Stem SPAC Presentation Deck

stem Hardware Deliveries Drive Strong Recurring Software Cash Flows

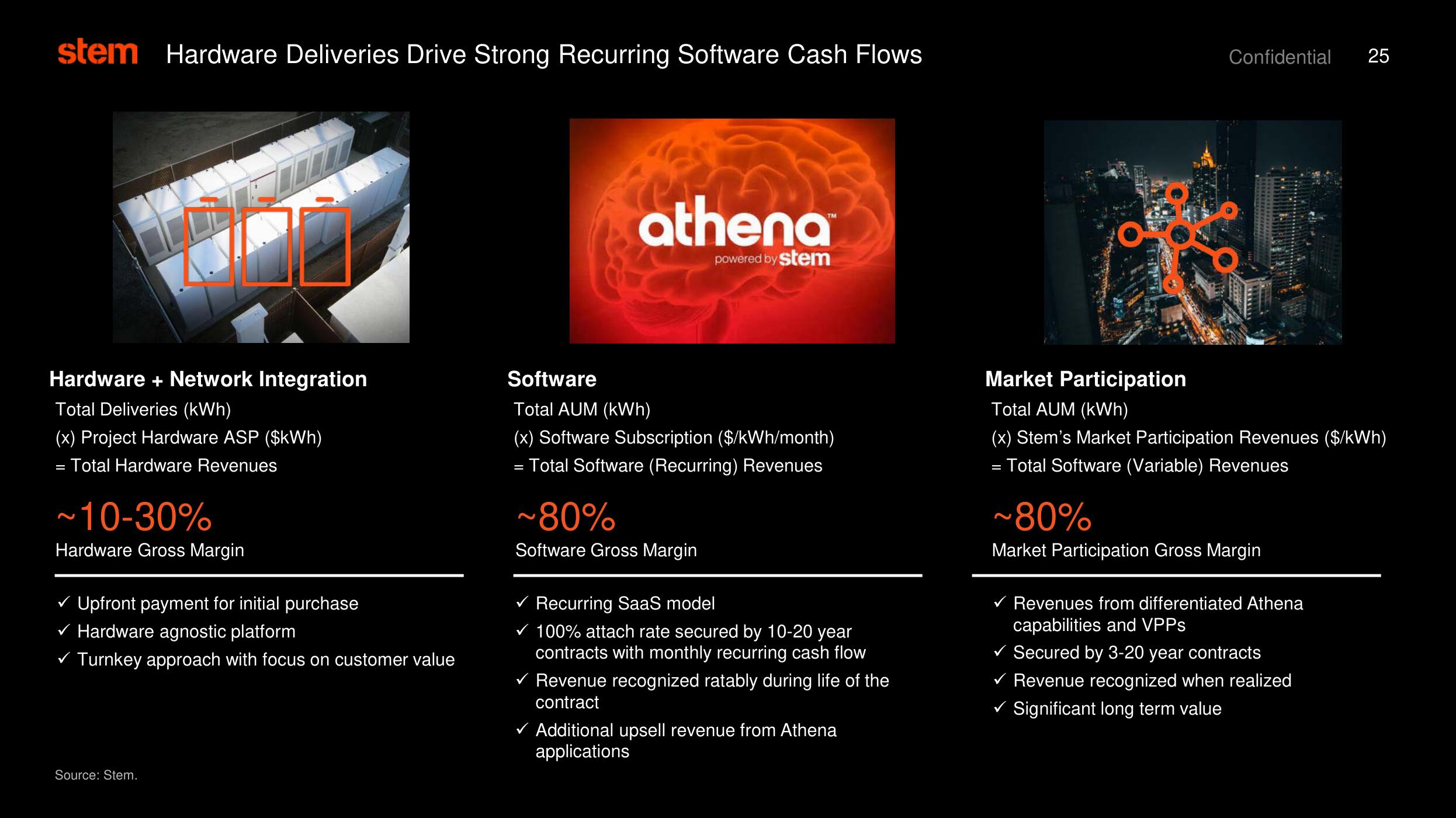

Hardware + Network Integration

Total Deliveries (kWh)

(x) Project Hardware ASP ($kWh)

= Total Hardware Revenues

~10-30%

Hardware Gross Margin

✓ Upfront payment for initial purchase

✓ Hardware agnostic platform

✓ Turnkey approach with focus on customer value

Source: Stem.

athena

powered by stem

Software

Total AUM (kWh)

(x) Software Subscription ($/kWh/month)

Total Software (Recurring) Revenues

~80%

Software Gross Margin

✓ Recurring SaaS model

✓ 100% attach rate secured by 10-20 year

contracts with monthly recurring cash flow

✓ Revenue recognized ratably during life of the

contract

✓ Additional upsell revenue from Athena

applications

PER OF

O

424

Confidential

Market Participation

Total AUM (kWh)

(x) Stem's Market Participation Revenues ($/kWh)

= Total Software (Variable) Revenues

~80%

Market Participation Gross Margin

25

✓ Revenues from differentiated Athena

capabilities and VPPs

✓ Secured by 3-20 year contracts

✓ Revenue recognized when realized

✓ Significant long term valueView entire presentation