J.P.Morgan Results Presentation Deck

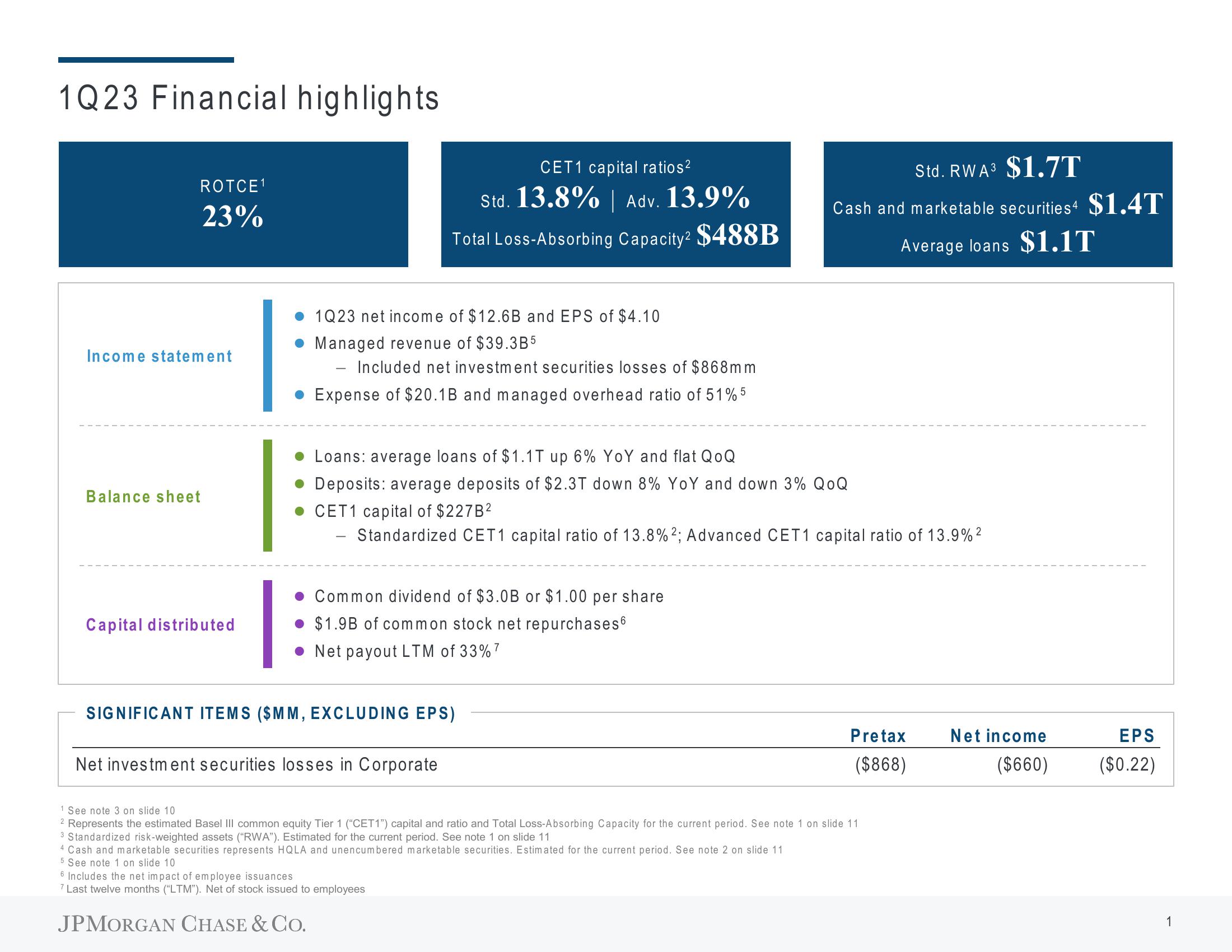

1Q23 Financial highlights

ROTCE¹

23%

Income statement

Balance sheet

Capital distributed

1Q23 net income of $12.6B and EPS of $4.10

Managed revenue of $39.3B5

Included net investment securities losses of $868mm

• Expense of $20.1B and managed overhead ratio of 51% 5

CET1 capital ratios²

Std. 13.8% | Adv. 13.9%

Total Loss-Absorbing Capacity2 $488B

-

• Loans: average loans of $1.1T up 6% YoY and flat QoQ

• Deposits: average deposits of $2.3T down 8% YoY and down 3% QoQ

CET1 capital of $227B²

Standardized CET1 capital ratio of 13.8% ²; Advanced CET1 capital ratio of 13.9%²

. Common dividend of $3.0B or $1.00 per share

$1.9B of common stock net repurchases

Net payout LTM of 33% 7

SIGNIFICANT ITEMS ($MM, EXCLUDING EPS)

Net investment securities losses in Corporate

Std. RWA3 $1.7T

Cash and marketable securities $1.4T

Average loans $1.1T

4 Cash and marketable securities represents HQLA and unencumbered marketable securities. Estimated for the current period. See note 2 on slide 11

5 See note 1 on slide 10

6 Includes the net impact of employee issuances

7 Last twelve months ("LTM"). Net of stock issued to employees

JPMORGAN CHASE & CO.

1 See note 3 on slide 10

2 Represents the estimated Basel III common equity Tier 1 ("CET1") capital and ratio and Total Loss-Absorbing Capacity for the current period. See note 1 on slide 11

3 Standardized risk-weighted assets ("RWA"). Estimated for the current period. See note 1 on slide 11

Pretax

($868)

Net income

($660)

EPS

($0.22)

1View entire presentation