Nogin SPAC Presentation Deck

TRANSACTION SUMMARY

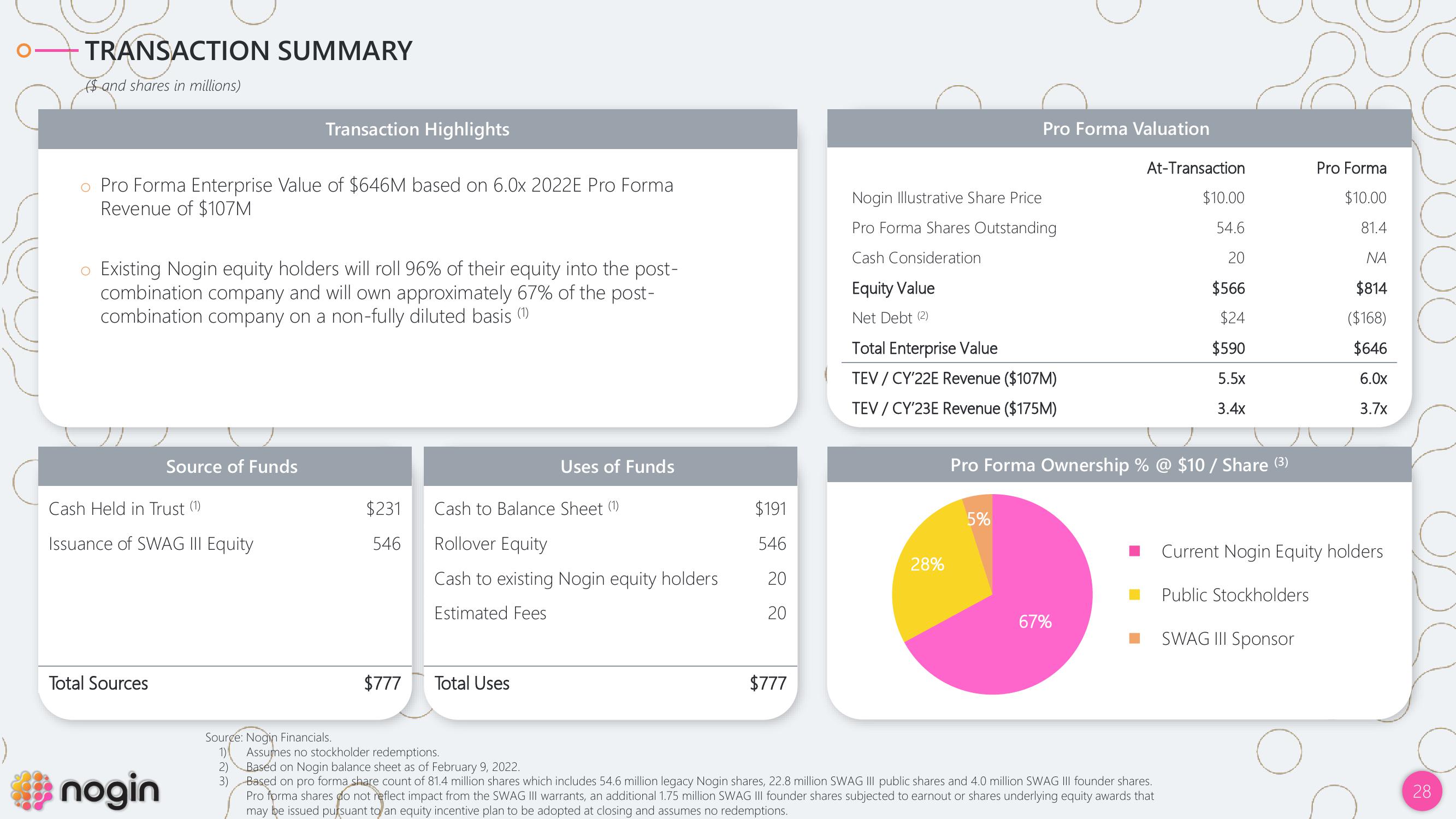

($and shares in millions)

Pro Forma Enterprise Value of $646M based on 6.0x 2022E Pro Forma

Revenue of $107M

Existing Nogin equity holders will roll 96% of their equity into the post-

combination company and will own approximately 67% of the post-

combination company on a non-fully diluted basis (1)

Cash Held in Trust (1)

Issuance of SWAG III Equity

Total Sources

Source of Funds

nogin

Transaction Highlights

Source: Nogin Financials.

1)

2)

3)

$231

546

$777

Uses of Funds

Cash to Balance Sheet (1)

Rollover Equity

Cash to existing Nogin equity holders

Estimated Fees

Total Uses

$191

546

20

20

$777

Nogin Illustrative Share Price

Pro Forma Shares Outstanding

Cash Consideration

Equity Value

Net Debt (2)

Pro Forma Valuation

Total Enterprise Value

TEV/CY'22E Revenue ($107M)

TEV / CY'23E Revenue ($175M)

28%

5%

At-Transaction

Pro Forma Ownership % @ $10 / Share (³)

67%

$10.00

54.6

20

$566

$24

$590

5.5x

3.4x

Assumes no stockholder redemptions.

Based on Nogin balance sheet as of February 9, 2022.

Based on pro forma share count of 81.4 million shares which includes 54.6 million legacy Nogin shares, 22.8 million SWAG III public shares and 4.0 million SWAG III founder shares.

Pro forma shares do not reflect impact from the SWAG III warrants, an additional 1.75 million SWAG III founder shares subjected to earnout or shares underlying equity awards that

may be issued pursuant to an equity incentive plan to be adopted at closing and assumes no redemptions.

Pro Forma

$10.00

81.4

ΝΑ

$814

($168)

$646

6.0x

3.7x

Current Nogin Equity holders

Public Stockholders

SWAG III Sponsor

O

2

28View entire presentation