Matson Investor Presentation Deck

14

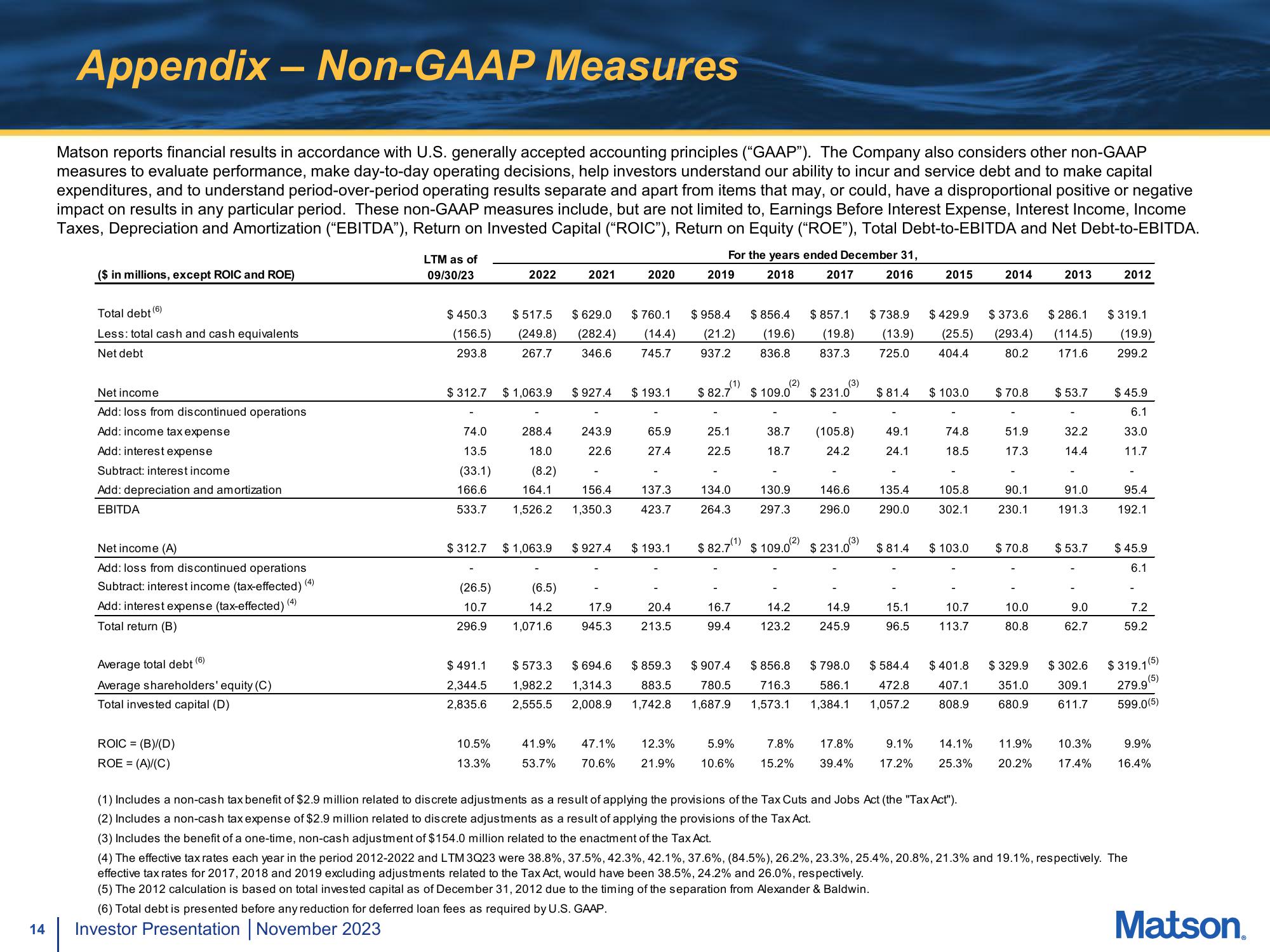

Appendix -Non-GAAP Measures

Matson reports financial results in accordance with U.S. generally accepted accounting principles ("GAAP"). The Company also considers other non-GAAP

measures to evaluate performance, make day-to-day operating decisions, help investors understand our ability to incur and service debt and to make capital

expenditures, and to understand period-over-period operating results separate and apart from items that may, or could, have a disproportional positive or negative

impact on results in any particular period. These non-GAAP measures include, but are not limited to, Earnings Before Interest Expense, Interest Income, Income

Taxes, Depreciation and Amortization ("EBITDA"), Return on Invested Capital ("ROIC"), Return on Equity ("ROE"), Total Debt-to-EBITDA and Net Debt-to-EBITDA.

