Invitation Homes Investor Presentation Deck

A Business Model For All Seasons

We believe our portfolio and proven strategy position us well to weather periods of economic uncertainty

The location and quality of our homes attract a higher-end SFR customer; new residents (T12M) have an average annual

income of over $142,000 and an income-to-rent ratio of 5.2x as of 3Q23

Our investment-grade rated balance sheet provides us with nearly $1.8 billion of liquidity as of September 30, 2023, and

we have no debt reaching final maturity prior to 2026, 99.4% of our debt is fixed rate or swapped to fixed rate, 83.5% of

our homes are unencumbered, and over 75% of our debt is unsecured

In August 2023, Fitch Ratings revised its rating outlook for the Company to "Positive" from "Stable" and affirmed the

Company's ratings, including the "BBB" Long-Term Issuer Default Ratings

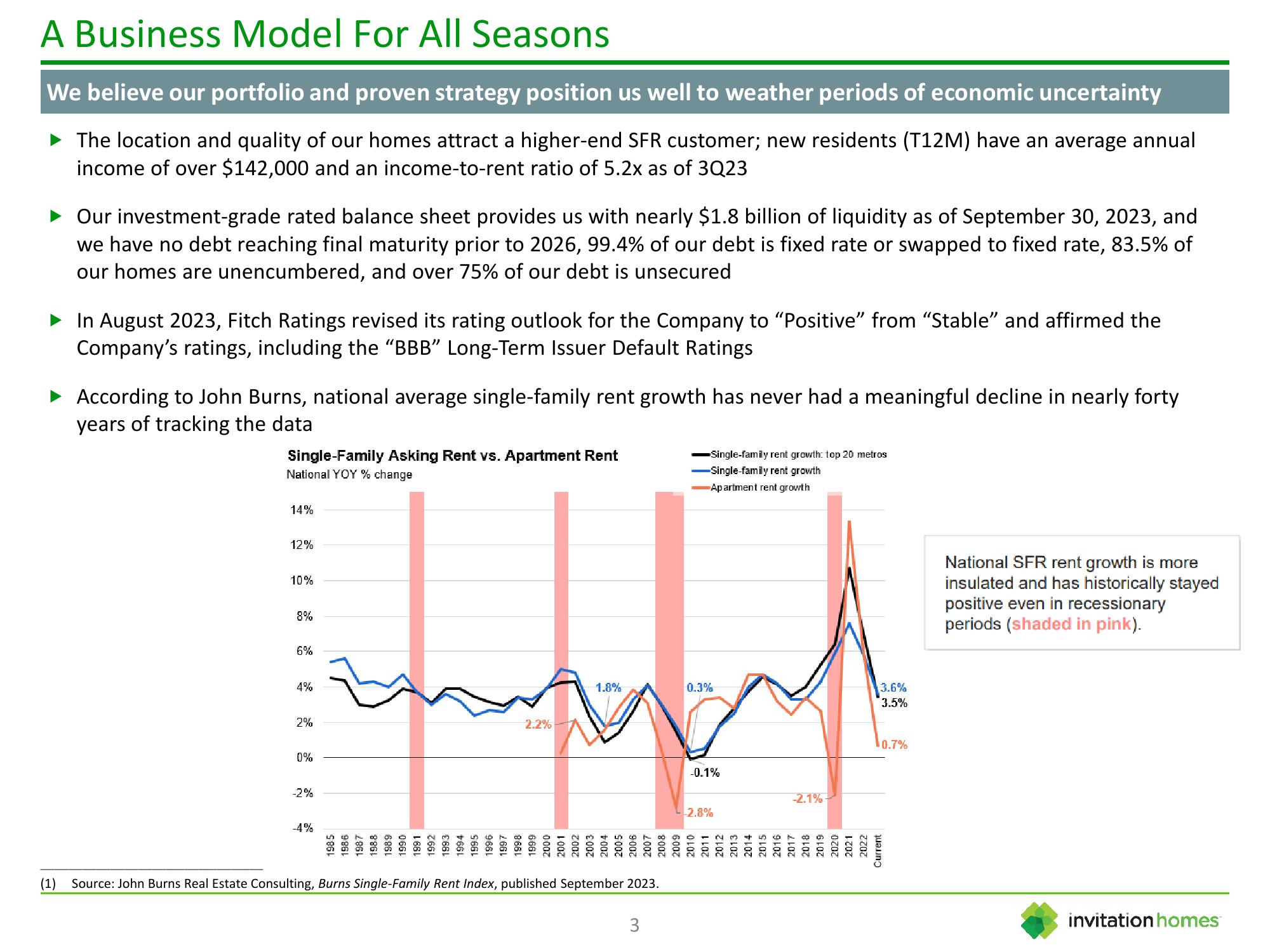

According to John Burns, national average single-family rent growth has never had a meaningful decline in nearly forty

years of tracking the data

Single-Family Asking Rent vs. Apartment Rent

National YOY % change

14%

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

2.2%

1997

1998

1999

2000

2001

1.8%

2002

2003

2004

2005

2006

2007

Single-family rent growth: top 20 metros

-Single-family rent growth

Apartment rent growth

(1) Source: John Burns Real Estate Consulting, Burns Single-Family Rent Index, published September 2023.

0.3%

-0.1%

-2.8%

2008

2009

2010

2011

2012

2013

2014

-2.1%-

z

3.6%

3.5%

2015

2016

2017

2018

2019

2020

2021

2022

Current

0.7%

National SFR rent growth is more

insulated and has historically stayed

positive even in recessionary

periods (shaded in pink).

invitation homesView entire presentation