Worthington Industries Mergers and Acquisitions Presentation Deck

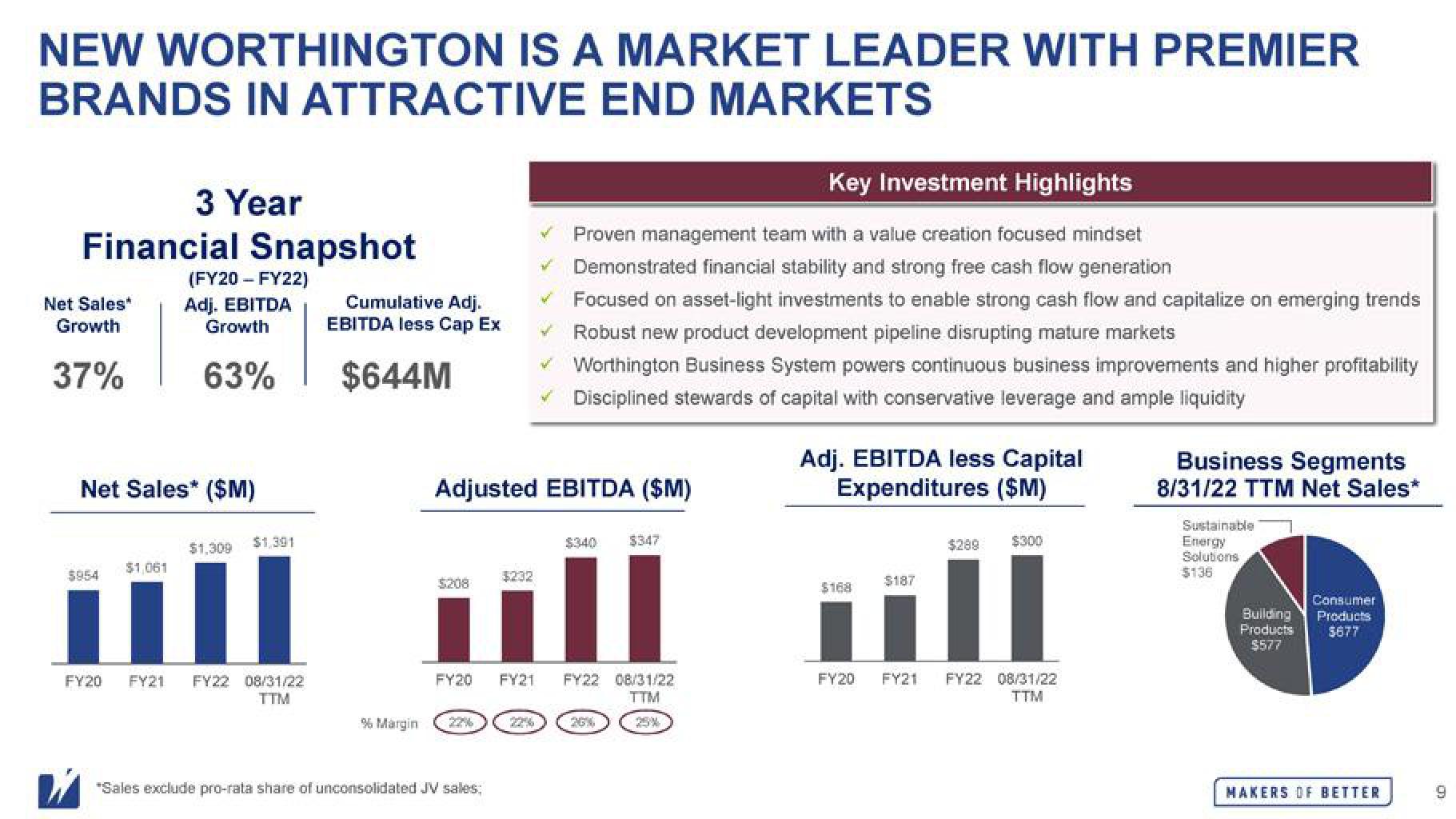

NEW WORTHINGTON IS A MARKET LEADER WITH PREMIER

BRANDS IN ATTRACTIVE END MARKETS

3 Year

Financial Snapshot

(FY20 - FY22)

Adj. EBITDA

Growth

63%

Net Sales*

Growth

37%

Net Sales* ($M)

$954

$1,061

$1,309

$1,391

FY20 FY21 FY22 08/31/22

TTM

Cumulative Adj.

EBITDA less Cap Ex

$644M

% Margin

$208

Adjusted EBITDA ($M)

Key Investment Highlights

B Proven management team with a value creation focused mindset

Demonstrated financial stability and strong free cash flow generation

Focused on asset-light investments to enable strong cash flow and capitalize on emerging trends

Robust new product development pipeline disrupting mature markets

Worthington Business System powers continuous business improvements and higher profitability

Disciplined stewards of capital with conservative leverage and ample liquidity

$232

*Sales exclude pro-rata share of unconsolidated JV sales;

V

$340

$347

FY20 FY21 FY22 08/31/22

TTM

Adj. EBITDA less Capital

Expenditures ($M)

$168

$187

FY20 FY21

$289 $300

II

FY22 08/31/22

TTM

Business Segments

8/31/22 TTM Net Sales*

Sustainable

Energy

Solutions

$136

Consumer

Building Products

Products

$577

$677

MAKERS OF BETTER

9View entire presentation