Endeavour Mining Results Presentation Deck

Power

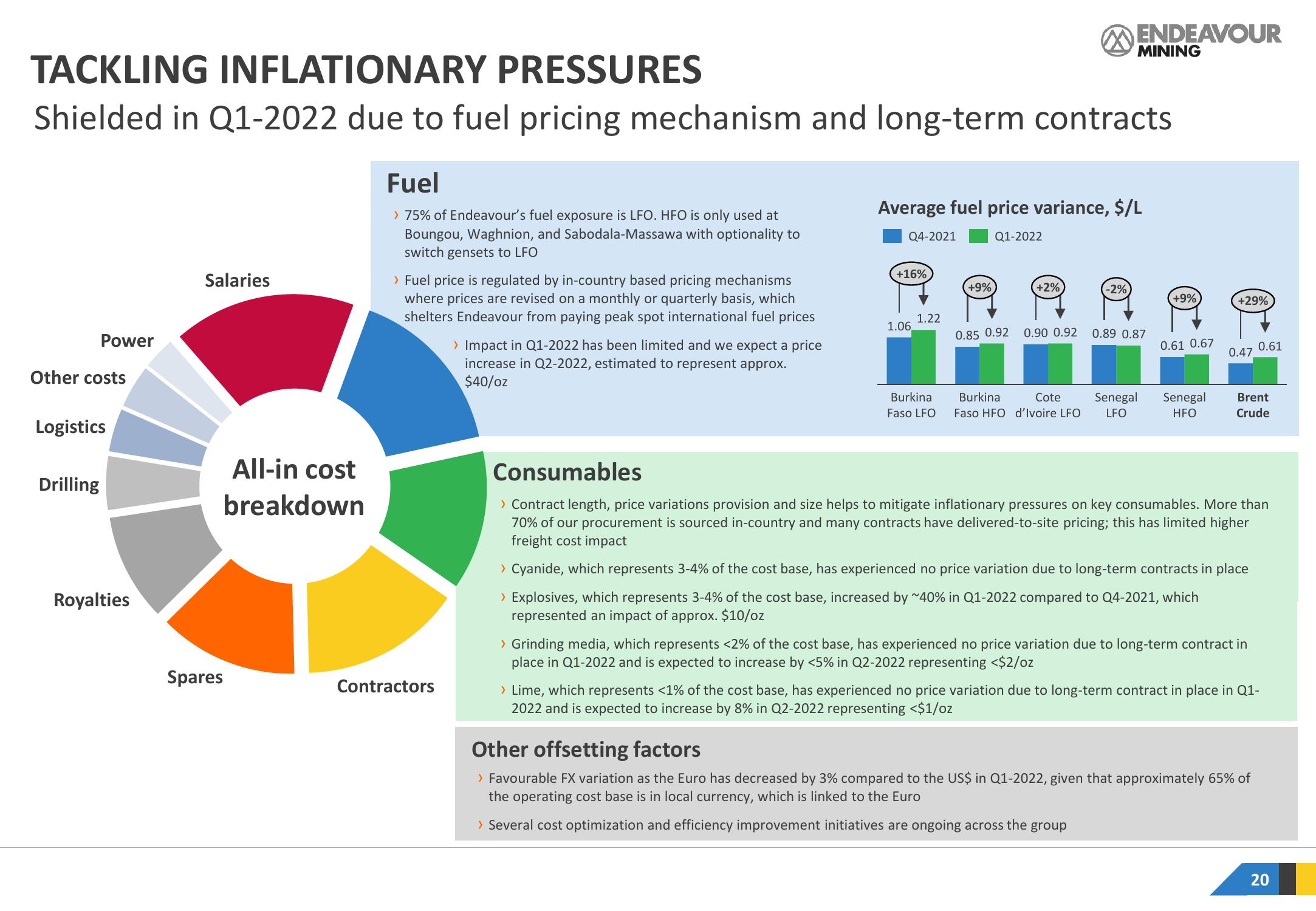

TACKLING INFLATIONARY PRESSURES

Shielded in Q1-2022 due to fuel pricing mechanism and long-term contracts

Other costs

Logistics

Drilling

Royalties

Salaries

Spares

All-in cost

breakdown

Fuel

> 75% of Endeavour's fuel exposure is LFO. HFO is only used at

Boungou, Waghnion, and Sabodala-Massawa with optionality to

switch gensets to LFO

> Fuel price is regulated by in-country based pricing mechanisms

where prices are revised on a monthly or quarterly basis, which

shelters Endeavour from paying peak spot international fuel prices

Contractors

> Impact in Q1-2022 has been limited and we expect a price

increase in Q2-2022, estimated to represent approx.

$40/oz

Q4-2021

Average fuel price variance, $/L

Q1-2022

+16%

1.06

1.22

Burkina

Faso LFO

+9%

0.85 0.92

+2%

ENDEAVOUR

0.90 0.92

MINING

-2%)

0.89 0.87

Burkina Cote Senegal

Faso HFO d'Ivoire LFO LFO

+9%

0.61 0.67

Senegal

HFO

+29%

0.47

Brent

Crude

0.61

Consumables

> Contract length, price variations provision and size helps to mitigate inflationary pressures on key consumables. More than

70% of our procurement is sourced in-country and many contracts have delivered-to-site pricing; this has limited higher

freight cost impact

> Cyanide, which represents 3-4% of the cost base, has experienced no price variation due to long-term contracts in place

> Explosives, which represents 3-4% of the cost base, increased by ~40% in Q1-2022 compared to Q4-2021, which

represented an impact of approx. $10/oz

› Grinding media, which represents <2% of the cost base, has experienced no price variation due to long-term contract in

place in Q1-2022 and is expected to increase by <5% in Q2-2022 representing <$2/oz

> Lime, which represents <1% of the cost base, has experienced no price variation due to long-term contract in place in Q1-

2022 and is expected to increase by 8% in Q2-2022 representing <$1/oz

Other offsetting factors

> Favourable FX variation as the Euro has decreased by 3% compared to the US$ in Q1-2022, given that approximately 65% of

the operating cost base is in local currency, which is linked to the Euro

> Several cost optimization and efficiency improvement initiatives are ongoing across the group

20View entire presentation