FiscalNote SPAC Presentation Deck

6

MASO

CAPITAL

DUDDELL

STREET

ACQUISITION CORP.

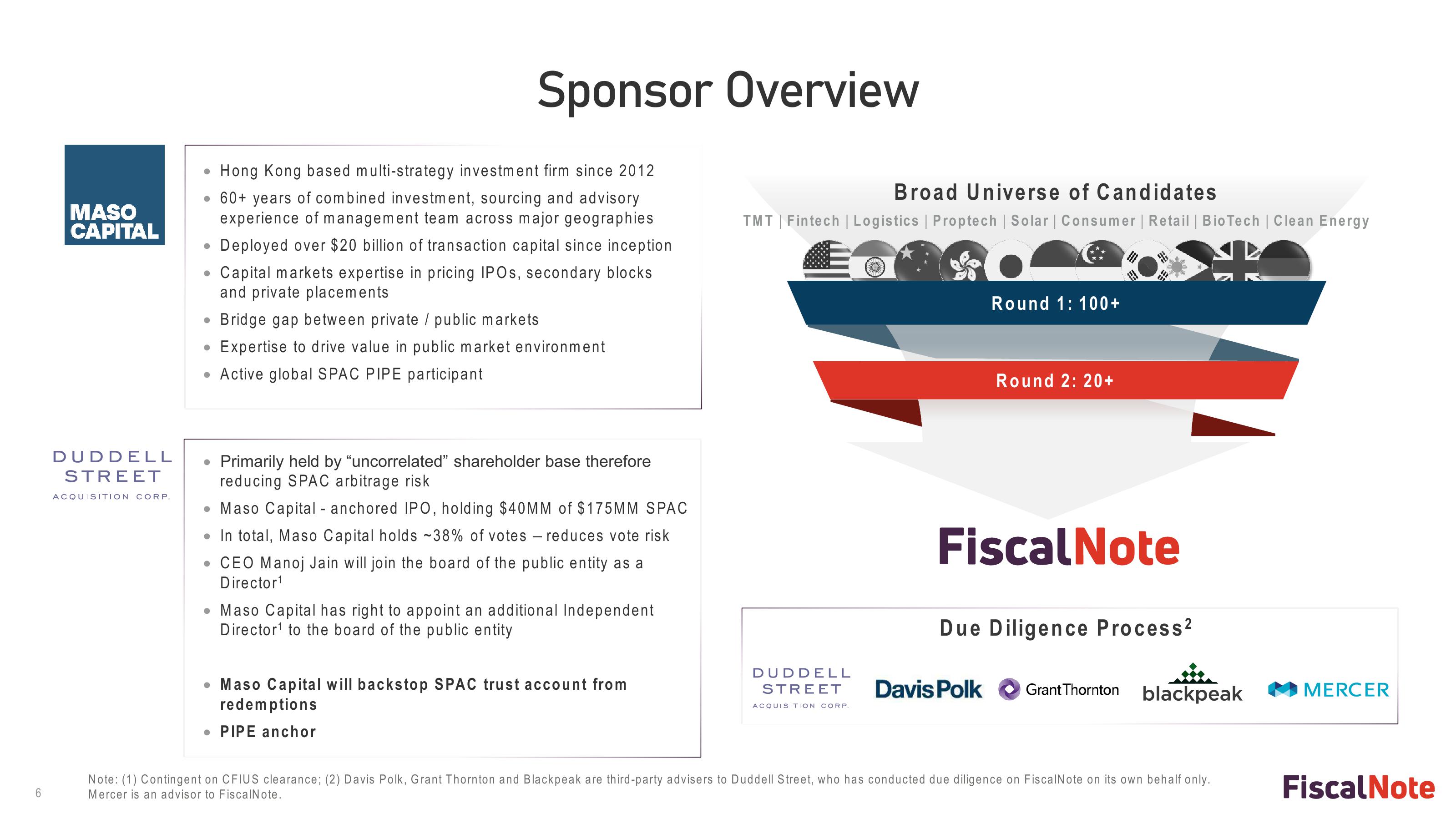

Hong Kong based multi-strategy investment firm since 2012

• 60+ years of combined investment, sourcing and advisory

experience of management team across major geographies

Deployed over $20 billion of transaction capital since inception

• Capital markets expertise in pricing IPOs, secondary blocks

and private placements

Sponsor Overview

●

Bridge gap between private / public markets

Expertise to drive value in public market environment

• Active global SPAC PIPE participant

●

●

Primarily held by "uncorrelated" shareholder base therefore

reducing SPAC arbitrage risk

• Maso Capital - anchored IPO, holding $40MM of $175MM SPAC

• In total, Maso Capital holds -38% of votes - reduces vote risk

• CEO Manoj Jain will join the board of the public entity as a

Director¹

• Maso Capital has right to appoint an additional Independent

Director¹ to the board of the public entity

• Maso Capital will backstop SPAC trust account from

redemptions

• PIPE anchor

Broad Universe of Candidates

TMT | Fintech | Logistics | Proptech | Solar | Consumer | Retail | BioTech | Clean Energy

€:

DUDDELL

STREET

ACQUISITION CORP.

Round 1: 100+

Round 2: 20+

Fiscal Note

Davis Polk

Due Diligence Process ²

Grant Thornton blackpeak

Note: (1) Contingent on CFIUS clearance; (2) Davis Polk, Grant Thornton and Blackpeak are third-party advisers to Duddell Street, who has conducted due diligence on FiscalNote on its own behalf only.

Mercer is an advisor to FiscalNote.

MERCER

FiscalNoteView entire presentation