For the years ended December 31,

2018 2017 2016

($ in millions, except ROIC and ROE)

Total debt (6)

Less: total cash and cash equivalents

Net debt

Net income

Add: loss from discontinued operations

Add: income tax expense

Add: interest expense

Subtract: interest income

Add: depreciation and amortization

EBITDA

Net income (A)

Add: loss from discontinued operations

Subtract: interest income (tax-effected)

Add: interest expense (tax-effected)

Total return (B)

(6)

Average total debt

Average shareholders' equity (C)

Total invested capital (D)

ROIC = (B)/(D)

ROE = (A)/(C)

(4)

(4)

LTM as of

09/30/23

$450.3

(156.5)

293.8

74.0

13.5

(33.1)

166.6

533.7

$312.7 $1,063.9

(26.5)

10.7

296.9

2022

$ 491.1

2,344.5

2,835.6

$517.5

(249.8)

267.7

10.5%

13.3%

$312.7 $ 1,063.9

288.4

18.0

(8.2)

2021

(6.5)

14.2

1,071.6

$ 927.4

164.1

156.4

1,526.2 1,350.3

$ 629.0 $760.1 $958.4 $ 856.4

(282.4) (14.4) (21.2) (19.6)

346.6 745.7 937.2 836.8

243.9

22.6

$927.4

17.9

945.3

2020

$ 193.1

65.9

27.4

(6) Total debt is presented before any reduction for deferred loan fees as required by U.S. GAAP.

Investor Presentation | November 2023

137.3

423.7

$ 193.1

2019

20.4

213.5

$ 82.7

25.1

22.5

16.7

99.4

(2)

41.9% 47.1% 12.3%

5.9%

53.7% 70.6% 21.9% 10.6%

$109.0

38.7

18.7

130.9

297.3

134.0

264.3

146.6

296.0

$82.7¹) $109.02) $231.0(³)

$ 573.3 $694.6 $859.3 $ 907.4 $856.8

1,982.2 1,314.3 883.5 780.5 716.3

2,555.5 2,008.9 1,742.8 1,687.9 1,573.1

14.2

123.2

$857.1 $738.9 $ 429.9

(19.8) (13.9)

837.3 725.0

(25.5)

404.4

(3)

$ 231.0

(105.8)

24.2

14.9

245.9

$81.4

7.8% 17.8%

15.2% 39.4%

49.1

24.1

135.4

290.0

$81.4

15.1

96.5

$798.0 $ 584.4

586.1 472.8

1,384.1 1,057.2

2015

$ 103.0

74.8

18.5

105.8

302.1

$ 103.0

10.7

113.7

$401.8

407.1

808.9

9.1% 14.1%

17.2% 25.3%

2014

$70.8

$373.6 $286.1 $319.1

(293.4) (114.5)

80.2 171.6

51.9

17.3

90.1

230.1

$ 70.8

10.0

80.8

2013

$ 329.9

351.0

680.9

$53.7

32.2

14.4

91.0

191.3

$53.7

9.0

62.7

$302.6

309.1

611.7

2012

11.9% 10.3%

20.2% 17.4%

(19.9)

299.2

$45.9

6.1

33.0

11.7

95.4

192.1

$45.9

6.1

7.2

59.2

$319,1 (5)

(5)

279.9"

599.0(5)

9.9%

16.4%

(1) Includes a non-cash tax benefit of $2.9 million related to discrete adjustments as a result of applying the provisions of the Tax Cuts and Jobs Act (the "Tax Act").

(2) Includes a non-cash tax expense of $2.9 million related to discrete adjustments as a result of applying the provisions of the Tax Act.

(3) Includes the benefit of a one-time, non-cash adjustment of $154.0 million related to the enactment of the Tax Act.

(4) The effective tax rates each year in the period 2012-2022 and LTM 3Q23 were 38.8%, 37.5%, 42.3%, 42.1%, 37.6%, (84.5%), 26.2%, 23.3%, 25.4%, 20.8%, 21.3% and 19.1%, respectively. The

effective tax rates for 2017, 2018 and 2019 excluding adjustments related to the Tax Act, would have been 38.5%, 24.2% and 26.0%, respectively.

(5) The 2012 calculation is based on total invested capital as of December 31, 2012 due to the timing of the separation from Alexander & Baldwin.

Matson.View entire presentation