Oatly Results Presentation Deck

Notes:

1.

2.

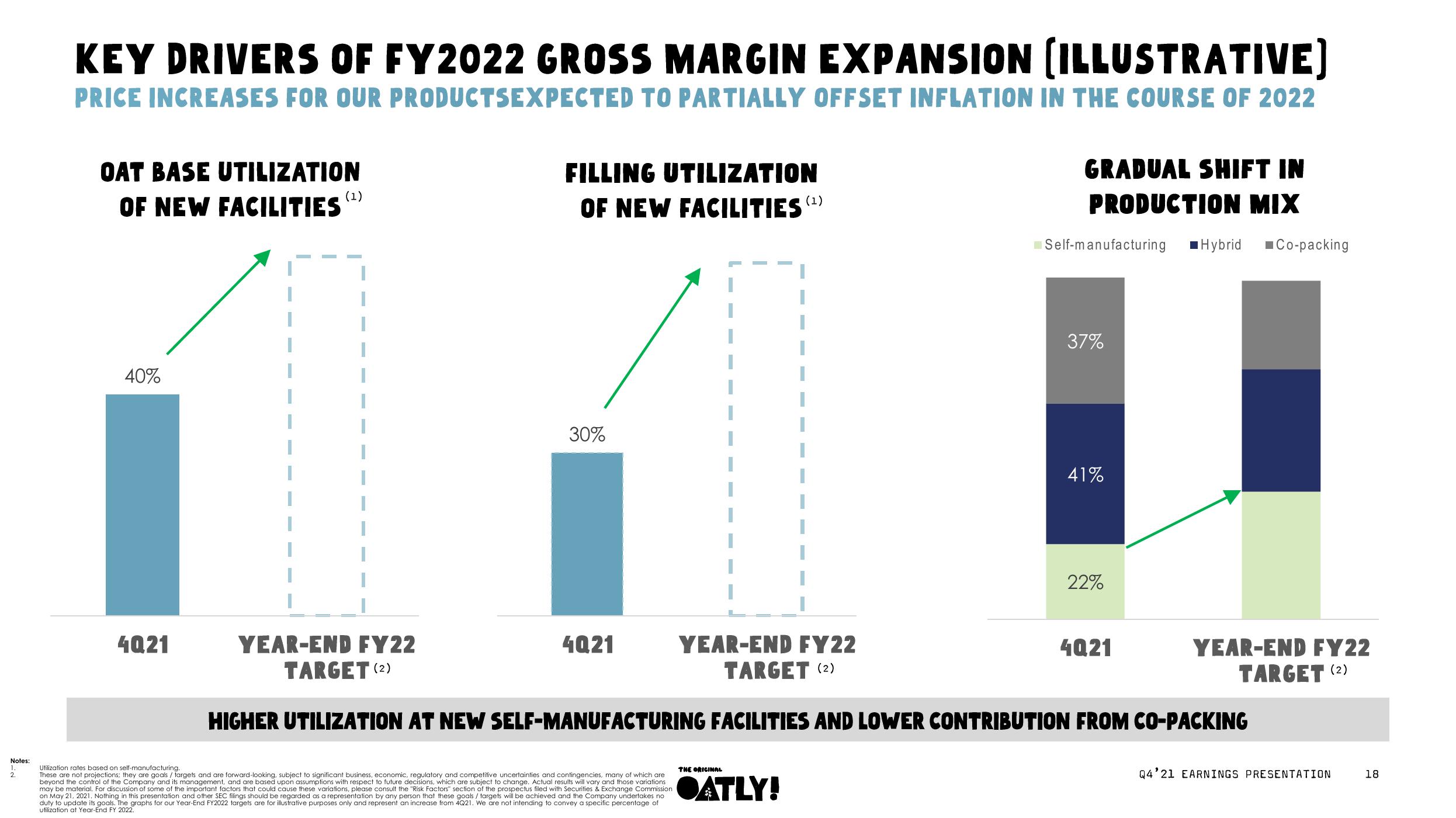

KEY DRIVERS OF FY2022 GROSS MARGIN EXPANSION (ILLUSTRATIVE]

PRICE INCREASES FOR OUR PRODUCTSEXPECTED TO PARTIALLY OFFSET INFLATION IN THE COURSE OF 2022

OAT BASE UTILIZATION

OF NEW FACILITIES

40%

4021

(1)

FILLING UTILIZATION

OF NEW FACILITIES (¹)

30%

4021

Utilization rates based on self-manufacturing.

These are not projections; they are goals / targets and are forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are

beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations

may be material. For discussion of some of the important factors that could cause these variations, please consult the "Risk Factors" section of the prospectus filed with Securities & Exchange Commission

on May 21, 2021. Nothing in this presentation and other SEC filings should be regarded as a representation by any person that these goals / targets will be achieved and the Company undertakes no

duty to update its goals. The graphs for our Year-End FY2022 targets are for illustrative purposes only and represent an increase from 4Q21. We are not intending to convey a specific percentage of

utilization at Year-End FY 2022.

THE ORIGINAL

GRADUAL SHIFT IN

PRODUCTION MIX

OATLY!

Self-manufacturing ■Hybrid Co-packing

YEAR-END FY22

TARGET (2)

YEAR-END FY22

TARGET (2)

HIGHER UTILIZATION AT NEW SELF-MANUFACTURING FACILITIES AND LOWER CONTRIBUTION FROM CO-PACKING

37%

41%

22%

4021

YEAR-END FY22

TARGET (2)

Q4'21 EARNINGS PRESENTATION

18View entire presentation