Lyft Results Presentation Deck

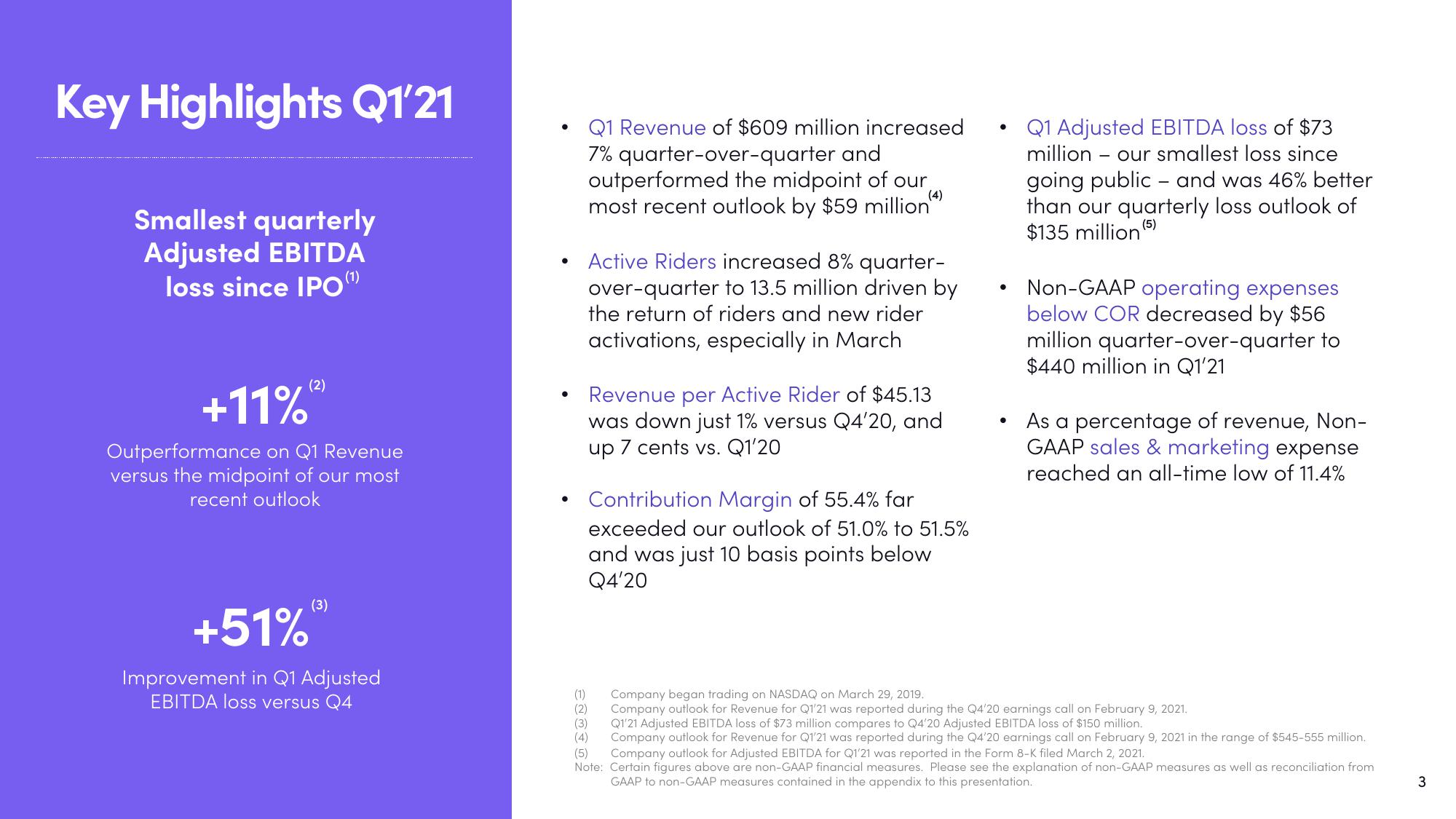

Key Highlights Q1'21

Smallest quarterly

Adjusted EBITDA

loss since IPO(¹)

+11%

Outperformance on Q1 Revenue

versus the midpoint of our most

recent outlook

(3)

+51%

Improvement in Q1 Adjusted

EBITDA loss versus Q4

●

Q1 Revenue of $609 million increased

7% quarter-over-quarter and

outperformed the midpoint of our

most recent outlook by $59 million

(4)

Active Riders increased 8% quarter-

over-quarter to 13.5 million driven by

the return of riders and new rider

activations, especially in March

Revenue per Active Rider of $45.13

was down just 1% versus Q4'20, and

up 7 cents vs. Q1'20

Contribution Margin of 55.4% far

exceeded our outlook of 51.0% to 51.5%

and was just 10 basis points below

Q4'20

(1)

(2)

(3)

(4)

(5)

●

●

●

Q1 Adjusted EBITDA loss of $73

million our smallest loss since

going public and was 46% better

than our quarterly loss outlook of

$135 million 5

(5)

Non-GAAP operating expenses

below COR decreased by $56

million quarter-over-quarter to

$440 million in Q1'21

As a percentage of revenue, Non-

GAAP sales & marketing expense

reached an all-time low of 11.4%

Company began trading on NASDAQ on March 29, 2019.

Company outlook for Revenue for Q1'21 was reported during the Q4'20 earnings call on February 9, 2021.

Q1'21 Adjusted EBITDA loss of $73 million compares to Q4'20 Adjusted EBITDA loss of $150 million.

Company outlook for Revenue for Q1'21 was reported during the Q4'20 earnings call on February 9, 2021 in the range of $545-555 million.

Company outlook for Adjusted EBITDA for Q1'21 was reported in the Form 8-K filed March 2, 2021.

Note: Certain figures above are non-GAAP financial measures. Please see the explanation of non-GAAP measures as well as reconciliation from

GAAP to non-GAAP measures contained in the appendix to this presentation.

3View entire presentation