Q4 & Fiscal Year 2023 Financial Results

Cash Flow & Balance Sheet Highlights

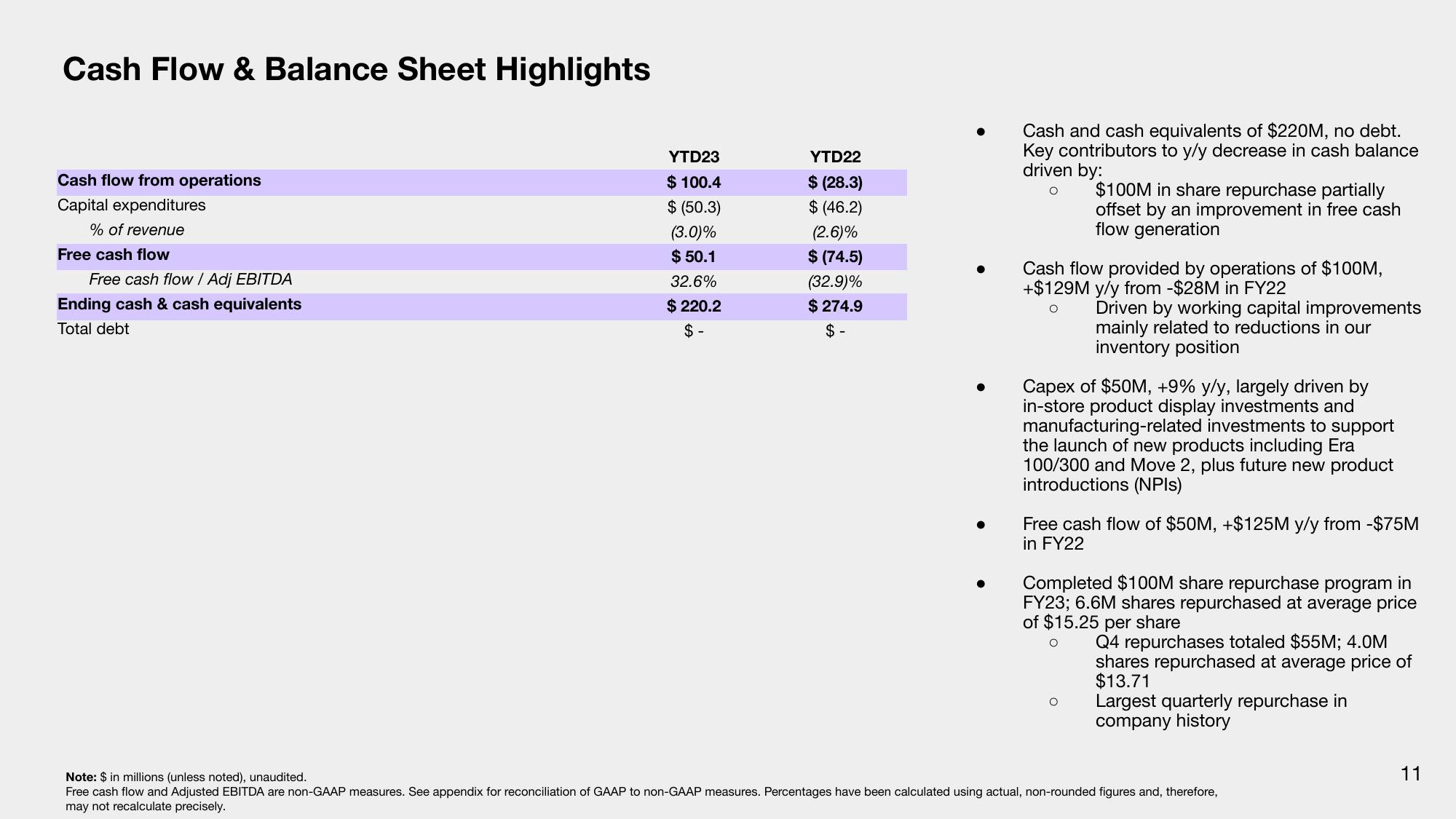

Cash flow from operations

Capital expenditures

% of revenue

Free cash flow

Free cash flow / Adj EBITDA

Ending cash & cash equivalents

Total debt

YTD23

$ 100.4

$ (50.3)

(3.0)%

$ 50.1

32.6%

$ 220.2

$-

YTD22

$ (28.3)

$ (46.2)

(2.6)%

$ (74.5)

(32.9)%

$ 274.9

$-

●

Cash and cash equivalents of $220M, no debt.

Key contributors to y/y decrease in cash balance

driven by:

O

$100M in share repurchase partially

offset by an improvement in free cash

flow generation

Cash flow provided by operations of $100M,

+$129M y/y from -$28M in FY22

O

Driven by working capital improvements

mainly related to reductions in our

inventory position

Capex of $50M, +9% y/y, largely driven by

in-store product display investments and

manufacturing-related investments to support

the launch of new products including Era

100/300 and Move 2, plus future new product

introductions (NPIs)

Free cash flow of $50M, +$125M y/y from -$75M

in FY22

O

Completed $100M share repurchase program in

FY23; 6.6M shares repurchased at average price

of $15.25 per share

O

Q4 repurchases totaled $55M; 4.0M

shares repurchased at average price of

$13.71

Largest quarterly repurchase in

company history

Note: $ in millions (unless noted), unaudited.

Free cash flow and Adjusted EBITDA are non-GAAP measures. See appendix for reconciliation of GAAP to non-GAAP measures. Percentages have been calculated using actual, non-rounded figures and, therefore,

may not recalculate precisely.

11View entire presentation