Kinnevik Results Presentation Deck

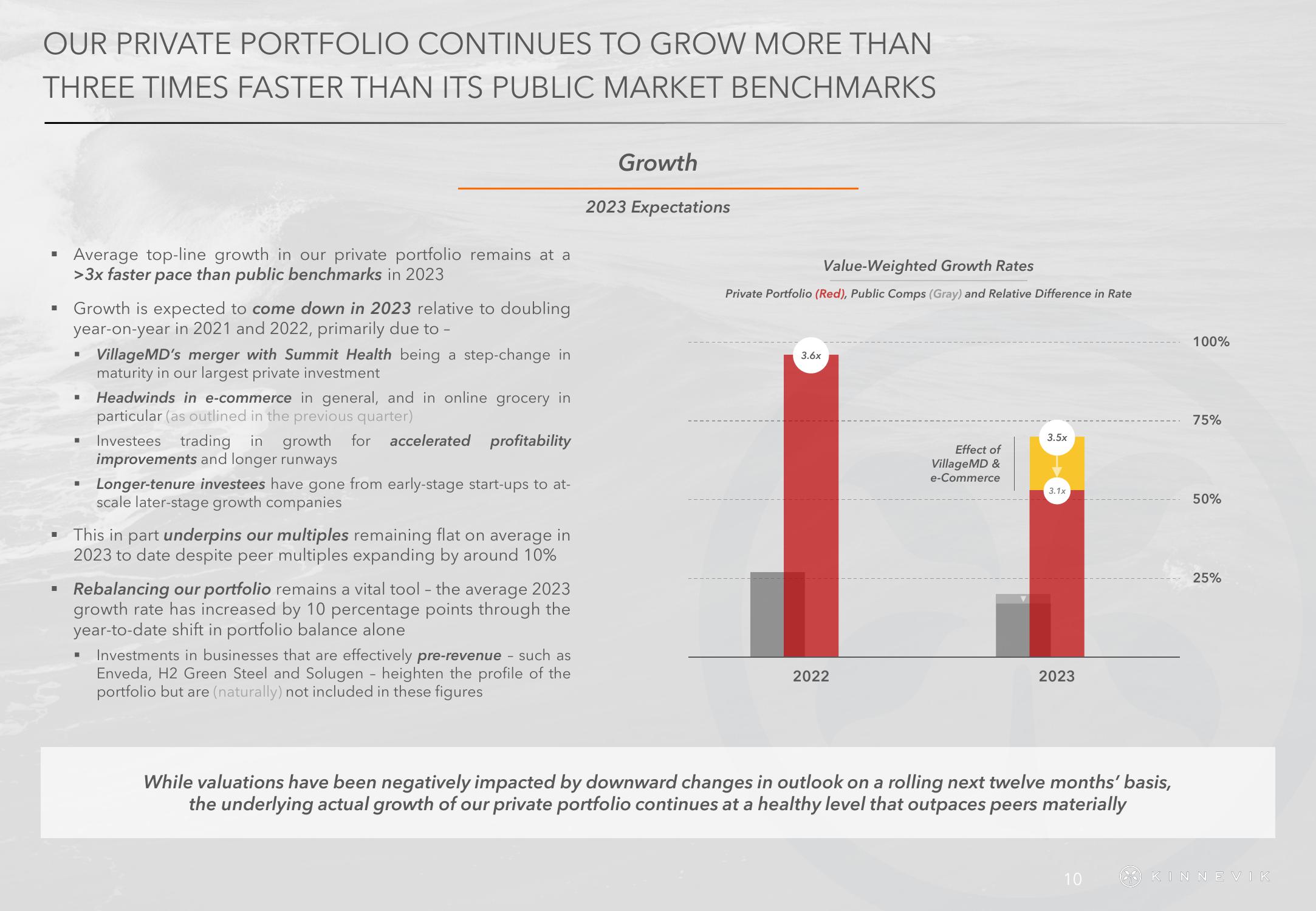

OUR PRIVATE PORTFOLIO CONTINUES TO GROW MORE THAN

THREE TIMES FASTER THAN ITS PUBLIC MARKET BENCHMARKS

■

■

■

Average top-line growth in our private portfolio remains at a

>3x faster pace than public benchmarks in 2023

Growth is expected to come down in 2023 relative to doubling

year-on-year in 2021 and 2022, primarily due to -

■

■

I

■

Village MD's merger with Summit Health being a step-change in

maturity in our largest private investment

Headwinds in e-commerce in general, and in online grocery in

particular (as outlined in the previous quarter)

H

Investees trading in growth for accelerated profitability

improvements and longer runways

Longer-tenure investees have gone from early-stage start-ups to at-

scale later-stage growth companies

This in part underpins our multiples remaining flat on average in

2023 to date despite peer multiples expanding by around 10%

Rebalancing our portfolio remains a vital tool - the average 2023

growth rate has increased by 10 percentage points through the

year-to-date shift in portfolio balance alone

Investments in businesses that are effectively pre-revenue - such as

Enveda, H2 Green Steel and Solugen - heighten the profile of the

portfolio but are (naturally) not included in these figures

Growth

2023 Expectations

Value-Weighted Growth Rates

Private Portfolio (Red), Public Comps (Gray) and Relative Difference in Rate

3.6x

2022

Effect of

Village MD &

e-Commerce

3.5x

3.1x

2023

months' basis,

While valuations have been negatively impacted by downward changes in outlook on a rolling next twelve

the underlying actual growth of our private portfolio continues at a healthy level that outpaces peers materially

10

100%

75%

50%

25%

KINNEVIKView entire presentation