Vivid Seats Results Presentation Deck

Non-GAAP Reconciliations

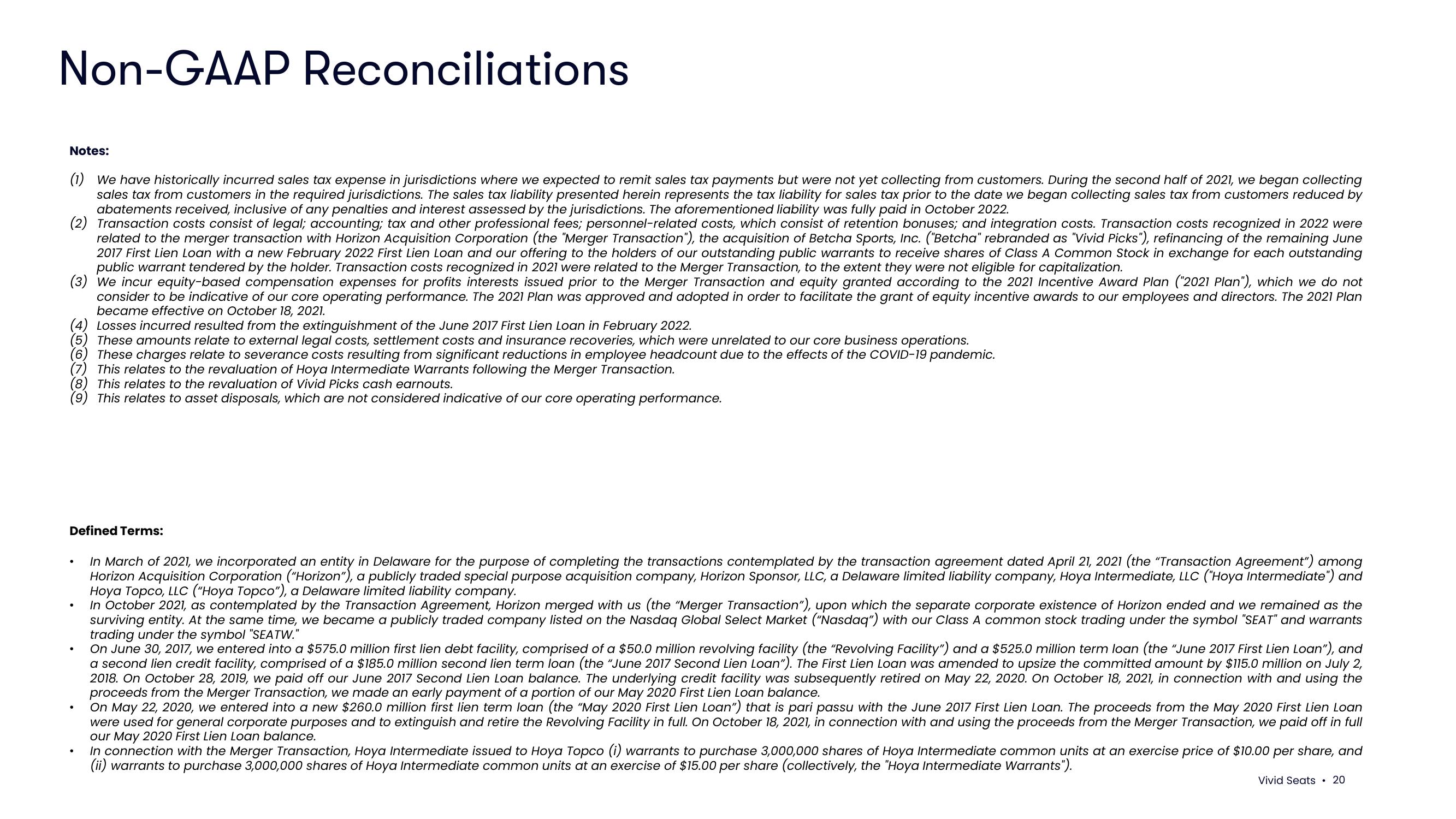

Notes:

(1) We have historically incurred sales tax expense in jurisdictions where we expected to remit sales tax payments but were not yet collecting from customers. During the second half of 2021, we began collecting

sales tax from customers in the required jurisdictions. The sales tax liability presented herein represents the tax liability for sales tax prior to the date we began collecting sales tax from customers reduced by

abatements received, inclusive of any penalties and interest assessed by the jurisdictions. The aforementioned liability was fully paid in October 2022.

