MoneyLion SPAC Presentation Deck

TRANSACTION OVERVIEW

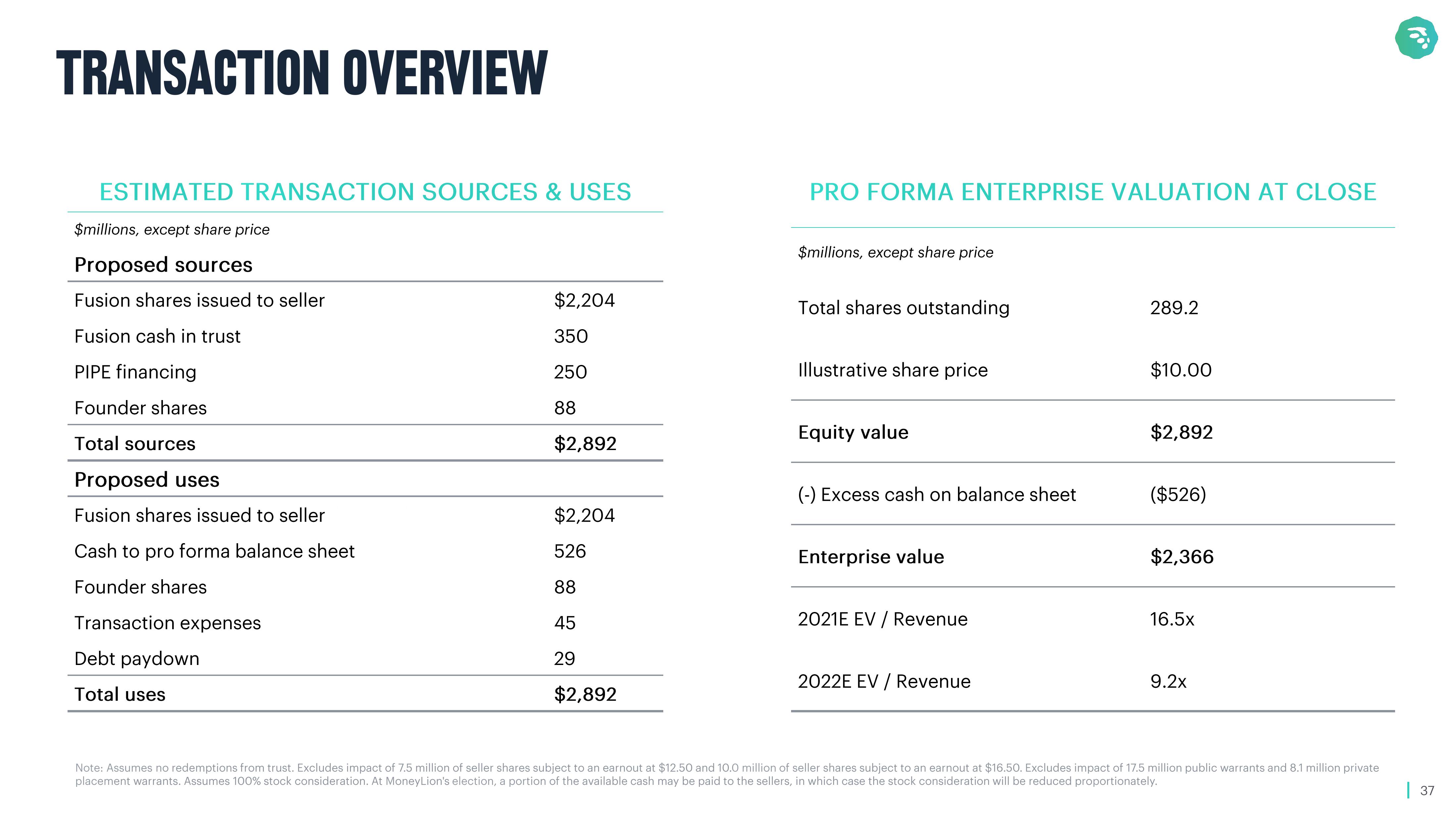

ESTIMATED TRANSACTION SOURCES & USES

$millions, except share price

Proposed sources

Fusion shares issued to seller

Fusion cash in trus

PIPE financing

Founder shares

Total sources

Proposed uses

Fusion shares issued to seller

Cash to pro forma balance sheet

Founder shares

Transaction expenses

Debt paydown

Total uses

$2,204

350

250

88

$2,892

$2,204

526

88

45

29

$2,892

PRO FORMA ENTERPRISE VALUATION AT CLOSE

$millions, except share price

Total shares outstanding

Illustrative share price

Equity value

(-) Excess cash on balance sheet

Enterprise value

2021E EV / Revenue

2022E EV / Revenue

289.2

$10.00

$2,892

($526)

$2,366

16.5x

9.2x

Note: Assumes no redemptions from trust. Excludes impact of 7.5 million of seller shares subject to an earnout at $12.50 and 10.0 million of seller shares subject to an earnout at $16.50. Excludes impact of 17.5 million public warrants and 8.1 million private.

placement warrants. Assumes 100% stock consideration. At MoneyLion's election, a portion of the available cash may be paid to the sellers, in which case the stock consideration will be reduced proportionately.

| 37View entire presentation