Kore SPAC Presentation Deck

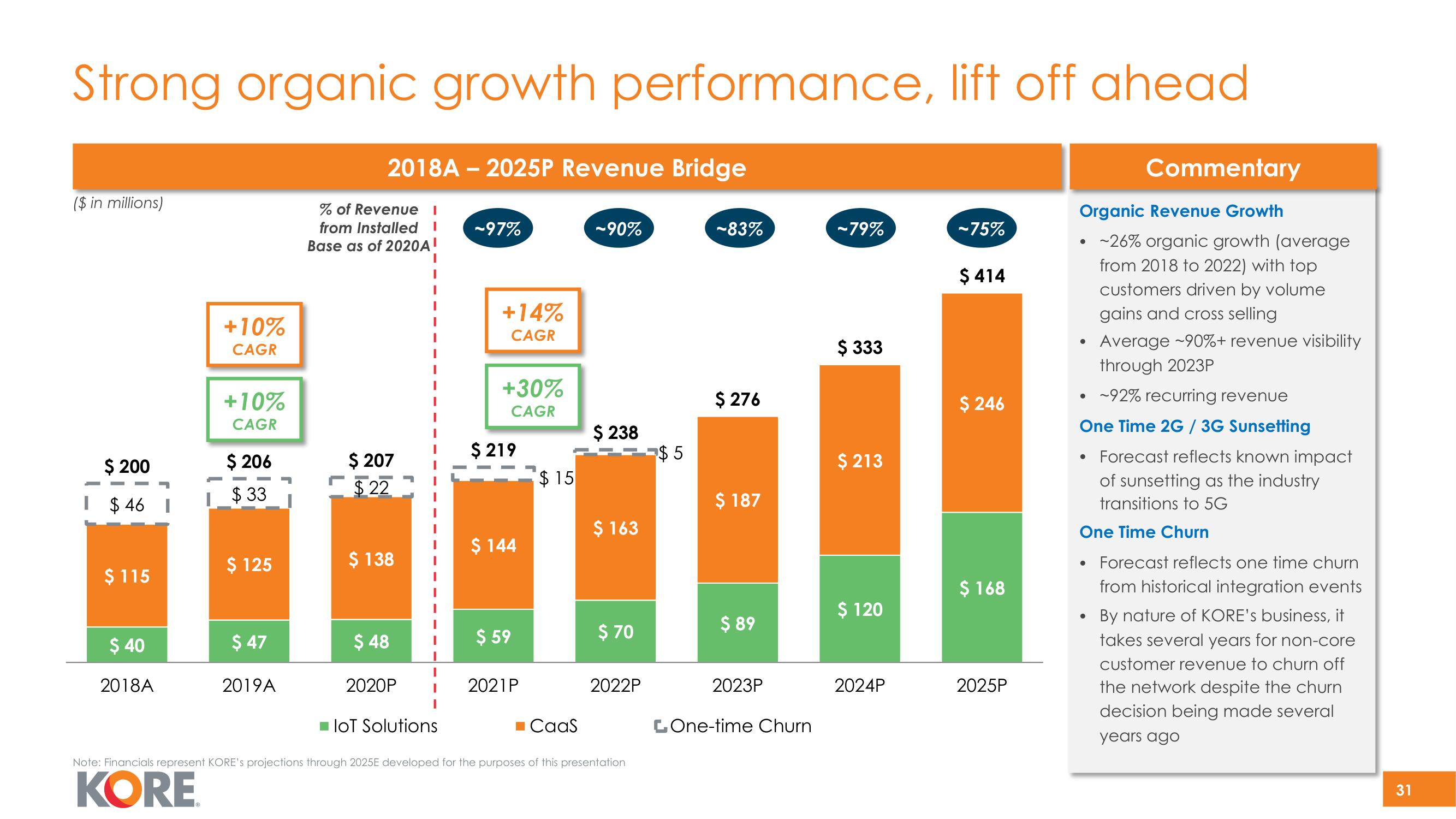

Strong organic growth performance, lift off ahead

($ in millions)

$ 200

$46

$ 115

$ 40

2018A

+10%

CAGR

+10%

CAGR

$ 206

$33

$ 125

$ 47

2019A

2018A - 2025P Revenue Bridge

% of Revenue I

from Installed

Base as of 2020A

$ 207

$22

$ 138

$ 48

2020P

IoT Solutions

-97%

+14%

CAGR

+30%

CAGR

$ 219

$ 144

$ 59

2021P

$15

■CaaS

~90%

$ 238

$ 163

$ 70

2022P

Note: Financials represent KORE's projections through 2025E developed for the purposes of this presentation

KORE

$5

-83%

$ 276

$ 187

$ 89

2023P

LOne-time Churn

-79%

$ 333

$ 213

$ 120

2024P

-75%

$ 414

$ 246

$ 168

2025P

Organic Revenue Growth

• ~26% organic growth (average

from 2018 to 2022) with top

●

Commentary

●

●

customers driven by volume

gains and cross selling

• ~92% recurring revenue

One Time 2G / 3G Sunsetting

Forecast reflects known impact

of sunsetting as the industry

transitions to 5G

One Time Churn

Average ~90%+ revenue visibility

through 2023P

Forecast reflects one time churn

from historical integration events

By nature of KORE's business, it

takes several years for non-core

customer revenue to churn off

the network despite the churn

decision being made several

years ago

31View entire presentation