OnesSpaWorld SPAC

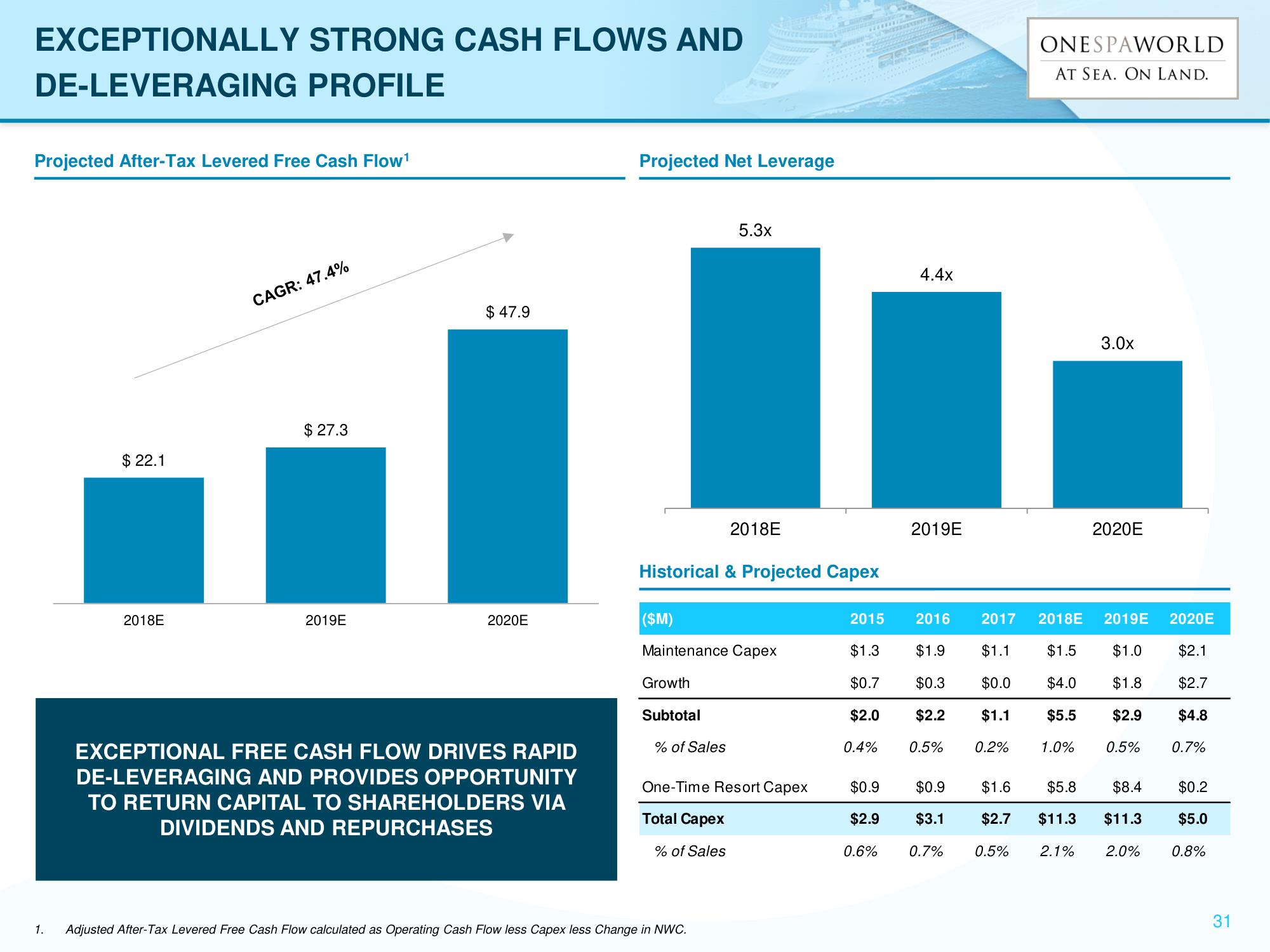

EXCEPTIONALLY STRONG CASH FLOWS AND

DE-LEVERAGING PROFILE

Projected After-Tax Levered Free Cash Flow¹

$22.1

2018E

CAGR: 47.4%

$ 27.3

2019E

$ 47.9

2020E

EXCEPTIONAL FREE CASH FLOW DRIVES RAPID

DE-LEVERAGING AND PROVIDES OPPORTUNITY

TO RETURN CAPITAL TO SHAREHOLDERS VIA

DIVIDENDS AND REPURCHASES

Projected Net Leverage

Historical & Projected Capex

Growth

($M)

Maintenance Capex

Subtotal

5.3x

% of Sales

2018E

1. Adjusted After-Tax Levered Free Cash Flow calculated as Operating Cash Flow less Capex less Change in NWC.

One-Time Resort Capex

Total Capex

% of Sales

2015

$1.3

$0.7

$2.0

0.4%

$0.9

$2.9

0.6%

4.4x

2019E

0.5%

$0.9

$3.1

0.7%

ONESPAWORLD

AT SEA. ON LAND.

2016 2017 2018E 2019E

$1.9

$1.1 $1.5

$1.0

$0.3

$0.0

$4.0

$1.8

$2.2

$1.1

$5.5

$2.9

0.2%

1.0%

0.5%

3.0x

0.5%

2020E

$1.6 $5.8

$8.4

$2.7 $11.3 $11.3

2.1% 2.0%

2020E

$2.1

$2.7

$4.8

0.7%

$0.2

$5.0

0.8%

31View entire presentation