Bed Bath & Beyond Results Presentation Deck

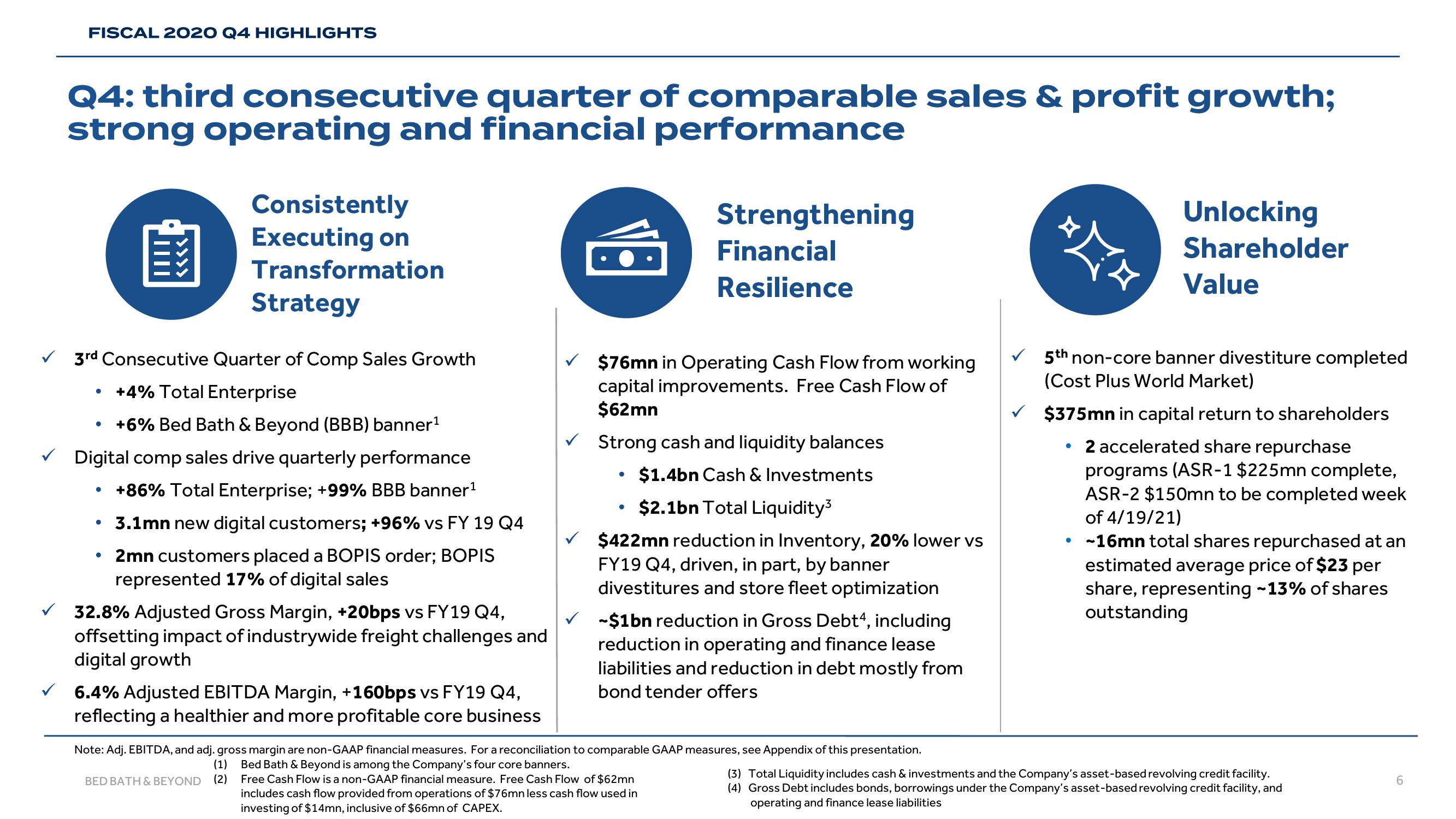

FISCAL 2020 Q4 HIGHLIGHTS

Q4: third consecutive quarter of comparable sales & profit growth;

strong operating and financial performance

Consistently

Executing on

Transformation

Strategy

3rd Consecutive Quarter of Comp Sales Growth

+4% Total Enterprise

• +6% Bed Bath & Beyond (BBB) banner¹

Digital comp sales drive quarterly performance

• +86% Total Enterprise; +99% BBB banner¹

• 3.1mn new digital customers; +96% vs FY 19 Q4

2mn customers placed a BOPIS order; BOPIS

represented 17% of digital sales

●

32.8% Adjusted Gross Margin, +20bps vs FY 19 Q4,

offsetting impact of industrywide freight challenges and

digital growth

6.4% Adjusted EBITDA Margin, +160bps vs FY19 Q4,

reflecting a healthier and more profitable core business

$76mn in Operating Cash Flow from working

capital improvements. Free Cash Flow of

$62mn

Strong cash and liquidity balances

$1.4bn Cash & Investments

$2.1bn Total Liquidity³

●

Strengthening

Financial

Resilience

●

$422mn reduction in Inventory, 20% lower vs

FY19 Q4, driven, in part, by banner

divestitures and store fleet optimization

-$1bn reduction in Gross Debt4, including

reduction in operating and finance lease

liabilities and reduction in debt mostly from

bond tender offers

Note: Adj. EBITDA, and adj. gross margin are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

(1) Bed Bath & Beyond is among the Company's four core banners.

BED BATH & BEYOND (2)

Free Cash Flow is a non-GAAP financial measure. Free Cash Flow of $62mn

includes cash flow provided from operations of $76mn less cash flow used in

investing of $14mn, inclusive of $66mn of CAPEX.

¤¯¤

Unlocking

Shareholder

Value

5th non-core banner divestiture completed

(Cost Plus World Market)

$375mn in capital return to shareholders

• 2 accelerated share repurchase

programs (ASR-1 $225mn complete,

ASR-2 $150mn to be completed week

of 4/19/21)

●

-16mn total shares repurchased at an

estimated average price of $23 per

share, representing -13% of shares

outstanding

(3) Total Liquidity includes cash & investments and the Company's asset-based revolving credit facility.

(4) Gross Debt includes bonds, borrowings under the Company's asset-based revolving credit facility, and

operating and finance lease liabilities

6View entire presentation