Freyr SPAC Presentation Deck

■

■

■

■

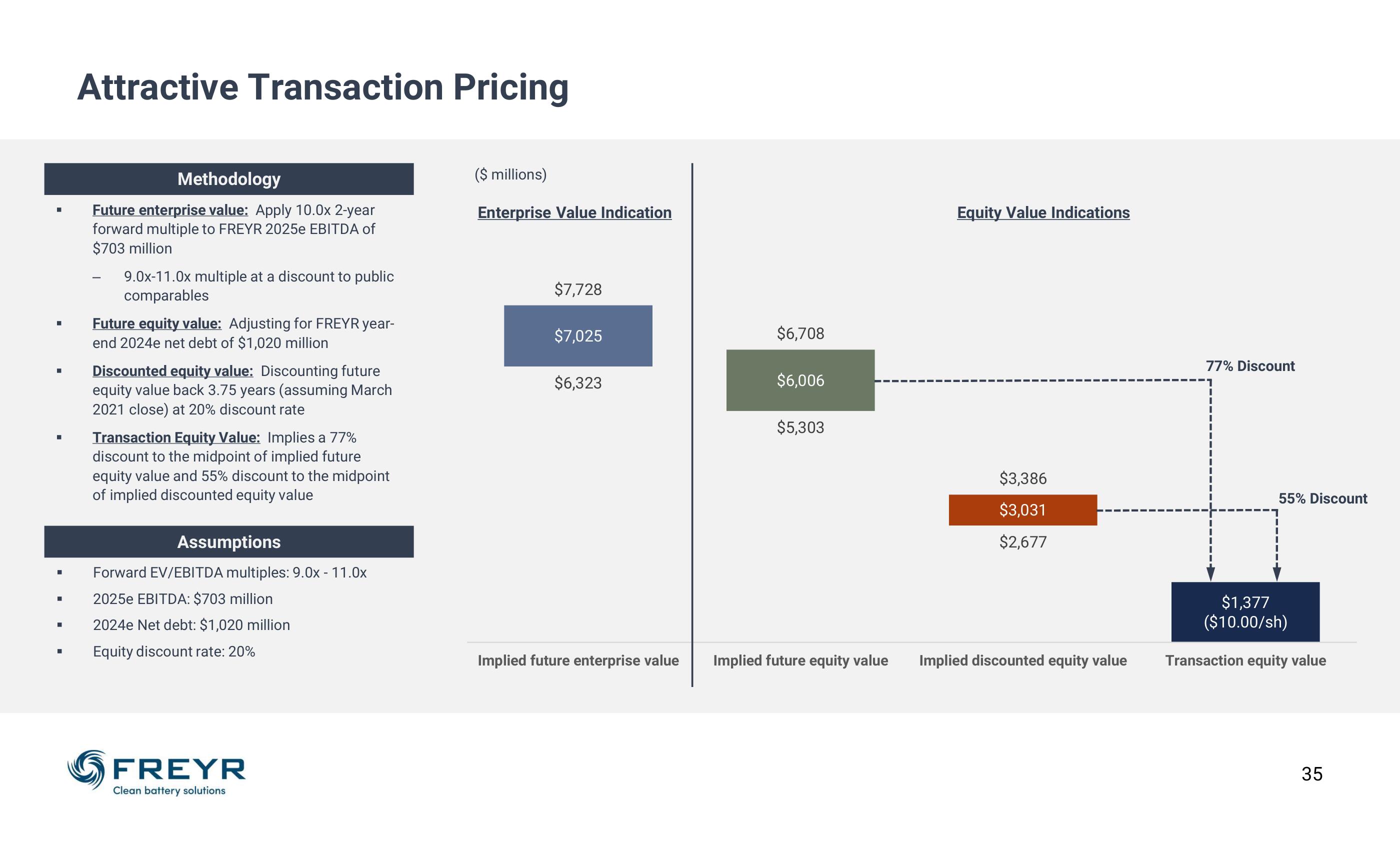

Attractive Transaction Pricing

Methodology

Future enterprise value: Apply 10.0x 2-year

forward multiple to FREYR 2025e EBITDA of

$703 million

9.0x-11.0x multiple at a discount to public

comparables

Future equity value: Adjusting for FREYR year-

end 2024e net debt of $1,020 million

Discounted equity value: Discounting future

equity value back 3.75 years (assuming March

2021 close) at 20% discount rate

Transaction Equity Value: Implies a 77%

discount to the midpoint of implied future

equity value and 55% discount to the midpoint

of implied discounted equity value

Assumptions

Forward EV/EBITDA multiples: 9.0x - 11.0x

2025e EBITDA: $703 million

2024e Net debt: $1,020 million

Equity discount rate: 20%

FREYR

Clean battery solutions

($ millions)

Enterprise Value Indication

$7,728

$7,025

$6,323

$6,708

$6,006

$5,303

Equity Value Indications

$3,386

$3,031

$2,677

Implied future enterprise value Implied future equity value Implied discounted equity value

77% Discount

55% Discount

I

1

$1,377

($10.00/sh)

Transaction equity value

35View entire presentation