One Medical Investor Conference Presentation Deck

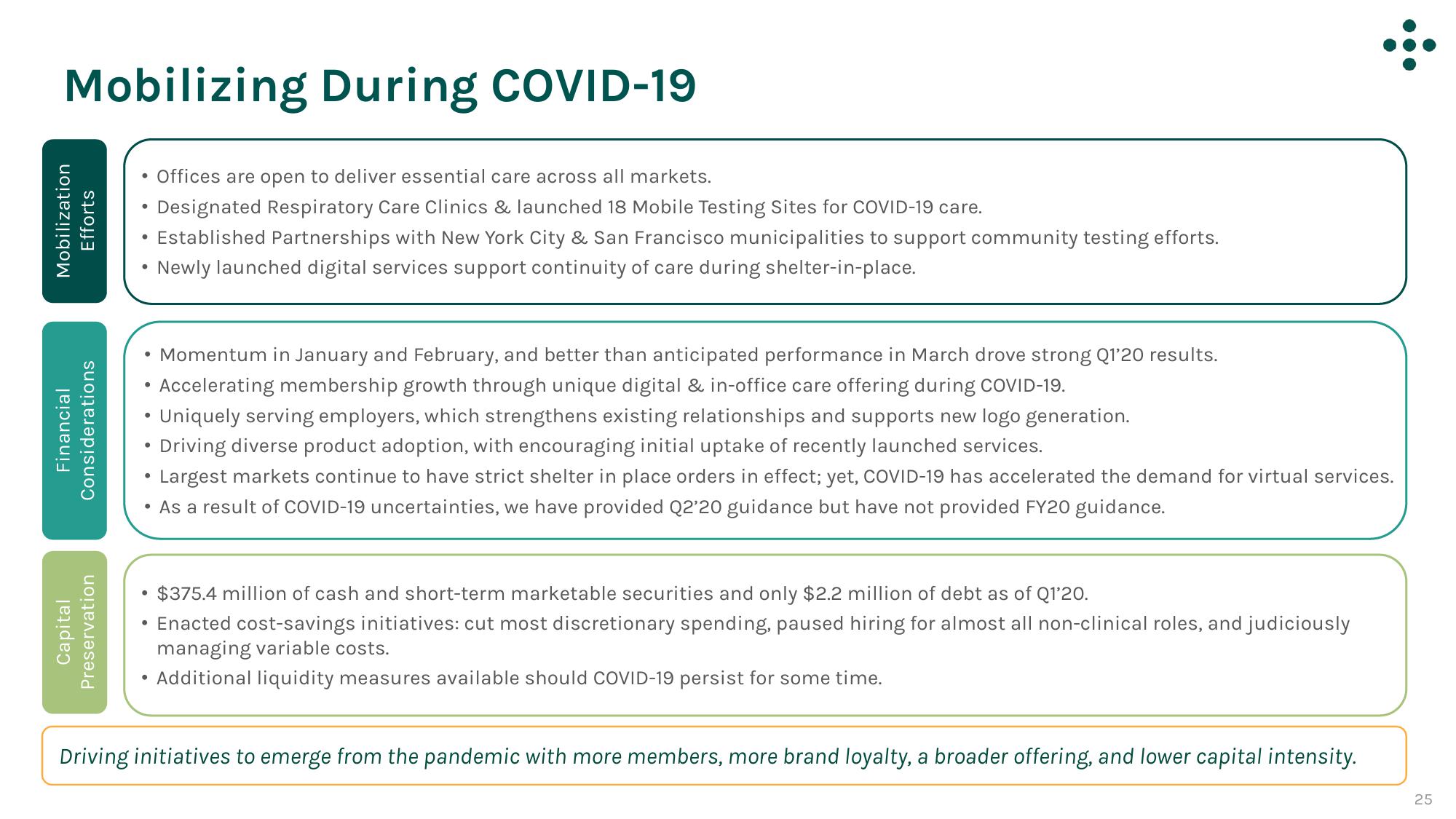

Mobilizing During COVID-19

Mobilization

Efforts

Financial

Considerations

Capital

Preservation

• Offices are open to deliver essential care across all markets.

Designated Respiratory Care Clinics & launched 18 Mobile Testing Sites for COVID-19 care.

Established Partnerships with New York City & San Francisco municipalities to support community testing efforts.

Newly launched digital services support continuity of care during shelter-in-place.

●

●

Momentum in January and February, and better than anticipated performance in March drove strong Q1'20 results.

• Accelerating membership growth through unique digital & in-office care offering during COVID-19.

Uniquely serving employers, which strengthens existing relationships and supports new logo generation.

• Driving diverse product adoption, with encouraging initial uptake of recently launched services.

Largest markets continue to have strict shelter in place orders in effect; yet, COVID-19 has accelerated the demand for virtual services.

●

As a result of COVID-19 uncertainties, we have provided Q2'20 guidance but have not provided FY20 guidance.

●

●

$375.4 million of cash and short-term marketable securities and only $2.2 million of debt as of Q1'20.

Enacted cost-savings initiatives: cut most discretionary spending, paused hiring for almost all non-clinical roles, and judiciously

managing variable costs.

Additional liquidity measures available should COVID-19 persist for some time.

.:.

Driving initiatives to emerge from the pandemic with more members, more brand loyalty, a broader offering, and lower capital intensity.

25View entire presentation