BAT Results Presentation Deck

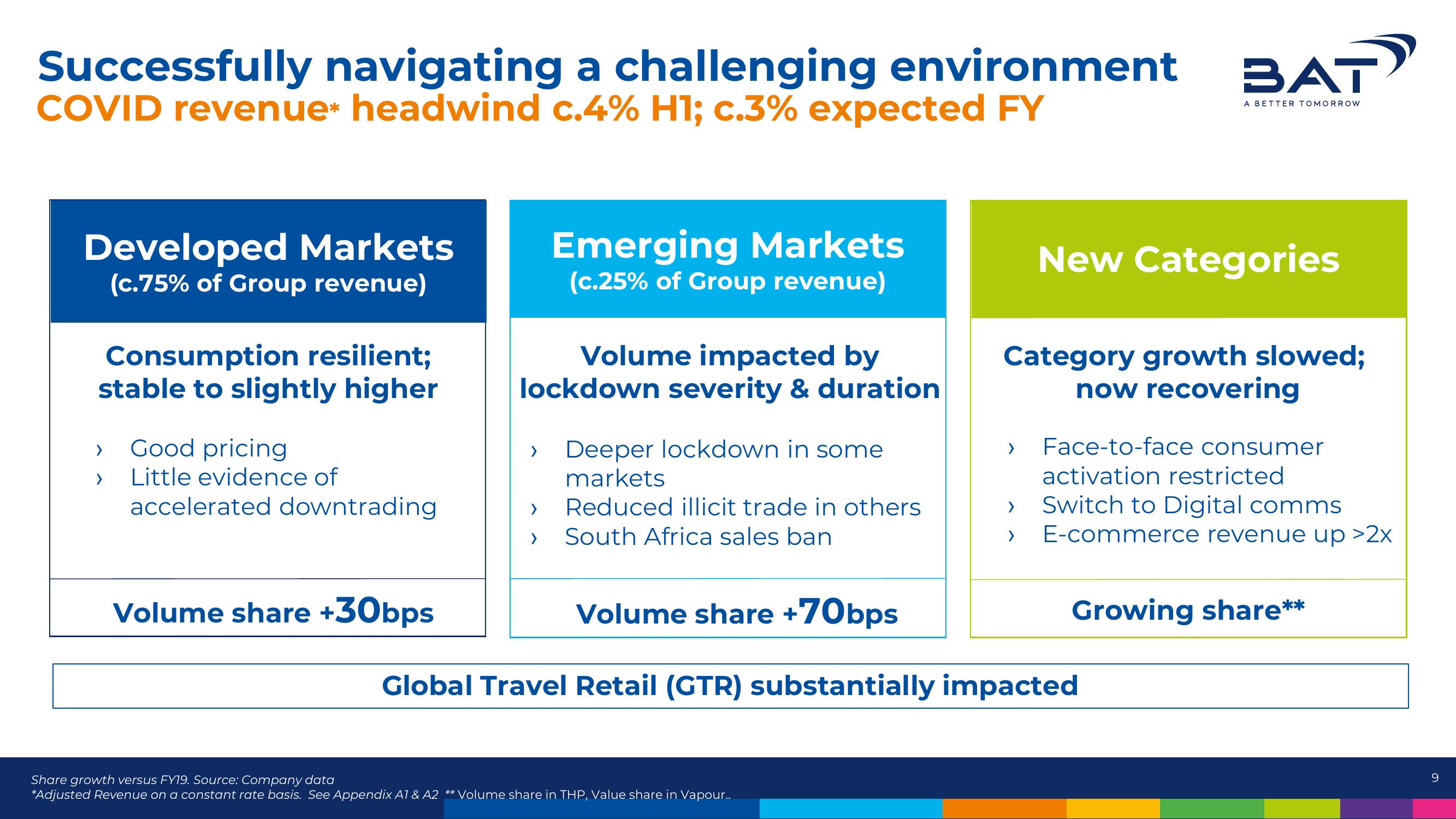

Successfully navigating a challenging environment

COVID revenue* headwind c.4% H1; c.3% expected FY

Developed Markets

(c.75% of Group revenue)

Consumption resilient;

stable to slightly higher

> Good pricing

>

Little evidence of

accelerated downtrading

Volume share +30bps

Emerging Markets

(c.25% of Group revenue)

Volume impacted by

lockdown severity & duration

>

>

Deeper lockdown in some

markets

Reduced illicit trade in others

South Africa sales ban

Share growth versus FY19. Source: Company data

*Adjusted Revenue on a constant rate basis. See Appendix A1 & A2 ** Volume share in THP, Value share in Vapour..

BAT

Volume share +70bps

Global Travel Retail (GTR) substantially impacted

A BETTER TOMORROW

New Categories

Category growth slowed;

now recovering

> Face-to-face consumer

activation restricted

> Switch to Digital comms

> E-commerce revenue up >2x

Growing share**

9View entire presentation