Deutsche Bank Results Presentation Deck

Investment Bank

In € m, unless stated otherwise

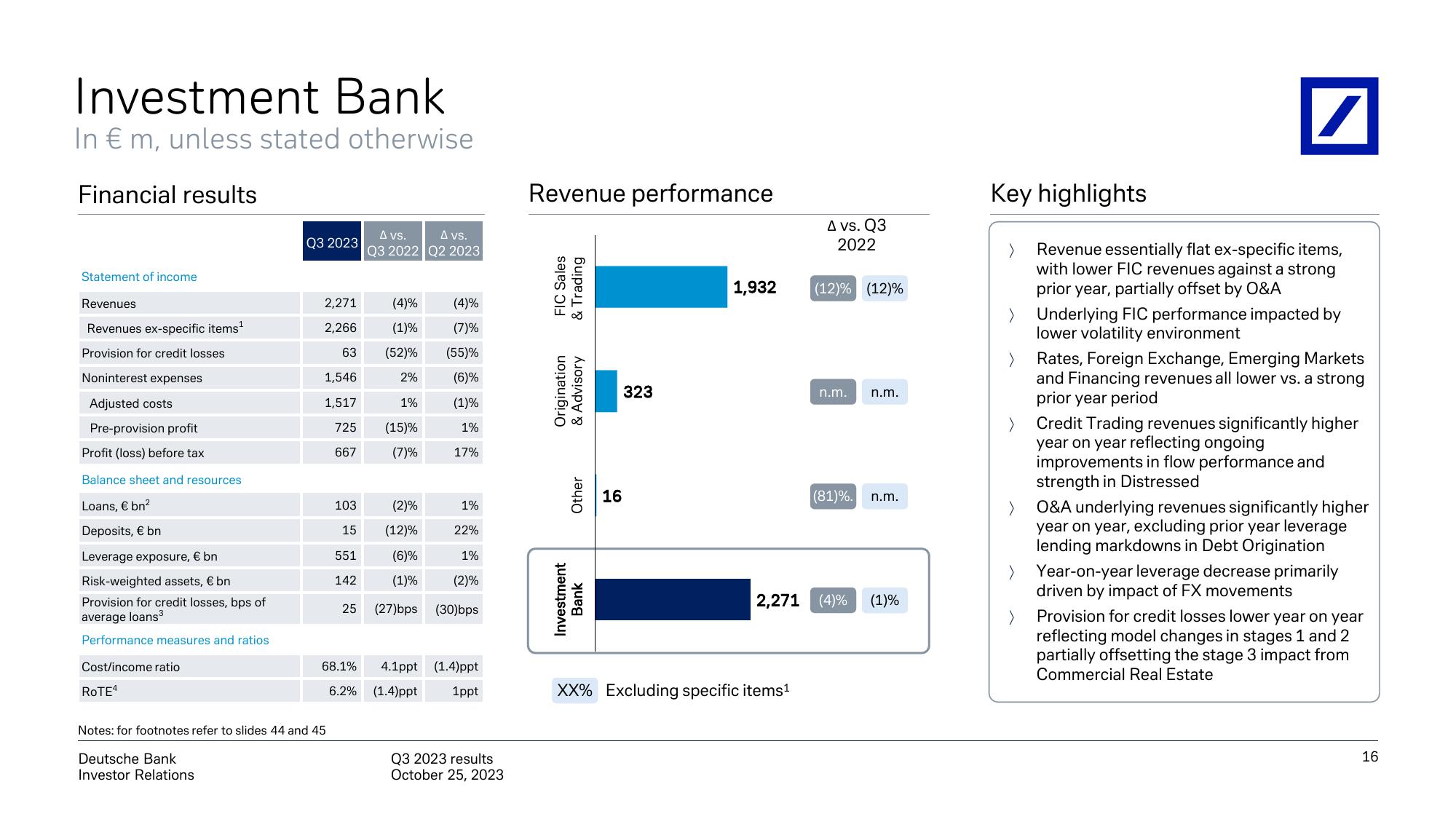

Financial results

Statement of income

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Balance sheet and resources

Loans, € bn²

Deposits, € bn

Leverage exposure, € bn

Risk-weighted assets, € bn

Provision for credit losses, bps of

average loans³

Performance measures and ratios

Cost/income ratio

ROTE4

Q3 2023

Deutsche Bank

Investor Relations

2,271

2,266

63

1,546

1,517

725

667

Notes: for footnotes refer to slides 44 and 45

103

15

551

142

25

68.1%

6.2%

A vs.

A vs.

Q3 2022 Q2 2023

(4)%

(1)%

(52)%

2%

1%

(15)%

(7)%

(4)%

(7)%

(55)%

(6)%

(1)%

1%

17%

(2)%

1%

(12)%

22%

(6)%

1%

(2)%

(1)%

(27)bps (30)bps

4.1ppt (1.4)ppt

(1.4)ppt 1ppt

Q3 2023 results

October 25, 2023

Revenue performance

FIC Sales

& Trading

Origination

& Advisory

Other

Investment

Bank

16

323

1,932

A vs. Q3

2022

XX% Excluding specific items¹

(12)% (12)%

n.m.

n.m.

(81)%. n.m.

2,271 (4)% (1)%

Key highlights

/

Revenue essentially flat ex-specific items,

with lower FIC revenues against a strong

prior year, partially offset by O&A

Underlying FIC performance impacted by

lower volatility environment

Rates, Foreign Exchange, Emerging Markets

and Financing revenues all lower vs. a strong

prior year period

Credit Trading revenues significantly higher

year on year reflecting ongoing

improvements in flow performance and

strength in Distressed

O&A underlying revenues significantly higher

year on year, excluding prior year leverage

lending markdowns in Debt Origination

Year-on-year leverage decrease primarily

driven by impact of FX movements

Provision for credit losses lower year on year

reflecting model changes in stages 1 and 2

partially offsetting the stage 3 impact from

Commercial Real Estate

16View entire presentation