Atalaya Risk Management Overview

Structuring Investments: Rediscount Lending

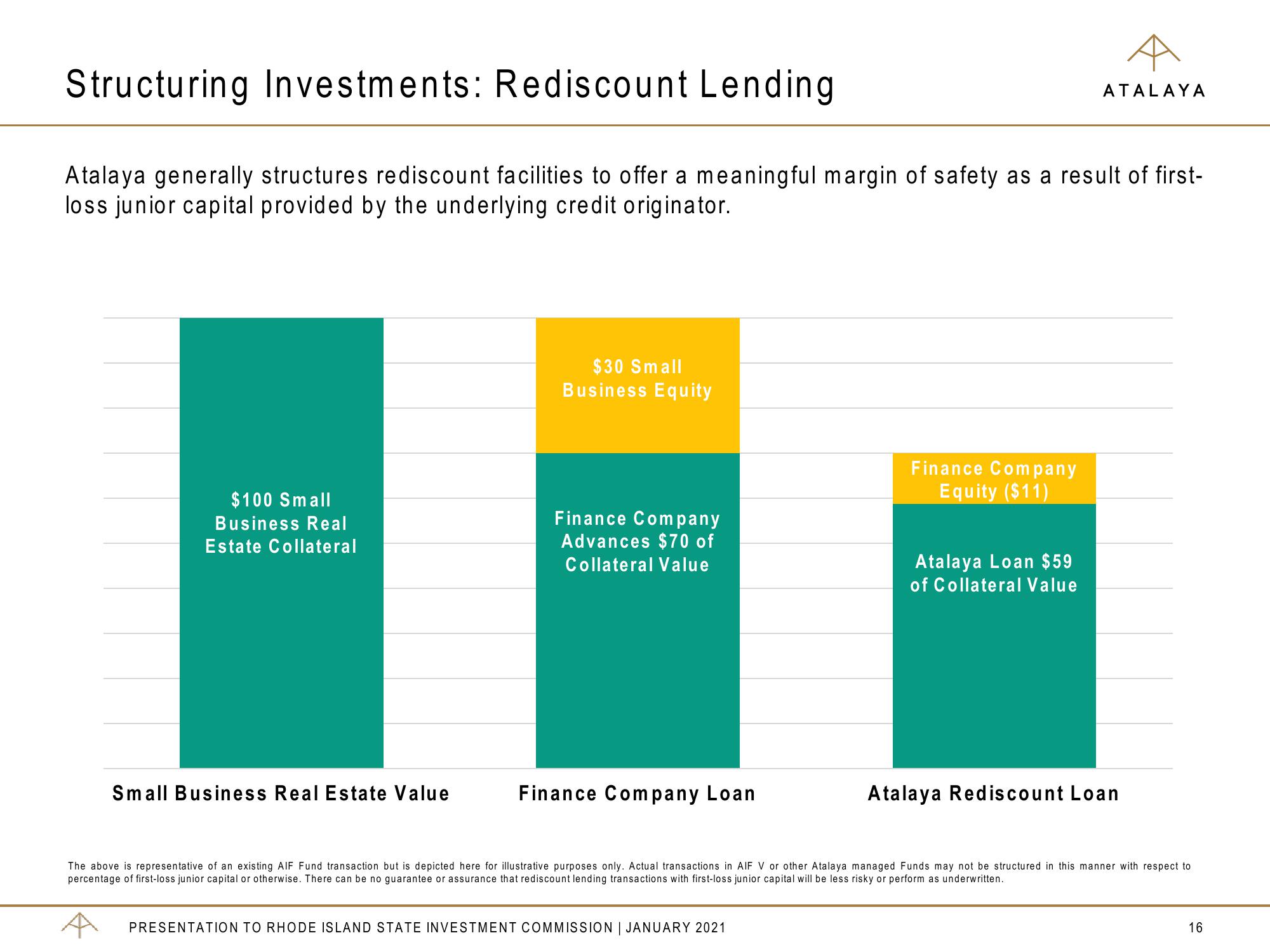

Atalaya generally structures rediscount facilities to offer a meaningful margin of safety as a result of first-

loss junior capital provided by the underlying credit originator.

$100 Small

Business Real

Estate Collateral

Small Business Real Estate Value

$30 Small

Business Equity

Finance Company

Advances $70 of

Collateral Value

Finance Company Loan

Finance Company

Equity ($11)

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

Atalaya Loan $59

of Collateral Value

ATALAYA

Atalaya Rediscount Loan

The above is representative of an existing AIF Fund transaction but is depicted here for illustrative purposes only. Actual transactions in AIF V or other Atalaya managed Funds may not be structured in this manner with respect to

percentage of first-loss junior capital or otherwise. There can be no guarantee or assurance that rediscount lending transactions with first-loss junior capital will be less risky or perform as underwritten.

16View entire presentation