Credit Suisse Results Presentation Deck

Wealth Management

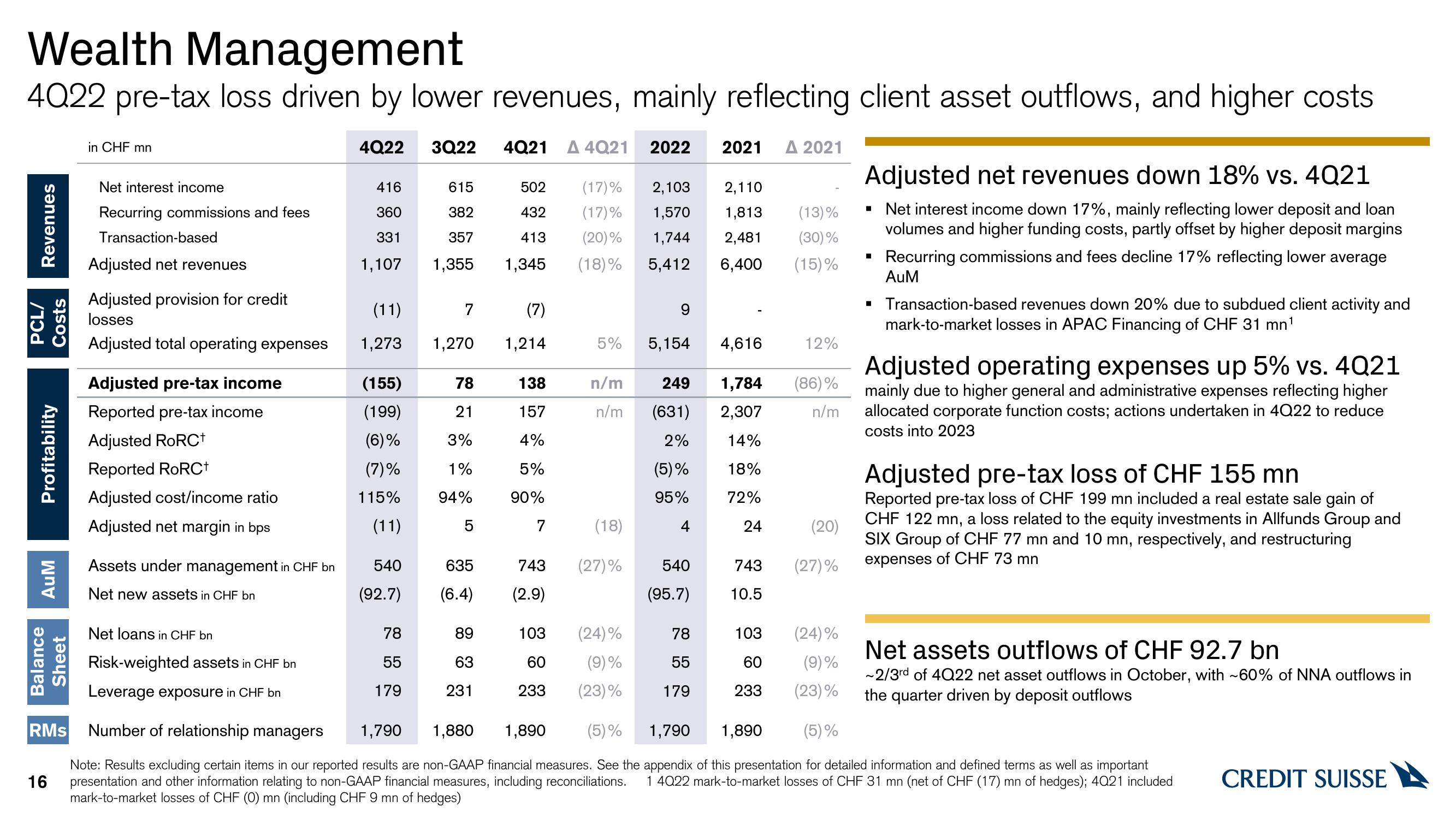

4022 pre-tax loss driven by lower revenues, mainly reflecting client asset outflows, and higher costs

4Q22

3Q22 4Q21 A 4Q21

2022 2021 Δ 2021

Revenues

PCL/

Costs

Profitability

AuM

Balance

Sheet

in CHF mn

16

Net interest income

Recurring commissions and fees

Transaction-based

Adjusted net revenues

Adjusted provision for credit

losses

Adjusted total operating expenses

Adjusted pre-tax income

Reported pre-tax income

Adjusted RoRC+

Reported RoRC+

Adjusted cost/income ratio

Adjusted net margin in bps

Assets under management in CHF bn

Net new assets in CHF bn

Net loans in CHF bn

Risk-weighted assets in CHF bn

Leverage exposure in CHF bn

416

360

331

1,107

(11)

1,273 1,270

(155)

(199)

(6)%

(7)%

115%

(11)

540

(92.7)

615

382

357

1,355

78

55

179

7

78

21

3%

1%

94%

5

502 (17)%

432 (17)%

413 (20)%

1,345 (18)%

89

63

231

(7)

1,214

138

157

4%

5%

90%

7

635

743

(6.4) (2.9)

5%

n/m

n/m

(18)

(27)%

103

60

(24)%

(9)%

233 (23)%

2,103

1,570

1,744

5,412

5,154

249

(631)

2%

(5)%

95%

4

540

(95.7)

78

55

179

2,110

1,813

2,481

6,400

4,616

1,784

2,307

14%

18%

72%

24

743

10.5

103

60

233

(13)%

(30) %

(15)%

12%

(86) %

n/m

(20)

(27)%

(24)%

(9)%

(23)%

Adjusted net revenues down 18% vs. 4Q21

▪ Net interest income down 17%, mainly reflecting lower deposit and loan

volumes and higher funding costs, partly offset by higher deposit margins

Recurring commissions and fees decline 17% reflecting lower average

AuM

▪ Transaction-based revenues down 20% due to subdued client activity and

mark-to-market losses in APAC Financing of CHF 31 mn¹

Adjusted operating expenses up 5% vs. 4Q21

mainly due to higher general and administrative expenses reflecting higher

allocated corporate function costs; actions undertaken in 4Q22 to reduce

costs into 2023

Adjusted pre-tax loss of CHF 155 mn

Reported pre-tax loss of CHF 199 mn included a real estate sale gain of

CHF 122 mn, a loss related to the equity investments in Allfunds Group and

SIX Group of CHF 77 mn and 10 mn, respectively, and restructuring

expenses of CHF 73 mn

Net assets outflows of CHF 92.7 bn

~2/3rd of 4Q22 net asset outflows in October, with ~60% of NNA outflows in

the quarter driven by deposit outflows

RMS Number of relationship managers

1,790

1,880 1,890

(5)% 1,790 1,890

(5)%

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 4Q22 mark-to-market losses of CHF 31 mn (net of CHF (17) mn of hedges); 4021 included

mark-to-market losses of CHF (0) mn (including CHF 9 mn of hedges)

CREDIT SUISSEView entire presentation