(2) Transaction costs consist of legal; accounting; tax and other professional fees; personnel-related costs, which consist of retention bonuses; and integration costs. Transaction costs recognized in 2022 were

related to the merger transaction with Horizon Acquisition Corporation (the "Merger Transaction"), the acquisition of Betcha Sports, Inc. ("Betcha" rebranded as "Vivid Picks"), refinancing of the remaining June

public warrant tendered by the holder. Transaction costs recognized in 2021 were related to the Merger Transaction, to the extent they were not eligible for capitalization.

2017 First

Loan with a new February 2022 First Lien Loan and our offering to the holders of our outstanding public warrants to receive shares of Class A Common Stock in exchange for each outstanding

(3) We incur equity-based compensation expenses for profits interests issued prior to the Merger Transaction and equity granted according to the 2021 Incentive Award Plan ("2021 Plan"), which we do not

consider to be indicative of our core operating performance. The 2021 Plan was approved and adopted in order to facilitate the grant of equity incentive awards to our employees and directors. The 2021 Plan

became effective on October 18, 2021.

(4) Losses incurred resulted from the extinguishment of the June 2017 First Lien Loan in February 2022.

(5) These amounts relate to external legal costs, settlement costs and insurance recoveries, which were unrelated to our core business operations.

These charges relate to severance costs resulting from significant reductions in employee headcount due to the effects of the COVID-19 pandemic.

This relates to the revaluation of Hoya Intermediate Warrants following the Merger Transaction.

(8) This relates to the revaluation of Vivid Picks cash earnouts.

(9) This relates to asset disposals, which are not considered indicative of our core operating performance.

Defined Terms:

In March of 2021, we incorporated an entity in Delaware for the purpose of completing the transactions contemplated by the transaction agreement dated April 21, 2021 (the "Transaction Agreement") among

Horizon Acquisition Corporation ("Horizon"), a publicly traded special purpose acquisition company, Horizon Sponsor, LLC, a Delaware limited liability company, Hoya Intermediate, LLC ("Hoya Intermediate") and

Hoya Topco, LLC ("Hoya Topco"), a Delaware limited liability company.

In October 2021, as contemplated by the Transaction Agreement, Horizon merged with us (the "Merger Transaction"), upon which the separate corporate existence of Horizon ended and we remained as the

surviving entity. At the same time, we became a publicly traded company listed on the Nasdaq Global Select Market ("Nasdaq") with our Class A common stock trading under the symbol "SEAT" and warrants

trading under the symbol "SEATW."

On June 30, 2017, we entered into a $575.0 million first lien debt facility, comprised of a $50.0 million revolving facility (the "Revolving Facility") and a $525.0 million term loan (the "June 2017 First Lien Loan"), and

a second lien credit facility, comprised of a $185.0 million second lien term loan (the "June 2017 Second Lien Loan"). The First Lien Loan was amended to upsize the committed amount by $115.0 million on July 2,

2018. On October 28, 2019, we paid off our June 2017 Second Lien Loan balance. The underlying credit facility was subsequently retired on May 22, 2020. On October 18, 2021, in connection with and using the

proceeds from the Merger Transaction, we made an early payment of a portion of our May 2020 First Lien Loan balance.

On May 22, 2020, we entered into a new $260.0 million first lien term loan (the "May 2020 First Lien Loan") that is pari passu with the June 2017 First Lien Loan. The proceeds from the May 2020 First Lien Loan

were used for general corporate purposes and to extinguish and retire the Revolving Facility in full. On October 18, 2021, in connection with and using the proceeds from the Merger Transaction, we paid off in full

our May 2020 First Lien Loan balance.

In connection with the Merger Transaction, Hoya Intermediate issued to Hoya Topco (i) warrants to purchase 3,000,000 shares of Hoya Intermediate common units at an exercise price of $10.00 per share, and

(ii) warrants to purchase 3,000,000 shares of Hoya Intermediate common units at an exercise of $15.00 per share (collectively, the "Hoya Intermediate Warrants").

.

.

●

Vivid Seats. 20View entire presentation