Hertz Investor Presentation Deck

DIP FINANCING SIZING OVERVIEW (CONT'D)

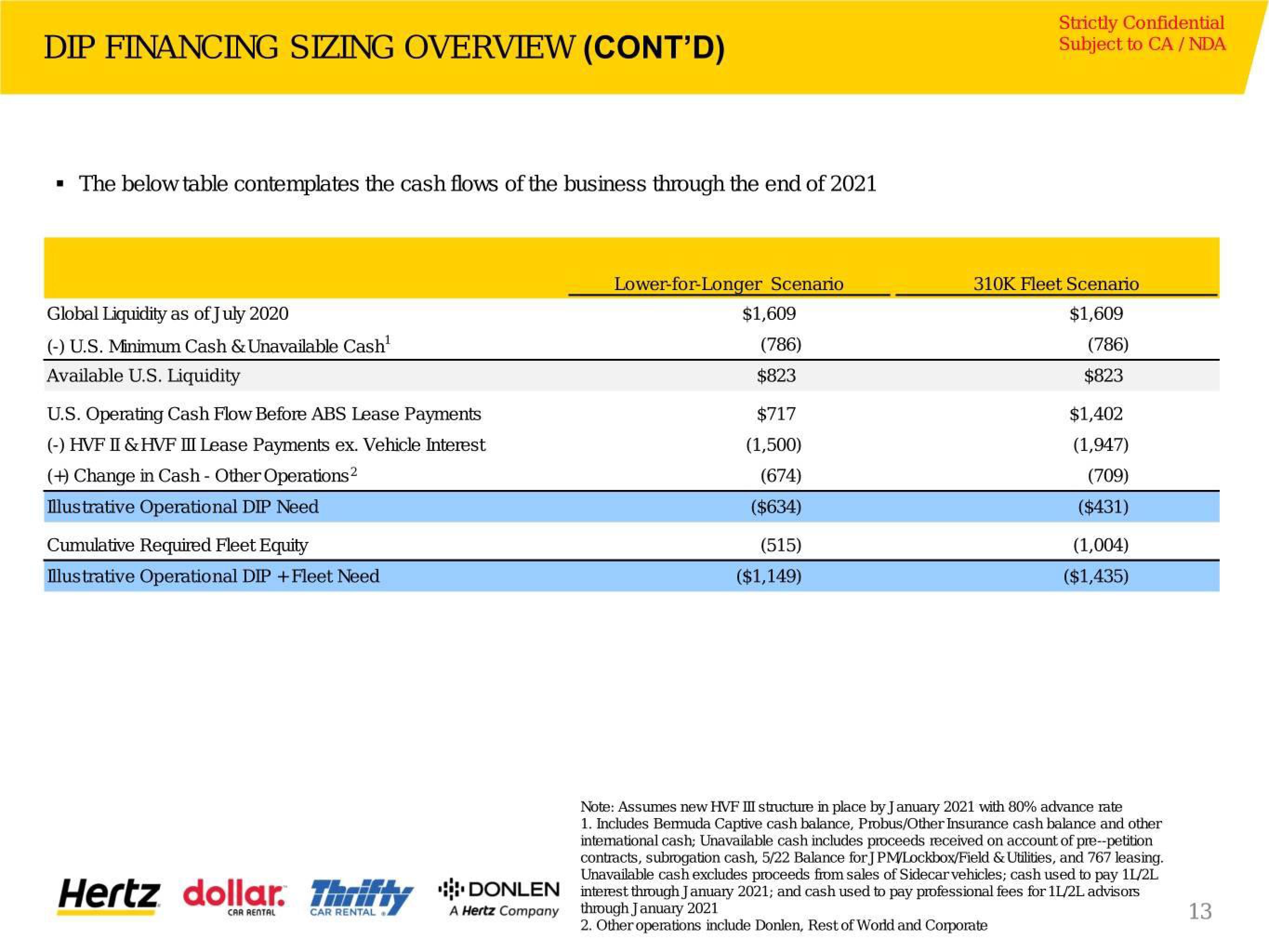

The below table contemplates the cash flows of the business through the end of 2021

Global Liquidity as of July 2020

(-) U.S. Minimum Cash & Unavailable Cash¹

Available U.S. Liquidity

U.S. Operating Cash Flow Before ABS Lease Payments

(-) HVF II & HVF III Lease Payments ex. Vehicle Interest

(+) Change in Cash - Other Operations²

Illustrative Operational DIP Need

Cumulative Required Fleet Equity

Illustrative Operational DIP + Fleet Need

Hertz dollar. Thrifty

CAR RENTAL

CAR RENTAL

DONLEN

A Hertz Company

Lower-for-Longer Scenario

$1,609

(786)

$823

$717

(1,500)

(674)

($634)

(515)

($1,149)

Strictly Confidential

Subject to CA/ NDA

310K Fleet Scenario

$1,609

(786)

$823

$1,402

(1,947)

(709)

($431)

(1,004)

($1,435)

Note: Assumes new HVF III structure in place by January 2021 with 80% advance rate

1. Includes Bermuda Captive cash balance, Probus/Other Insurance cash balance and other

international cash; Unavailable cash includes proceeds received on account of pre--petition

contracts, subrogation cash, 5/22 Balance for JPM/Lockbox/Field & Utilities, and 767 leasing.

Unavailable cash excludes proceeds from sales of Sidecar vehicles; cash used to pay 1L/2L

interest through January 2021; and cash used to pay professional fees for 11/2L advisors

through January 2021

2. Other operations include Donlen, Rest of World and Corporate

13View entire presentation