Antero Midstream Partners Investor Presentation Deck

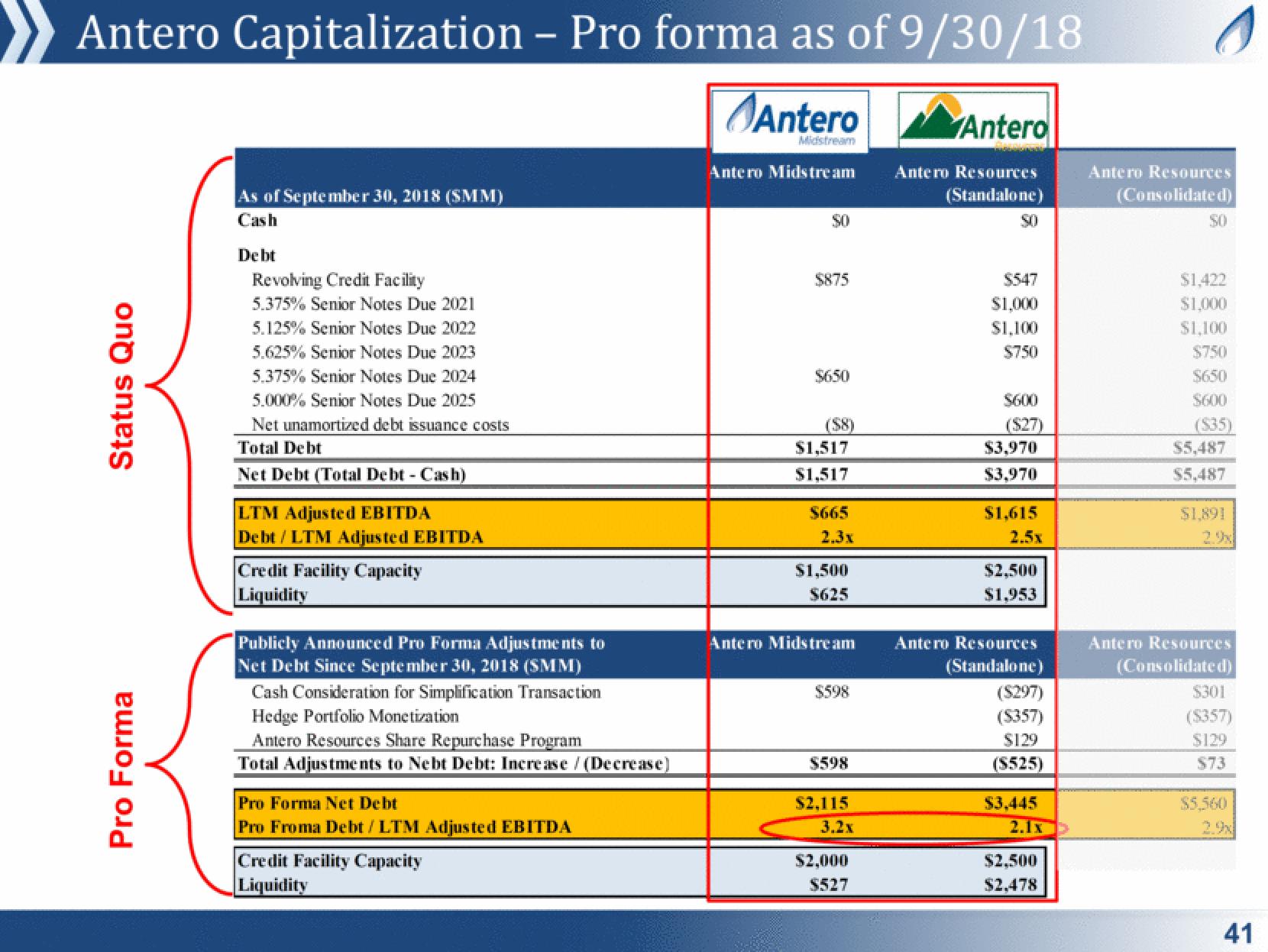

Antero Capitalization – Pro forma as of 9/30/18

Antero

Midstream

Status Quo

Pro Forma

As of September 30, 2018 (SMM)

Cash

Debt

Revolving Credit Facility

5.375% Senior Notes Due 2021

5.125% Senior Notes Due 2022

5.625% Senior Notes Due 2023

5.375% Senior Notes Due 2024

5.000% Senior Notes Due 2025

Net unamortized debt issuance costs

Total Debt

Net Debt (Total Debt - Cash)

LTM Adjusted EBITDA

Debt / LTM Adjusted EBITDA

Credit Facility Capacity

Liquidity

Publicly Announced Pro Forma Adjustments to

Net Debt Since September 30, 2018 (SMM)

Cash Consideration for Simplification Transaction

Hedge Portfolio Monetization

Antero Resources Share Repurchase Program

Total Adjustments to Nebt Debt: Increase / (Decrease)

Pro Forma Net Debt

Pro Froma Debt / LTM Adjusted EBITDA

Credit Facility Capacity

Liquidity

Antero Midstream

50

$875

$650

($8)

$1,517

$1,517

$665

2.3x

$1,500

$625

Antero Midstream

$598

$598

$2,115

3.2x

$2,000

$527

Antero

Antero Resources

(Standalone)

50

$547

$1,000

$1,100

$750

$600

($27)

$3,970

$3,970

$1,615

2.5x

$2,500

$1,953

Antero Resources

(Standalone)

($297)

($357)

$129

(S525)

$3,445

2.1x

$2,500

$2,478

0

Antero Resources

(Consolidated)

$1,422

$1,000

$1,100

$750

$650

$600

($35)

$5,487

$5,487

$1,891

2.9x

Antero Resources

(Consolidated)

$301

($357)

$129

$73

$5,560

2.9x

41View entire presentation