First Merchants Results Presentation Deck

Investment Portfolio Highlights

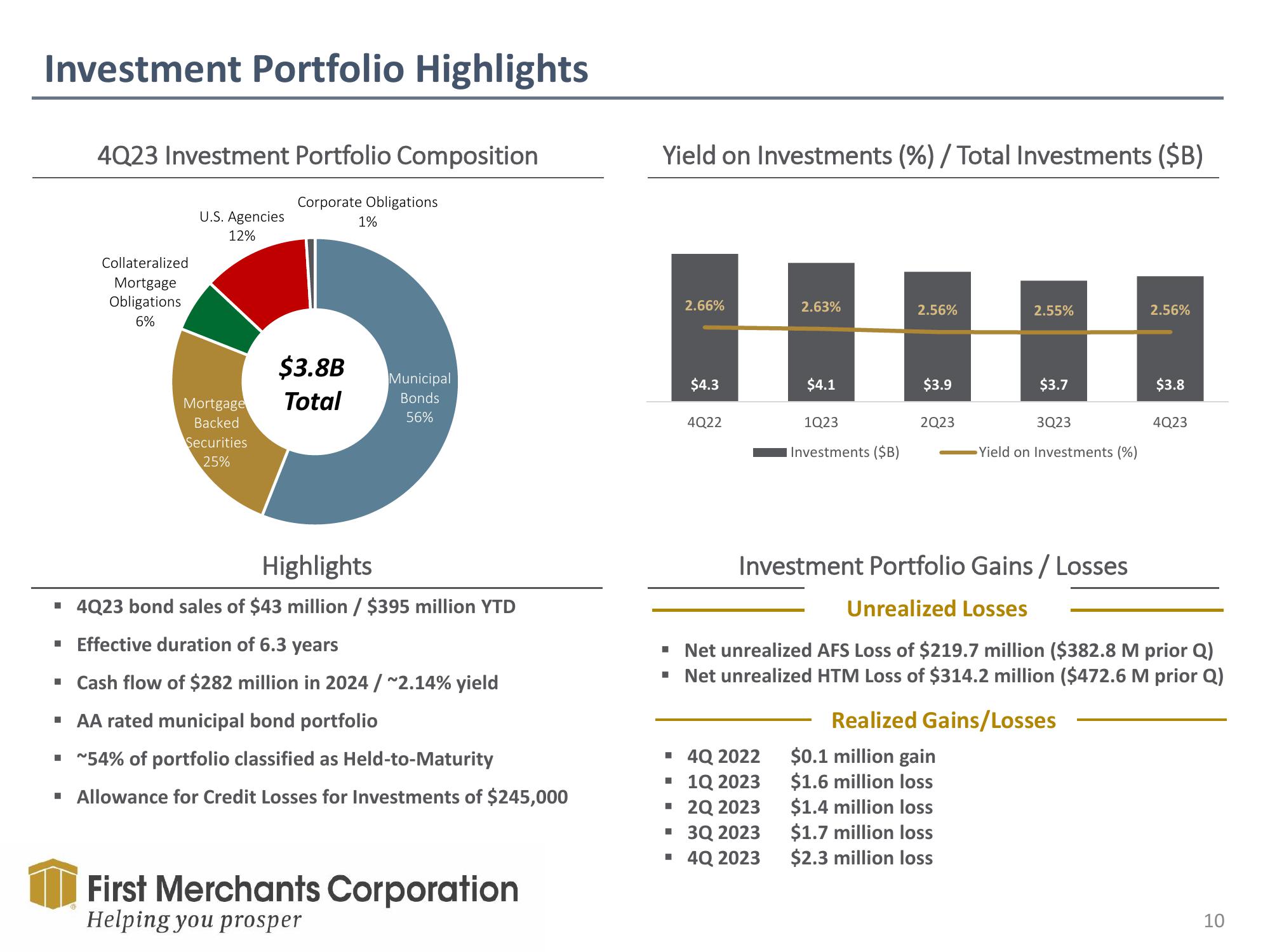

4Q23 Investment Portfolio Composition

Collateralized

Mortgage

Obligations

6%

U.S. Agencies

12%

Mortgage

Backed

Securities

25%

Corporate Obligations

$3.8B

Total

1%

Municipal

Bonds

56%

Highlights

▪ 4Q23 bond sales of $43 million / $395 million YTD

▪ Effective duration of 6.3 years

▪ Cash flow of $282 million in 2024 /~2.14% yield

▪ AA rated municipal bond portfolio

▪ ~54% of portfolio classified as Held-to-Maturity

▪ Allowance for Credit Losses for Investments of $245,000

First Merchants Corporation

Helping you prosper

Yield on Investments (%) / Total Investments ($B)

2.66%

$4.3

4Q22

2.63%

▪ 4Q 2022

▪ 1Q 2023

▪ 2Q 2023

▪ 3Q 2023

▪ 4Q 2023

$4.1

1Q23

Investments ($B)

2.56%

$3.9

2Q23

2.55%

$3.7

$0.1 million gain

$1.6 million loss

$1.4 million loss

$1.7 million loss

$2.3 million loss

3Q23

Yield on Investments (%)

Realized Gains/Losses

2.56%

Investment Portfolio Gains / Losses

Unrealized Losses

▪ Net unrealized AFS Loss of $219.7 million ($382.8 M prior Q)

▪ Net unrealized HTM Loss of $314.2 million ($472.6 M prior Q)

$3.8

4Q23

10View entire presentation