Investing in Private Credit

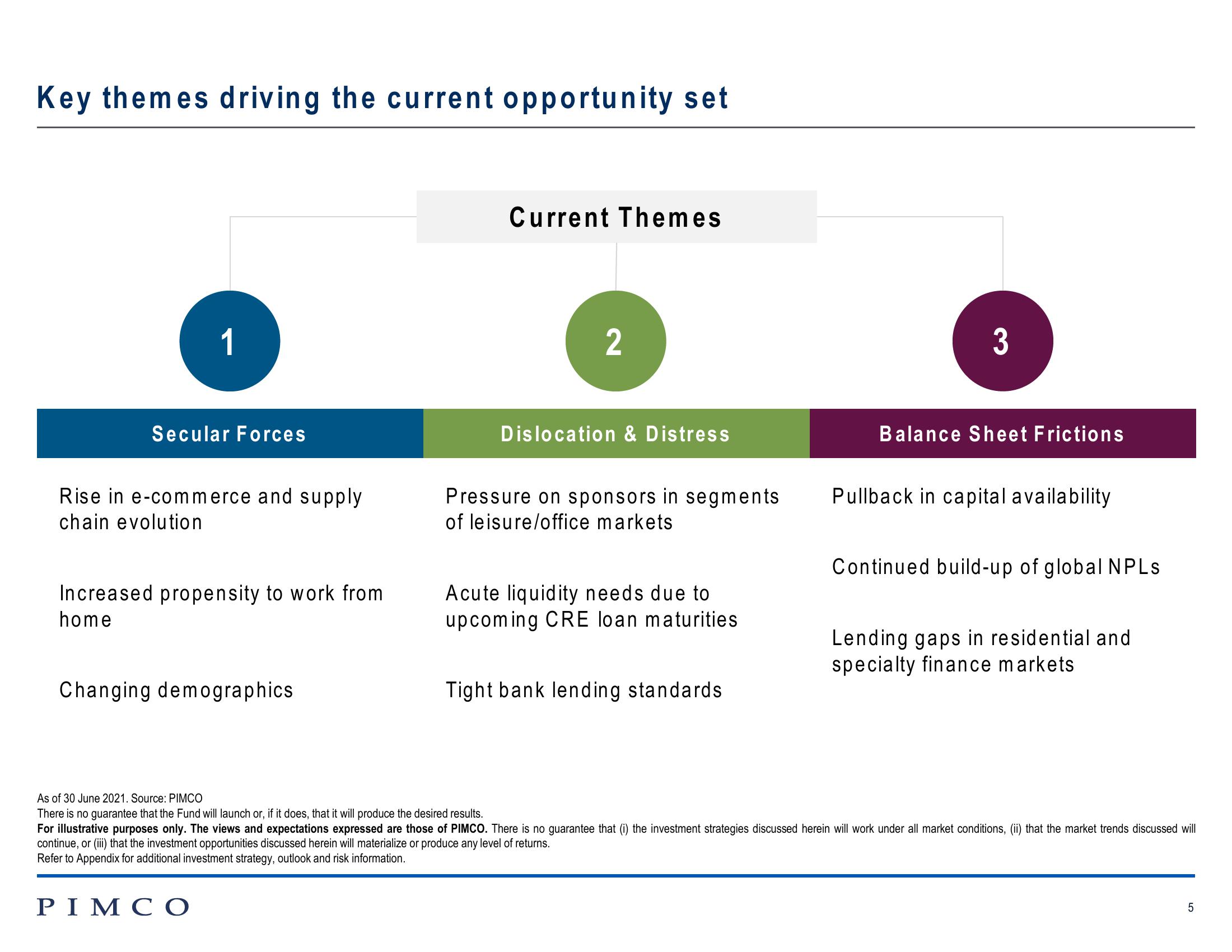

Key themes driving the current opportunity set

1

Secular Forces

Rise in e-commerce and supply

chain evolution

Increased propensity to work from

home

Changing demographics

PIMCO

Current Themes

2

Dislocation & Distress

Pressure on sponsors in segments

of leisure/office markets

Acute liquidity needs due to

upcoming CRE loan maturities.

Tight bank lending standards

3

Balance Sheet Frictions

Pullback in capital availability

Continued build-up of global NPLs

Lending gaps in residential and

specialty finance markets.

As of 30 June 2021. Source: PIMCO

There is no guarantee that the Fund will launch or, if it does, that it will produce the desired results.

For illustrative purposes only. The views and expectations expressed are those of PIMCO. There is no guarantee that (i) the investment strategies discussed herein will work under all market conditions, (ii) that the market trends discussed will

continue, or (iii) that the investment opportunities discussed herein will materialize or produce any level of returns.

Refer to Appendix for additional investment strategy, outlook and risk information.

01

5View entire presentation