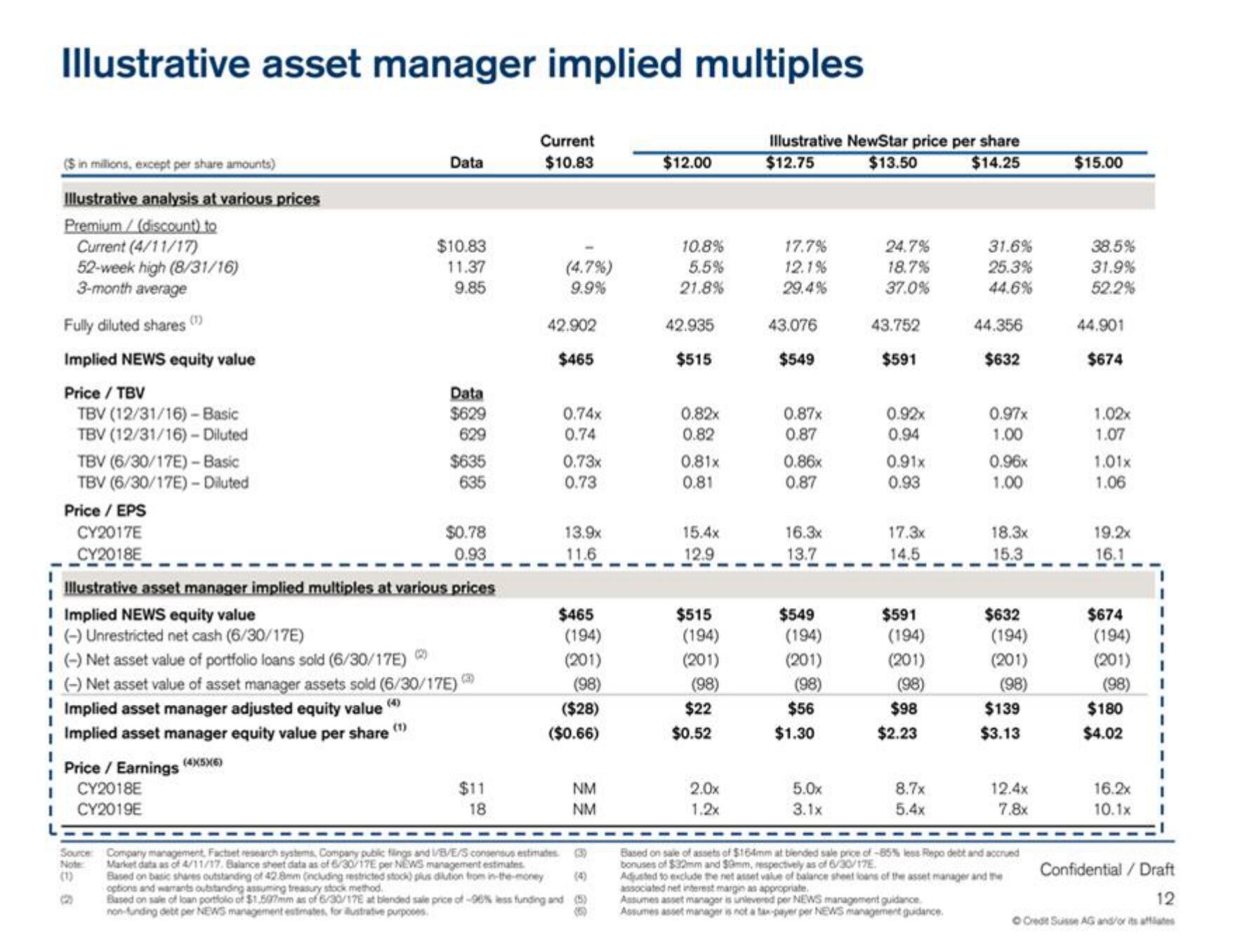

Illustrative asset manager implied multiples

($ in millions, except per share amounts)

Illustrative analysis at various prices

Premium/(discount) to

Current (4/11/17)

52-week high (8/31/16)

3-month average

Fully diluted shares (¹)

Implied NEWS equity value

Price / TBV

TBV (12/31/16) - Basic

TBV (12/31/16) -Diluted

TBV (6/30/17E)-Basic

TBV (6/30/17E) - Diluted

Price / EPS

CY2017E

CY2018E

Price / Earnings (4)5X(6)

CY2018E

ICY2019E

Source

Note

9

Data

$10.83

11.37

9.85

Illustrative asset manager implied multiples at various prices

Implied NEWS equity value

(-)Unrestricted net cash (6/30/17E)

(-) Net asset value of portfolio loans sold (6/30/17E)

(-) Net asset value of asset manager assets sold (6/30/17E) (3)

Implied asset manager adjusted equity value (4)

Implied asset manager equity value per share (¹)

Data

$629

629

$635

635

$0.78

0.93

$11

18

Current

$10.83

(4.7%)

9.9%

42.902

$465

0.74x

0.74

0.73x

0.73

13.9x

11.6

$465

(194)

(201)

(98)

($28)

($0.66)

NM

NM

Company management, Factset research systems, Company public flings and I/B/E/S consensus estimates (3)

Market data as of 4/11/17. Balance sheet data as of 6/30/17E per NEWS management estimates.

Based on basic shares outstanding of 42.8mm (including restricted stock) plus dilution from in-the-money

options and warrants outstanding assuming treasury stock method.

Based on sale of loan portfolio of $1.597mm as of 6/30/17E at blended sale price of -96% less funding and (5)

non-funding debit per NEWS management estimates, for illustrative purposes.

(6)

$12.00

10.8%

5.5%

21.8%

42.935

$515

0.82x

0.82

0.81x

0.81

15.4x

12.9

$515

(194)

(201)

(98)

$22

$0.52

2.0x

1.2x

Illustrative NewStar price per share

$12.75 $13.50

$14.25

17.7%

12.1%

29.4%

43.076

$549

0.87x

0.87

0.86x

0.87

16.3x

13.7

$549

(194)

(201)

(98)

$56

$1.30

5.0x

3.1x

24.7%

18.7%

37.0%

43.752

$591

0.92x

0.94

0.91x

0.93

17.3x

14.5

$591

(194)

(201)

(98)

$98

$2.23

8.7x

5.4x

31.6%

25.3%

44.6%

44.356

$632

0.97x

1.00

0.96x

1.00

18.3x

15.3

$632

(194)

(201)

(98)

$139

$3.13

12.4x

7.8x

Based on sale of assets of $164mm at blended sale price of -85% less Repo debt and accrued

bonuses of $32mm and $9mm, respectively as of 6/30/17E.

Adjusted to exclude the net asset value of balance sheet loans of the asset manager and the

associated net interest margin as appropriate.

Assumes asset manager is unlevered per NEWS management guidance

Assumes asset manager is not a tax-payer per NEWS management guidance.

$15.00

38.5%

31.9%

52.2%

44.901

$674

1.02x

1.07

1.01x

1.06

19.2x

16.1

$674

(194)

(201)

(98)

$180

$4.02

16.2x

10.1x

Confidential / Draft

12

O Credit Suisse AG and/or its affiliatesView entire presentation