J.P.Morgan ESG Presentation Deck

B Energy Mix - Rationale

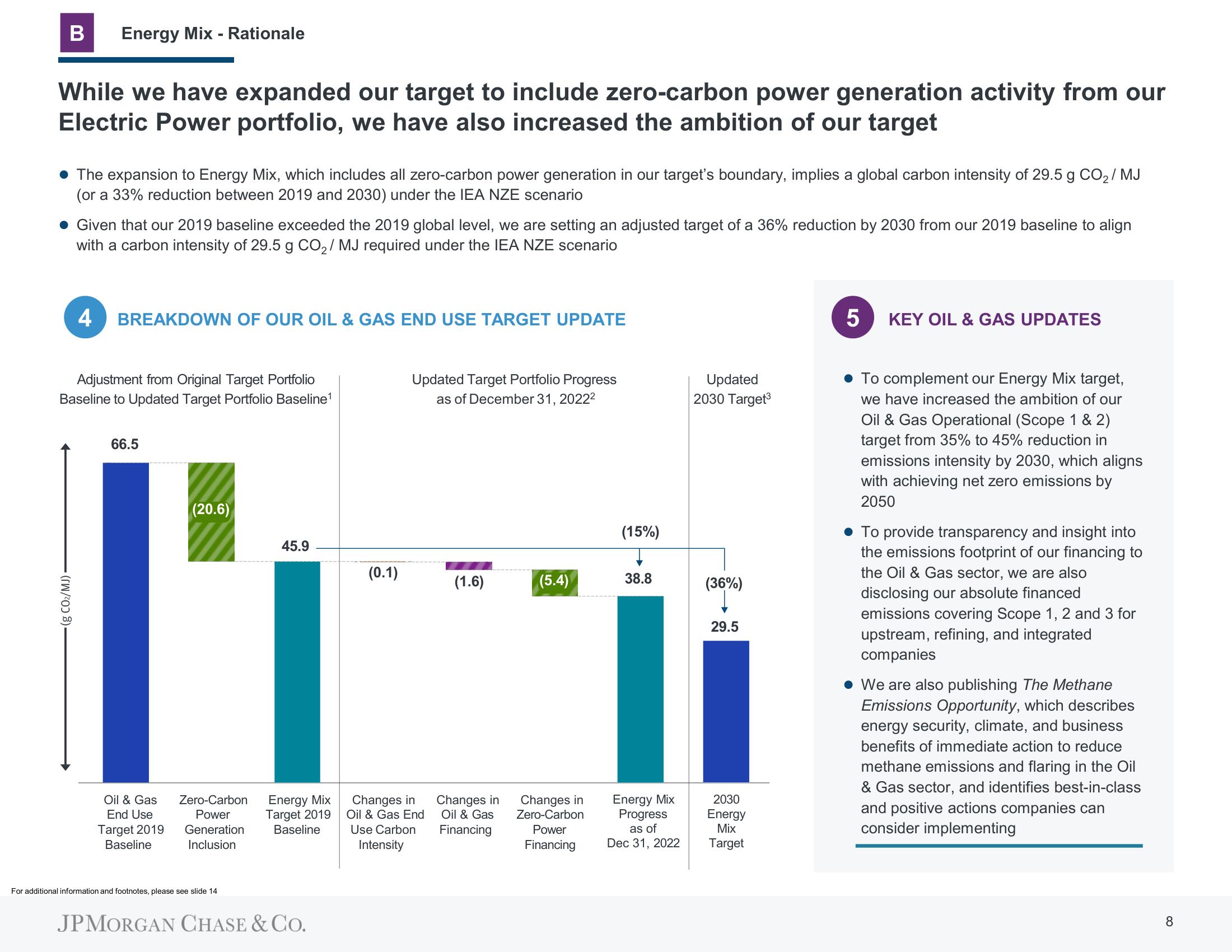

While we have expanded our target to include zero-carbon power generation activity from our

Electric Power portfolio, we have also increased the ambition of our target

• The expansion to Energy Mix, which includes all zero-carbon power generation in our target's boundary, implies a global carbon intensity of 29.5 g CO₂/MJ

(or a 33% reduction between 2019 and 2030) under the IEA NZE scenario

. Given that our 2019 baseline exceeded the 2019 global level, we are setting an adjusted target of a 36% reduction by 2030 from our 2019 baseline to align

with a carbon intensity of 29.5 g CO₂/ MJ required under the IEA NZE scenario

4 BREAKDOWN OF OUR OIL & GAS END USE TARGET UPDATE

Adjustment from Original Target Portfolio

Baseline to Updated Target Portfolio Baseline¹

(g CO₂/MJ)

66.5

(20.6)

45.9

I'l

Oil & Gas

End Use

Target 2019

Baseline

Zero-Carbon

Power

Generation

Inclusion

For additional information and footnotes, please see slide 14

Energy Mix

Target 2019

Baseline

JPMORGAN CHASE & CO.

(0.1)

Updated Target Portfolio Progress

as of December 31, 2022²

Changes in

Oil & Gas End

Use Carbon

Intensity

(1.6)

Changes in

Oil & Gas

Financing

(5.4)

Changes in

Zero-Carbon

Power

Financing

(15%)

38.8

Energy Mix

Progress

as of

Dec 31, 2022

Updated

2030 Target³

(36%)

29.5

2030

Energy

Mix

Target

5 KEY OIL & GAS UPDATES

• To complement our Energy Mix target,

we have increased the ambition of our

Oil & Gas Operational (Scope 1 & 2)

target from 35% to 45% reduction in

emissions intensity by 2030, which aligns

with achieving net zero emissions by

2050

• To provide transparency and insight into

the emissions footprint of our financing to

the Oil & Gas sector, we are also

disclosing our absolute financed

emissions covering Scope 1, 2 and 3 for

upstream, refining, and integrated

companies

• We are also publishing The Methane

Emissions Opportunity, which describes

energy security, climate, and business

benefits of immediate action to reduce

methane emissions and flaring in the Oil

& Gas sector, and identifies best-in-class

and positive actions companies can

consider implementing

8View entire presentation