Tuya Results Presentation Deck

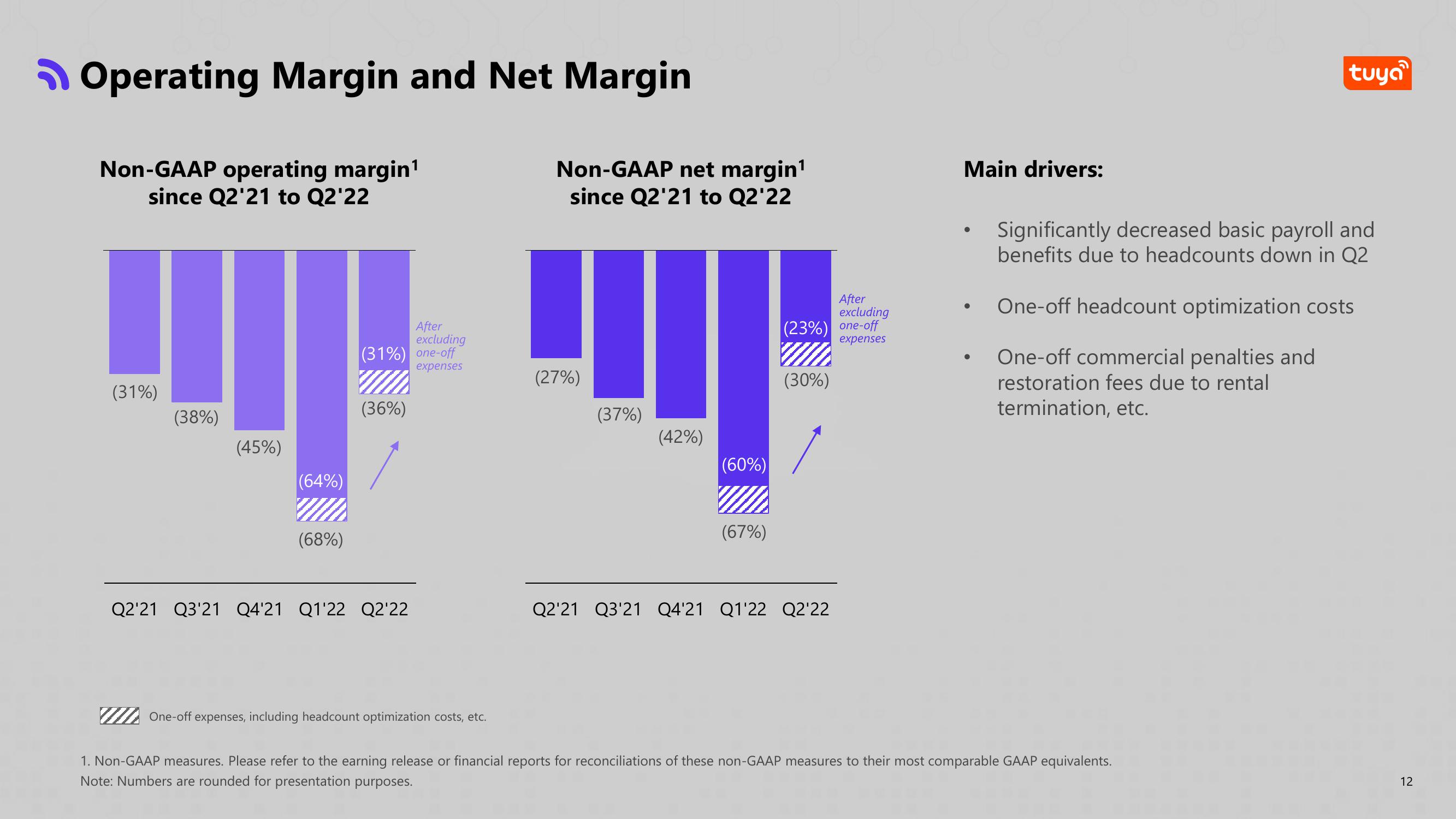

Operating Margin and Net Margin

Non-GAAP operating margin¹

since Q2'21 to Q2'22

(31%)

(38%)

(45%)

(64%)

(68%)

After

excluding

(31%) one-off

expenses

WW

(36%)

Q2'21 Q3'21 Q4'21 Q1'22 Q2'22

One-off expenses, including headcount optimization costs, etc.

Non-GAAP net margin¹

since Q2'21 to Q2'22

(27%)

(37%)

(42%)

(60%)

(67%)

After

excluding

(23%) one-off

expenses

WI

(30%)

Q2'21 Q3'21 Q4'21 Q1'22 Q2'22

Main drivers:

●

●

tuya

Significantly decreased basic payroll and

benefits due to headcounts down in Q2

One-off headcount optimization costs

One-off commercial penalties and

restoration fees due to rental

termination, etc.

1. Non-GAAP measures. Please refer to the earning release or financial reports for reconciliations of these non-GAAP measures to their most comparable GAAP equivalents.

Note: Numbers are rounded for presentation purposes.

12View entire presentation