Terran Orbital SPAC Presentation Deck

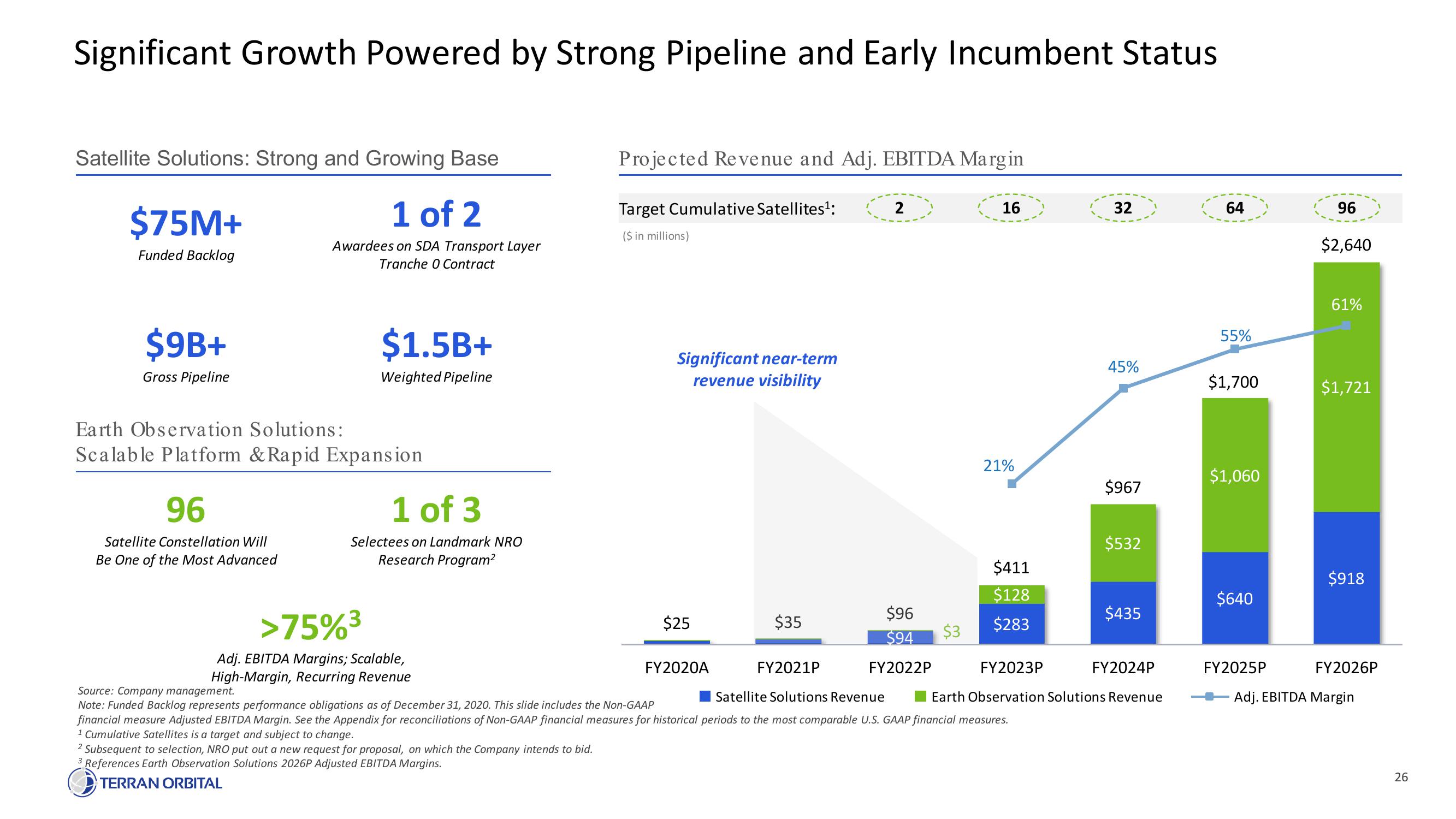

Significant Growth Powered by Strong Pipeline and Early Incumbent Status

Satellite Solutions: Strong and Growing Base

1 of 2

Awardees on SDA Transport Layer

Tranche 0 Contract

$75M+

Funded Backlog

$9B+

Gross Pipeline

$1.5B+

Weighted Pipeline

Earth Observation Solutions:

Scalable Platform & Rapid Expansion

96

Satellite Constellation Will

Be One of the Most Advanced

1 of 3

Selectees on Landmark NRO

Research Program²

>75%³

Adj. EBITDA Margins; Scalable,

High-Margin, Recurring Revenue

Projected Revenue and Adj. EBITDA Margin

Target Cumulative Satellites¹:

($ in millions)

Significant near-term

revenue visibility

$25

$35

FY2020A

2

16

21%

FY2022P

$411

$128

$96

$94 $3 $283

FY2021P

Satellite Solutions Revenue

Source: Company management.

Note: Funded Backlog represents performance obligations as of December 31, 2020. This slide includes the Non-GAAP

financial measure Adjusted EBITDA Margin. See the Appendix for reconciliations of Non-GAAP financial measures for historical periods to the most comparable U.S. GAAP financial measures.

1 Cumulative Satellites is a target and subject to change.

2 Subsequent to selection, NRO put out a new request for proposal, on which the Company intends to bid.

3 References Earth Observation Solutions 2026P Adjusted EBITDA Margins.

TERRAN ORBITAL

32

45%

$967

$532

$435

FY2023P

FY2024P

Earth Observation Solutions Revenue

64

55%

$1,700

$1,060

$640

FY2025P

96

$2,640

61%

$1,721

$918

FY2026P

Adj. EBITDA Margin

26View entire presentation