Pershing Square Activist Presentation Deck

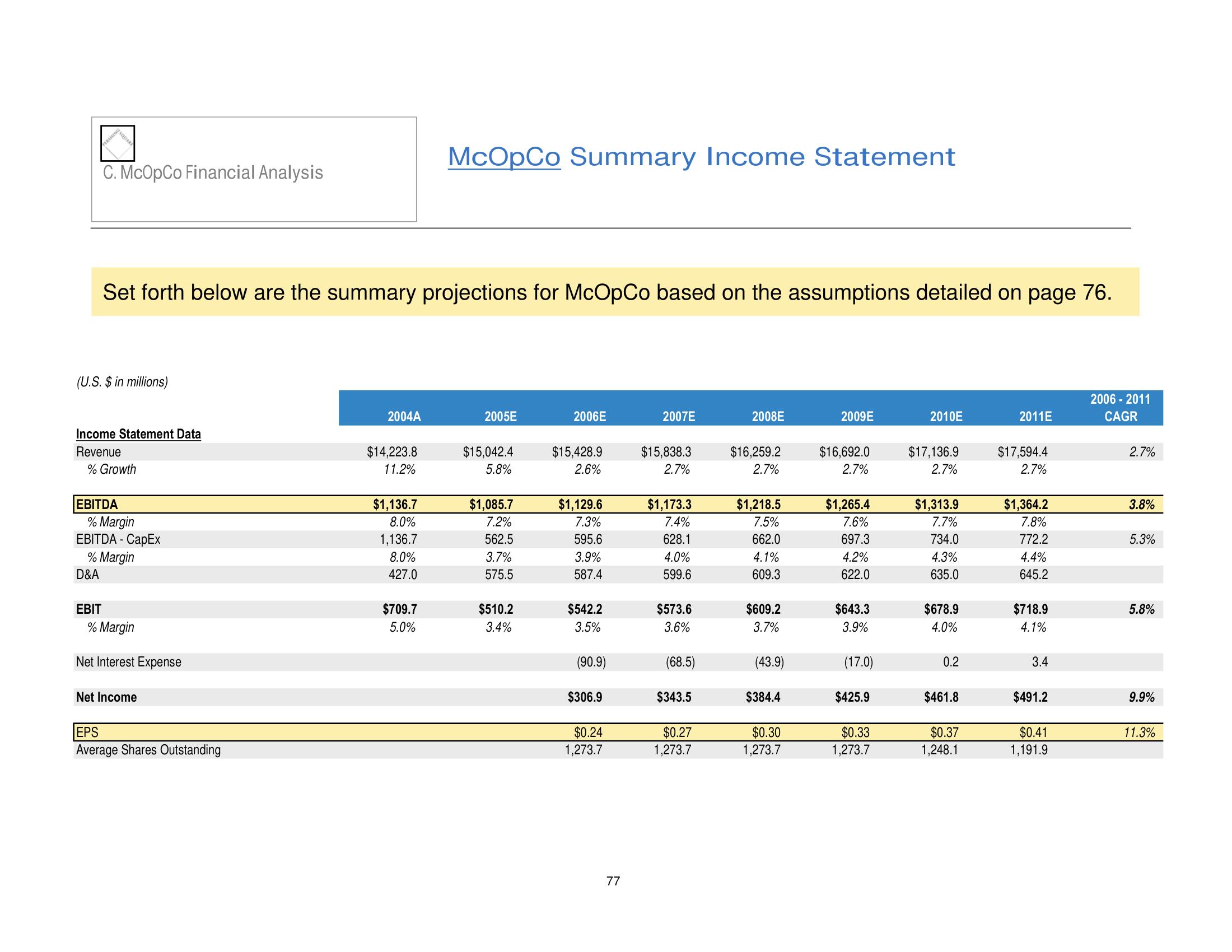

C. McOpCo Financial Analysis

(U.S. $ in millions)

Income Statement Data

Revenue

Set forth below are the summary projections for McOpCo based on the assumptions detailed on page 76.

% Growth

EBITDA

% Margin

EBITDA - CapEx

D&A

% Margin

EBIT

% Margin

Net Interest Expense

Net Income

EPS

Average Shares Outstanding

2004A

$14,223.8

11.2%

$1,136.7

8.0%

1,136.7

8.0%

427.0

McOpCo Summary Income Statement

$709.7

5.0%

2005E

$15,042.4

5.8%

$1,085.7

7.2%

562.5

3.7%

575.5

$510.2

3.4%

2006E

$15,428.9

2.6%

$1,129.6

7.3%

595.6

3.9%

587.4

$542.2

3.5%

(90.9)

$306.9

$0.24

1,273.7

77

2007E

$15,838.3

2.7%

$1,173.3

7.4%

628.1

4.0%

599.6

$573.6

3.6%

(68.5)

$343.5

$0.27

1,273.7

2008E

$16,259.2

2.7%

$1,218.5

7.5%

662.0

4.1%

609.3

$609.2

3.7%

(43.9)

$384.4

$0.30

1,273.7

2009E

$16,692.0

2.7%

$1,265.4

7.6%

697.3

4.2%

622.0

$643.3

3.9%

(17.0)

$425.9

$0.33

1,273.7

2010E

$17,136.9

2.7%

$1,313.9

7.7%

734.0

4.3%

635.0

$678.9

4.0%

0.2

$461.8

$0.37

1,248.1

2011E

$17,594.4

2.7%

$1,364.2

7.8%

772.2

4.4%

645.2

$718.9

4.1%

3.4

$491.2

$0.41

1,191.9

2006 - 2011

CAGR

2.7%

3.8%

5.3%

5.8%

9.9%

11.3%View entire presentation