Nikola SPAC Presentation Deck

H₂ STATION UNIT ECONOMICS

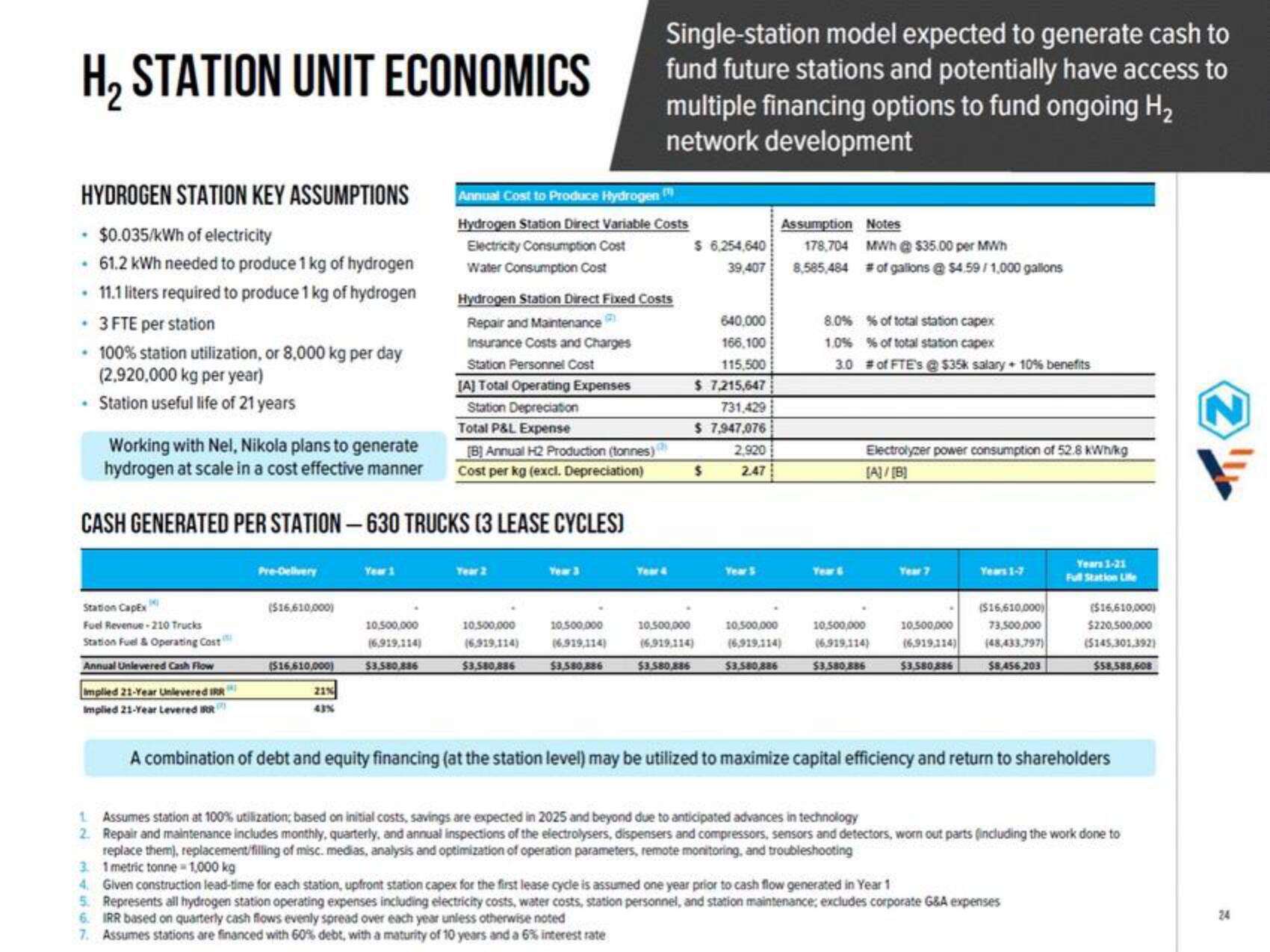

HYDROGEN STATION KEY ASSUMPTIONS

$0.035/kWh of electricity

• 61.2 kWh needed to produce 1 kg of hydrogen

• 11.1 liters required to produce 1 kg of hydrogen

• 3 FTE per station

• 100% station utilization, or 8,000 kg per day

(2,920,000 kg per year)

• Station useful life of 21 years

.

Station CapEx

Fuel Revenue-210 Trucks

Station Fuel & Operating Cost

Annual Unlevered Cash Flow

Hydrogen Station Direct Fixed Costs

Repair and Maintenance

Insurance Costs and Charges

Station Personnel Cost

[A] Total Operating Expenses

Station Depreciation

Total P&L Expense

Working with Nel, Nikola plans to generate

hydrogen at scale in a cost effective manner

[B] Annual H2 Production (tonnes)

Cost per kg (excl. Depreciation)

CASH GENERATED PER STATION-630 TRUCKS (3 LEASE CYCLES)

implied 21-Year Unlevered IRR

Implied 21-Year Levered IRR

Pre-Delivery

($16,610,000)

(516,610,000)

21%

43%

Year 1

10,500,000

(6,919,114)

$3,580,886

Annual Cost to Produce Hydrogen

Hydrogen Station Direct Variable Costs

Electricity Consumption Cost

Water Consumption Cost

Year 2

10,500,000

(6,919,114)

$3,580,886

Single-station model expected to generate cash to

fund future stations and potentially have access to

multiple financing options to fund ongoing H₂

network development

Year 3

10,500,000

(6,919,114)

$3,580,886

Year 4

$ 6,254,640

39,407

640,000

166,100

115,500

$ 7,215,647

731,429

$ 7,947,076

$

10,500,000

(6,919,114)

$3,580,886

2,920

2.47

Year 5

Assumption Notes

10,500,000

(6,919,114)

$3,580,886

178,704 MWh @ $35.00 per MWh

8,585,484 # of galions@ $4.59/1,000 gallons

8.0% % of total station capex

1.0% % of total station capex

3.0 # of FTE's @ $35k salary + 10% benefits

Year 6

Electrolyzer power consumption of 52.8 kWh/kg

[A]/[B]

10,500,000

(6,919,114)

$3,580,886

Year

Years 1-7

($16,610,000)

10,500,000 73,500,000

(6,919,114) (48,433,797)

$8,456,203

$3,580,886

Years 1-21

Full Station Life

($16,610,000)

$220,500,000

($145,301,392)

$58,588,608

A combination of debt and equity financing (at the station level) may be utilized to maximize capital efficiency and return to shareholders

1 Assumes station at 100% utilization; based on initial costs, savings are expected in 2025 and beyond due to anticipated advances in technology

2.

Repair and maintenance includes monthly, quarterly, and annual inspections of the electrolysers, dispensers and compressors, sensors and detectors, worn out parts (including the work done to

replace them), replacement filling of misc. medias, analysis and optimization of operation parameters, remote monitoring, and troubleshooting

3 1 metric tonne-1,000 kg

4. Given construction lead-time for each station, upfront station capex for the first lease cycle is assumed one year prior to cash flow generated in Year 1

5. Represents all hydrogen station operating expenses including electricity costs, water costs, station personnel, and station maintenance, excludes corporate G&A expenses

6. IRR based on quarterly cash flows evenly spread over each year unless otherwise noted

7. Assumes stations are financed with 60% debt, with a maturity of 10 years and a 6% interest rate

24View entire presentation