Bank of America Results Presentation Deck

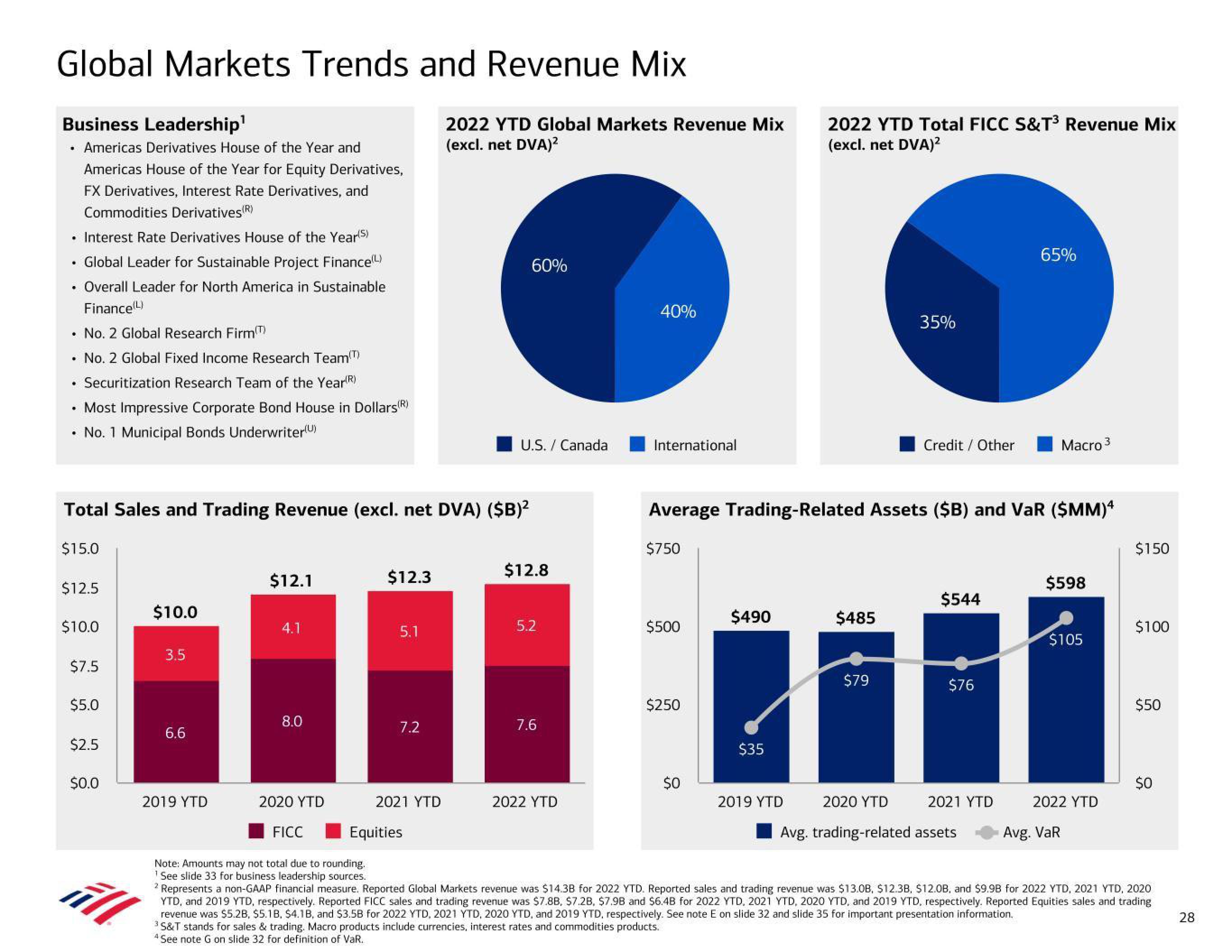

Global Markets Trends and Revenue Mix

Business Leadership¹

• Americas Derivatives House of the Year and

Americas House of the Year for Equity Derivatives,

FX Derivatives, Interest Rate Derivatives, and

Commodities Derivatives (R)

Interest Rate Derivatives House of the Year(s)

• Global Leader for Sustainable Project Finance()

• Overall Leader for North America in Sustainable

Finance(L)

No. 2 Global Research Firm(™)

• No. 2 Global Fixed Income Research Team(T)

Securitization Research Team of the Year)

• Most Impressive Corporate Bond House in Dollars(R)

No. 1 Municipal Bonds Underwriter(U)

$15.0

Total Sales and Trading Revenue (excl. net DVA) ($B)²

$12.5

$10.0

$7.5

$5.0

$2.5

$0.0

$10.0

3.5

6.6

$12.1

2019 YTD

4.1

8.0

2020 YTD

FICC

$12.3

5.1

Note: Amounts may not total due to rounding.

¹ See slide 33 for business leadership sources.

7.2

2022 YTD Global Markets Revenue Mix

(excl. net DVA)²

2021 YTD

Equities

60%

U.S. / Canada

$12.8

5.2

7.6

40%

2022 YTD

International

$750

$500

ill

2 Represents a non-GAAP financial measure. Reported Global Markets revenue was $14.3B for 2022 YTD. Reported sales and trading revenue was $13.0B, $12.3B, $12.0B, and $9.9B for 2022 YTD, 2021 YTD, 2020

YTD, and 2019 YTD, respectively. Reported FICC sales and trading revenue was $7.8B, $7.28, $7.9B and $6.4B for 2022 YTD, 2021 YTD, 2020 YTD, and 2019 YTD, respectively. Reported Equities sales and trading

revenue was $5.2B, $5.1B, $4.1B, and $3.5B for 2022 YTD, 2021 YTD, 2020 YTD, and 2019 YTD, respectively. See note E on slide 32 and slide 35 for important presentation information.

$250

Average Trading-Related Assets ($B) and VaR ($MM)4

S&T stands for sales & trading. Macro products include currencies, interest rates and commodities products.

4 See note G on slide 32 for definition of VaR.

$490

$0

2022 YTD Total FICC S&T³ Revenue Mix

(excl. net DVA)²

$35

2019 YTD

$485

35%

$79

Credit / Other

2020 YTD

$544

$76

65%

2021 YTD

Avg. trading-related assets

Macro 3

$598

$105

2022 YTD

Avg. VaR

$150

$100

$50

$0

28View entire presentation