Credit Suisse Investment Banking Pitch Book

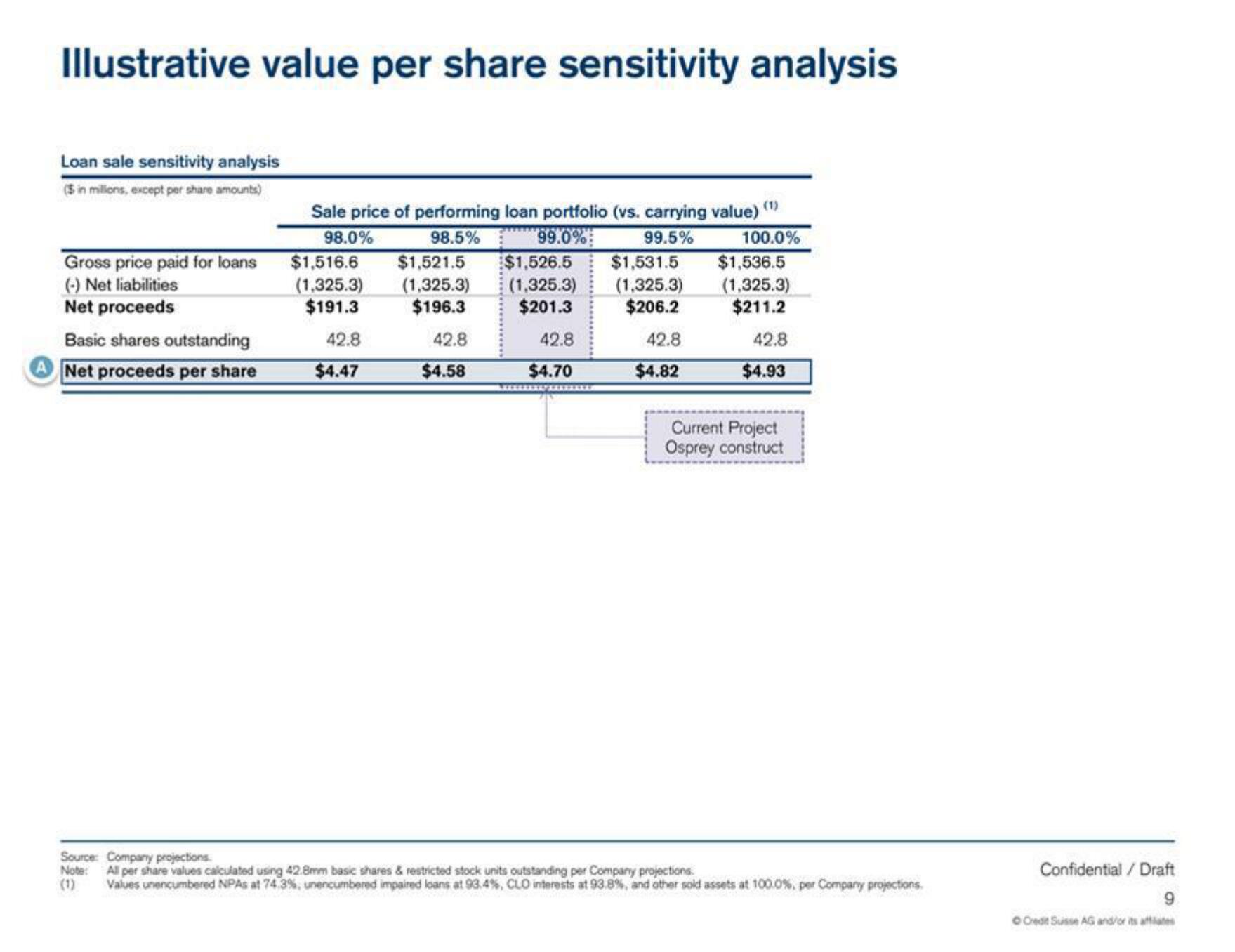

Illustrative value per share sensitivity analysis

Loan sale sensitivity analysis

(5 in millions, except per share amounts)

Gross price paid for loans

(-) Net liabilities

Net proceeds

Basic shares outstanding

A Net proceeds per share

Sale price of performing loan portfolio (vs. carrying value) (¹)

98.0%

98.5%

99.0%

99.5%

100.0%

$1,516.6 $1,521.5 $1,526.5

(1,325.3)

(1,325.3)

(1,325.3)

$191.3

$196.3

$201.3

42.8

$4.47

42.8

$4.58

42.8

$4.70

***********

$1,531.5

(1,325.3)

$206.2

42.8

$4.82

$1,536.5

(1,325.3)

$211.2

42.8

$4.93

Current Project

Osprey construct

Source: Company projections

All per share values calculated using 42.8mm basic shares & restricted stock units outstanding per Company projections.

Note:

(1)

Values unencumbered NPAs at 74.3%, unencumbered impaired loans at 93.4%, CLO interests at 93.8%, and other sold assets at 100.0%, per Company projections.

Confidential / Draft

9

O Credit Suisse AG and/or its affiliatesView entire presentation