Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

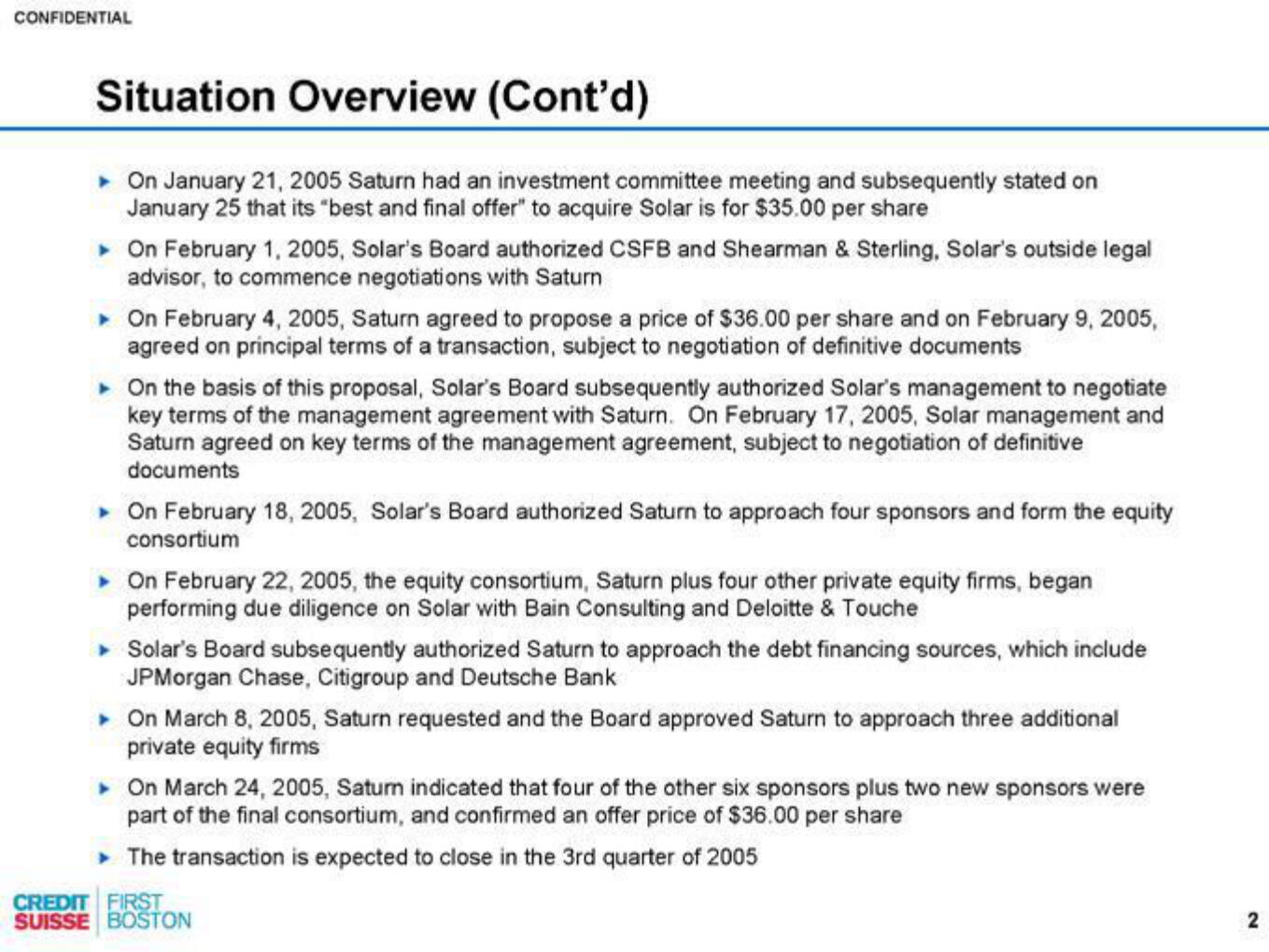

Situation Overview (Cont'd)

On January 21, 2005 Saturn had an investment committee meeting and subsequently stated on

January 25 that its "best and final offer" to acquire Solar is for $35.00 per share

▸ On February 1, 2005, Solar's Board authorized CSFB and Shearman & Sterling, Solar's outside legal

advisor, to commence negotiations with Saturn

▸ On February 4, 2005, Saturn agreed to propose a price of $36.00 per share and on February 9, 2005,

agreed on principal terms of a transaction, subject to negotiation of definitive documents

▸ On the basis of this proposal, Solar's Board subsequently authorized Solar's management to negotiate

key terms of the management agreement with Saturn. On February 17, 2005, Solar management and

Saturn agreed on key terms of the management agreement, subject to negotiation of definitive

documents

▸ On February 18, 2005, Solar's Board authorized Saturn to approach four sponsors and form the equity

consortium

▸ On February 22, 2005, the equity consortium, Saturn plus four other private equity firms, began

performing due diligence on Solar with Bain Consulting and Deloitte & Touche

▸ Solar's Board subsequently authorized Saturn to approach the debt financing sources, which include

JPMorgan Chase, Citigroup and Deutsche Bank

▸ On March 8, 2005, Saturn requested and the Board approved Saturn to approach three additional

private equity firms

▸ On March 24, 2005, Saturn indicated that four of the other six sponsors plus two new sponsors were

part of the final consortium, and confirmed an offer price of $36.00 per share

The transaction is expected to close in the 3rd quarter of 2005

CREDIT FIRST

SUISSE BOSTON

2View entire presentation