Tesla Results Presentation Deck

11

OTHER HIGHLIGHTS

Energy Storage

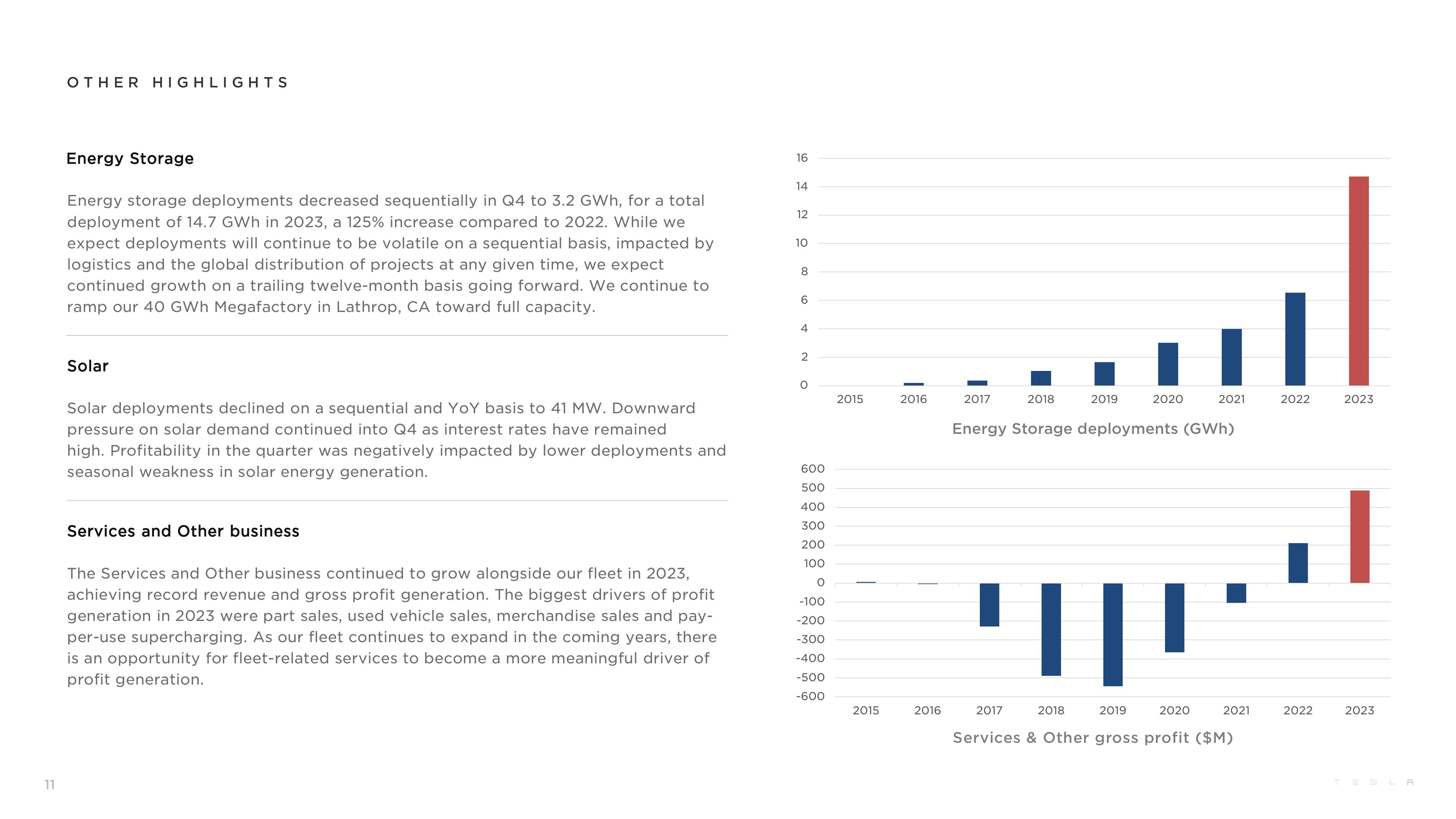

Energy storage deployments decreased sequentially in Q4 to 3.2 GWh, for a total

deployment of 14.7 GWh in 2023, a 125% increase compared to 2022. While we

expect deployments will continue to be volatile on a sequential basis, impacted by

logistics and the global distribution of projects at any given time, we expect

continued growth on a trailing twelve-month basis going forward. We continue to

ramp our 40 GWh Megafactory in Lathrop, CA toward full capacity.

Solar

Solar deployments declined on a sequential and YoY basis to 41 MW. Downward

pressure on solar demand continued into Q4 as interest rates have remained

high. Profitability in the quarter was negatively impacted by lower deployments and

seasonal weakness in solar energy generation.

Services and Other business

The Services and Other business continued to grow alongside our fleet in 2023,

achieving record revenue and gross profit generation. The biggest drivers of profit

generation in 2023 were part sales, used vehicle sales, merchandise sales and pay-

per-use supercharging. As our fleet continues to expand in the coming years, ere

is an opportunity for fleet-related services to become a more meaningful driver of

profit generation.

16

14

12

10

8

6

4

2

O

600

500

400

300

200

100

O

-100

-200

-300

-400

-500

-600

2015

2015

2016

2016

2017

2018

2019

2020

Energy Storage deployments (GWh)

2018

2021

2017

2019

Services & Other gross profit ($M)

|||··|

2020

2022

2021

2023

2022

2023

TESLAView entire presentation