Summit Hotel Properties Investor Presentation Deck

20

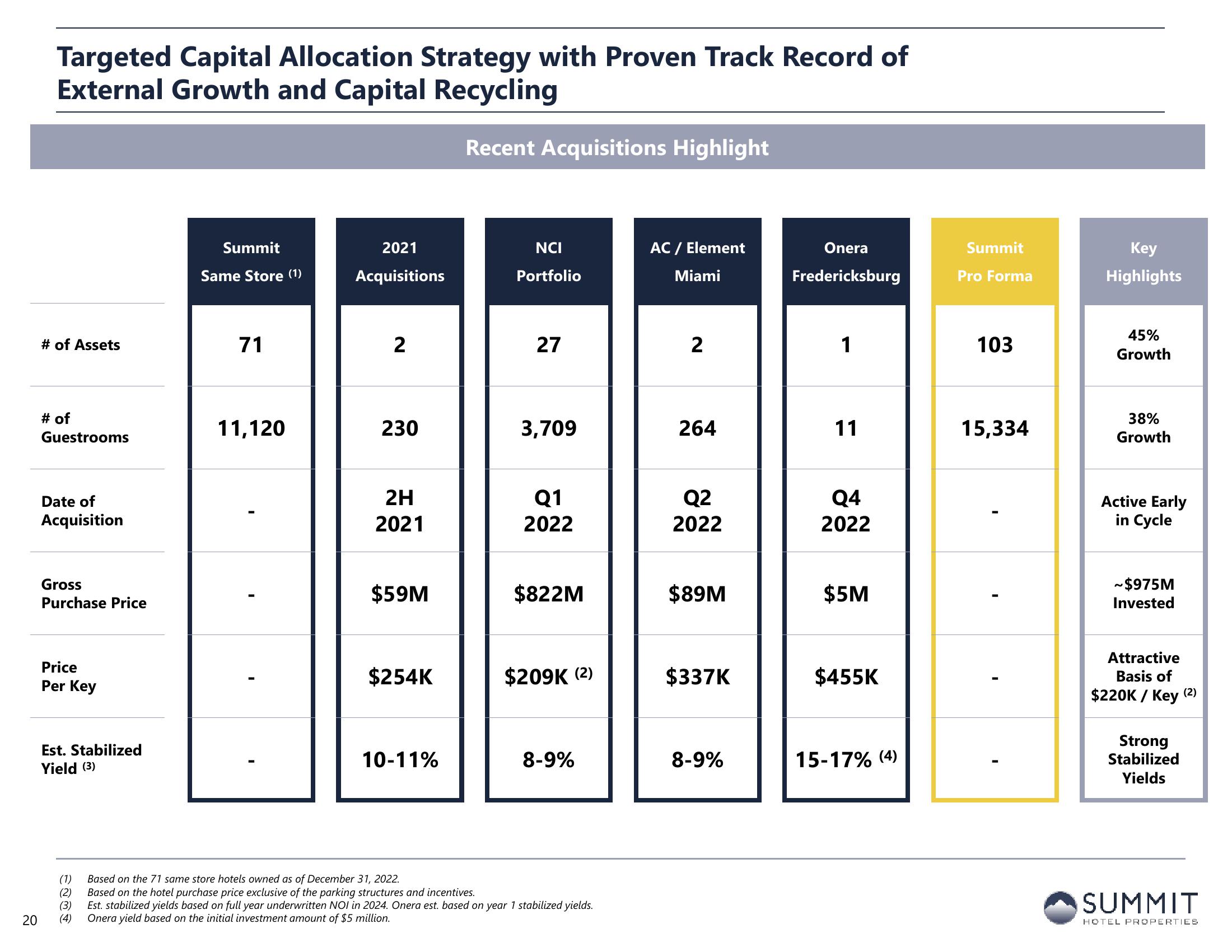

Targeted Capital Allocation Strategy with Proven Track Record of

External Growth and Capital Recycling

Recent Acquisitions Highlight

# of Assets

# of

Guestrooms

Date of

Acquisition

Gross

Purchase Price

Price

Per Key

Est. Stabilized

Yield (3)

Summit

Same Store (1)

71

11,120

2021

Acquisitions

2

230

2H

2021

$59M

$254K

10-11%

NCI

Portfolio

27

3,709

Q1

2022

$822M

$209K (2)

8-9%

(1) Based on the 71 same store hotels owned as of December 31, 2022.

(2) Based on the hotel purchase price exclusive of the parking structures and incentives.

(3)

Est. stabilized yields based on full year underwritten NOI in 2024. Onera est. based on year 1 stabilized yields.

(4) Onera yield based on the initial investment amount of $5 million.

AC / Element

Miami

2

264

Q2

2022

$89M

$337K

8-9%

Onera

Fredericksburg

1

11

Q4

2022

$5M

$455K

15-17% (4)

Summit

Pro Forma

103

15,334

Key

Highlights

45%

Growth

38%

Growth

Active Early

in Cycle

~$975M

Invested

Attractive

Basis of

$220K / Key (2)

Strong

Stabilized

Yields

SUMMIT

HOTEL PROPERTIESView entire presentation