Ares US Real Estate Opportunity Fund III

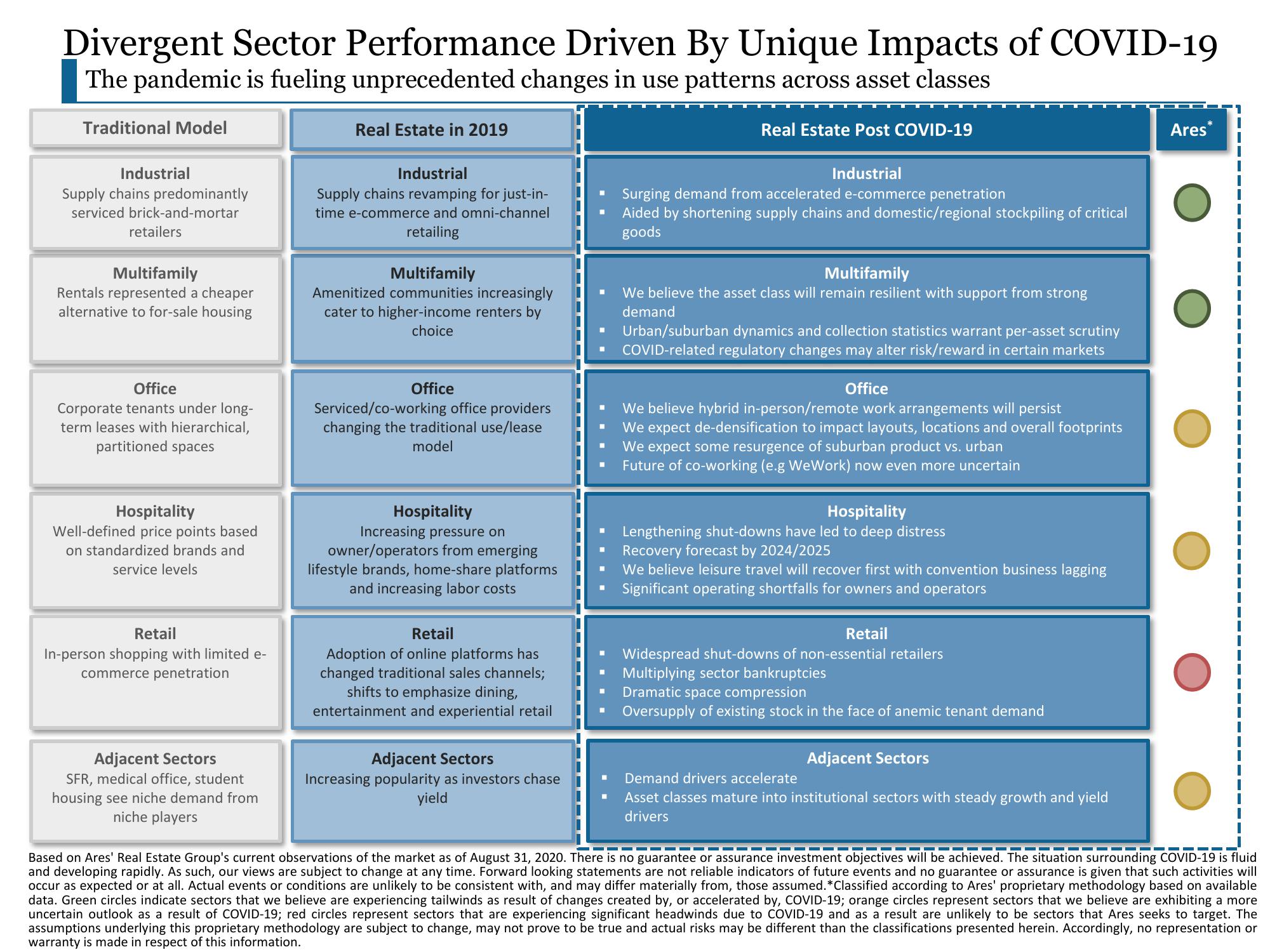

Divergent Sector Performance Driven By Unique Impacts of COVID-19

The pandemic is fueling unprecedented changes in use patterns across asset classes

Traditional Model

Industrial

Supply chains predominantly

serviced brick-and-mortar

retailers

Multifamily

Rentals represented a cheaper

alternative to for-sale housing

Office

Corporate tenants under long-

term leases with hierarchical,

partitioned spaces

Hospitality

Well-defined price points based

on standardized brands and

service levels

Retail

In-person shopping with limited e-

commerce penetration

Adjacent Sectors

SFR, medical office, student

housing see niche demand from

niche players

Real Estate in 2019

Industrial

Supply chains revamping for just-in-

time e-commerce and omni-channel

retailing

Multifamily

Amenitized communities increasingly

cater to higher-income renters by

choice

Office

Serviced/co-working office providers

changing the traditional use/lease

model

Hospitality

Increasing pressure on

owner/operators from emerging

lifestyle brands, home-share platforms

and increasing labor costs

Retail

Adoption of online platforms has

changed traditional sales channels;

shifts to emphasize dining,

entertainment and experiential retail

Adjacent Sectors

Increasing popularity as investors chase

yield

Industrial

■ Surging demand from accelerated e-commerce penetration

Aided by shortening supply chains and domestic/regional stockpiling of critical

goods

"

■

■

■

M

■

■

Real Estate Post COVID-19

■

Multifamily

We believe the asset class will remain resilient with support from strong

demand

Urban/suburban dynamics and collection statistics warrant per-asset scrutiny

COVID-related regulatory changes may alter risk/reward in certain markets

Office

We believe hybrid in-person/remote work arrangements will persist

We expect de-densification to impact layouts, locations and overall footprints

We expect some resurgence of suburban product vs. urban

Future of co-working (e.g WeWork) now even more uncertain

Hospitality

Lengthening shut-downs have led to deep distress

Recovery forecast by 2024/2025

We believe leisure travel will recover first with convention business lagging

Significant operating shortfalls for owners and operators

Retail

Widespread shut-downs of non-essential retailers

Multiplying sector bankruptcies

■ Dramatic space compression

Oversupply of existing stock in the face of anemic tenant demand

Adjacent Sectors

Demand drivers accelerate

Asset classes mature into institutional sectors with steady growth and yield

drivers

Ares

Based on Ares' Real Estate Group's current observations of the market as of August 31, 2020. There is no guarantee or assurance investment objectives will be achieved. The situation surrounding COVID-19 is fluid

and developing rapidly. As such, our views are subject to change at any time. Forward looking statements are not reliable indicators of future events and no guarantee or assurance is given that such activities will

occur as expected or at all. Actual events or conditions are unlikely to be consistent with, and may differ materially from, those assumed.*Classified according to Ares' proprietary methodology based on available

data. Green circles indicate sectors that we believe are experiencing tailwinds as result of changes created by, or accelerated by, COVID-19; orange circles represent sectors that we believe are exhibiting a more

uncertain outlook as a result of COVID-19; red circles represent sectors that are experiencing significant headwinds due to COVID-19 and as a result are unlikely to be sectors that Ares seeks to target. The

assumptions underlying this proprietary methodology are subject to change, may not prove to be true and actual risks may be different than the classifications presented herein. Accordingly, no representation or

warranty is made in respect of this information.View entire presentation